Accumulate Colgate Palmolive India Ltd For Target Rs. 2,730 By Geojit Financial Services Ltd

Ltd ( 1 ).jpg)

Defying Headwinds with Sustained Growth

Colgate-Palmolive (India) Ltd (Colgate) makes oral and body care consumer products such as soaps, cosmetics, toilet preparations, toothpastes, toothbrushes, shaving brushes, and glycerin.

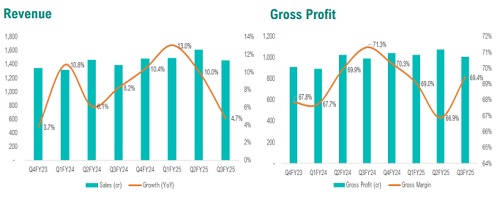

• In Q3FY25, consolidated revenue increased 4.7% YoY to Rs. 1,452cr, primarily driven by volume growth in the toothpaste segment, despite the relatively soft demand in the urban market. • Toothpaste segment reported mid-single-digit intrinsic volume growth, while toothbrushes showed competitive growth, driven by science-backed innovations in the premium portfolio. The company remains committed to delivering sustainable and profitable growth, with a focus on oral and personal care in the Indian market. • The company's EBITDA for Q3FY25 stood at Rs. 454cr, down 3.0% YoY, while EBITDA margin decreased 250bps to 31.3%, primarily due to an increase in the cost of sales of 11.6% YoY. • The company's profit after tax (PAT) for Q3FY25 stood at Rs. 323cr, as against Rs. 330cr in Q3FY24.

Outlook & Valuation

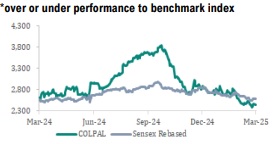

Colgate delivered a resilient performance in Q3FY25, with decent sales growth led by volume growth in the toothpaste segment. The company is committed to delivering sustainable and profitable growth, driven by science-backed innovations. Its premium portfolio has shown positive momentum, contributing to its resilient performance in a challenging environment with soft demand and increased competition. With a strong innovation pipeline, including new product launches and investments in artificial intelligence (AI)-generated dental screening reports and advertising, the company is well-positioned for long-term growth. Therefore, we upgrade our rating to ACCUMULATE from REDUCE on the stock, with a rolled forward target of Rs. 2,730, based on 43x FY27E adjusted EPS.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345

Ltd.jpg)