Add United Spirits Ltd For Target Rs. 1,620 By Yes Securities Ltd

Expect healthy operating growth in 4Q as well

han our estimates, largely led by business scale-up in the state of Andhra Pradesh (AP), strong festive period and decent wedding season. AP contributed 6.1% growth points this quarter (includes benefit from pipeline filling as well) and 2.4% growth points on YTD basis. Prestige & Above (P&A) saw 16.1% value growth this quarter but was 9.2% excluding AP. Management has retained its double-digit P&A value growth (including AP) target for the full year, which means ask rate for 4QFY25 will be in mid-teens atleast. EBIDTA margin (EM) was lower than our estimate at 17.1%, but operating growth was in-line and healthy (19.7% EBITDA growth). ENA continues to be inflationary, but glass prices remain benign and is expected to remain same for atleast one more quarter till deflation comes into the base. We thus expected healthy operating profit growth in 4QFY25 as well but receipt of dividend income from RCSPL in 3Q this year vs 4Q last year will lead to decline in PAT. The stock is up ~22% post our initiation dated 4th June 2024. While there is a change in guard, we remain fundamentally positive on the company. Targeting ~52x on March’27E Standalone EPS + RCSPL, we get a target price (TP) of Rs1,620. Maintain ADD.

Result Highlights

* Headline performance: Standalone net sales grew by 14.8% YoY to Rs34.3bn (vs est. Rs33.4bn). EBITDA grew by 19.7% YoY to Rs5.9bn (vs est. Rs5.85bn). Adjusted PAT (APAT) grew by 54.6% to Rs5.4bn (vs est. Rs4bn).

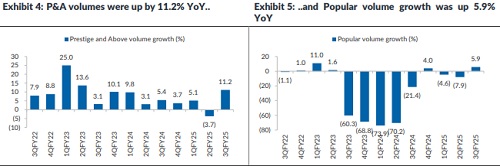

* Overall volumes for the quarter grew by 10.2% YoY to 18.2mn cases. Prestige & above (P&A; ~89% of net sales) volumes grew by 11.2% YoY to 14.9mn cases leading to 16.1% YoY value growth. Popular (~10% of net sales) volumes up ~5.9% YoY to 3.2mn cases leading to 9.6% YoY value growth.

* Gross revenue per case was up by 1% YoY to Rs4,258 in 3QFY25. Excise duty was down 140bps YoY. Net revenue per case was up by 4.2% YoY to Rs1,890 in 3QFY25.

* Standalone gross margin was up 130bps to 44.7% (but down 50bps QoQ). Increase in overheads meant that EBITDA margin was up ~70bps to 17.1% (vs est. 17.5%).

* EBITDA per case stood at Rs324 in 3QFY25 vs Rs298 in 3QFY24.

* 9MFY25: Standalone net sales, EBITDA, APAT were up 7.5%, 14.1% and 25.8% respectively. Gross margin was up 130bps YoY to 44.8% and EBITDA margin was up 100bps YoY to 18%.

Key near-term comments:

(1) Consumer social occasions has risen. Alco-Bev has been more resilient than other CPG categories. No signs of downtrading. There is still relative moderation at the top-end of the market. (2) Management still expects double-digit growth in P&A on full year basis including AP. (3) ENA seeing high single digit to low double-digit inflation and is not moderating. Glass has already seen three quarters of deflation now.

View & Valuation

There is no major change in our earnings. We now build EBITDA/Earnings CAGR of 14.6%/14.1% over FY24-27E for the standalone business. UNSP has recently resumed dividend, after almost a decade, as it wiped out all its accumulated losses in 1QFY24. Cash flow and return ratios are seeing improvement. The stock is up ~22% post our initiation dated 4th June 2024. While there is a change in guard, we remain fundamentally positive on the company. Targeting ~52x on March’27E Standalone EPS + RCSPL, we get a target price (TP) of Rs1,620. Maintain ADD.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632