No Record Found

Latest News

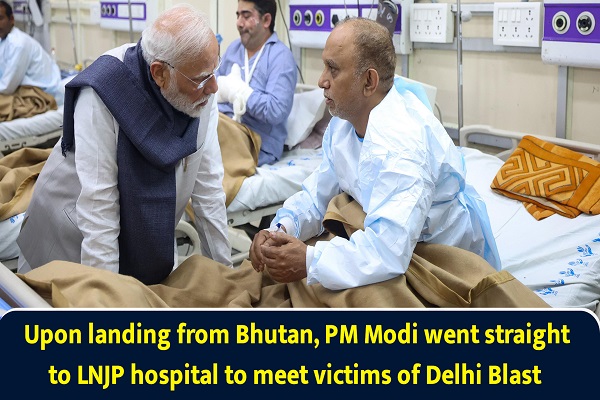

Upon landing from Bhutan, PM Narendra Modi went stra...

PM Narendra Modi returns to India after Concluding 2...

Kajol celebrates 32 years of `Baazigar`, calls it a ...

Quote on CPI data by Mahendra Patil, Founder and Man...

World Bank Economist hails India`s economic growth, ...

Perspective on CPI data by Rajani Sinha, Chief Econo...

Innovative Forklift-Inspired Wireless Charging Dock:...

Evening Roundup : A Daily Report on Bullion Energy &...

UP CM Yogi Adityanath attends Trophy welcoming cerem...

Yamaha unveils next-gen AI Motorcycle at Japan Mobil...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found