Diwali Stock Picks 2025 : Buy Adani Green Energy Ltd For Target Rs.2,142 by Ventura Securities Ltd

High CUFs and plant availability boost generation efficiency

Business Model – Adani Green Energy Ltd (AGEL) develops, owns and operates large scale solar, wind, and hybrid renewable projects, securing revenue through long-term PPAs with government and C&I customers.

AGEL stands at the forefront of India’s renewable energy revolution, having reached a significant operational milestone of 15.8 GW as of June 2025, making it the nation’s largest and fastest-growing pure-play renewable energy company. AGEL added 4,882 MW of green power capacities in the past 12 months, and Khavda accounted for 73.4% of this addition (3,582 MW), taking its installed base to 5.6 GW (~35.4% of total capacity). The 30 GW Khavda project (spread over 538 sq. km) will be completed by 2030, contributing ~60% of AGEL’s targeted capacity. AGEL is selective in bidding for new tenders, focusing on predictable and better returns given its significant locked-in capacity towards the 50 GW target. Of the approximately 36.5 GW total capacity, 31.5 GW is currently under PPA

Operational excellence continues to be a hallmark of AGEL, with cutting-edge AI- and MLenabled maintenance and monitoring through the Energy Network Operation Center, resulting in leading capacity utilization factors—28.0% for solar, 42.3% for wind, and 43.9% for hybrid assets in Q1 FY26. Beyond operational performance, AGEL’s commitment to ESG remains steadfast: the company is ranked first globally in FTSE Russell’s ESG score in the Alternative Electricity sub-sector, and has received India’s top power sector ranking from NSE Sustainability Ratings and CRISIL ESG. With repeat industry recognition and a best-in-class governance and sustainability framework, AGEL is well-positioned to accelerate India’s transition to clean, affordable energy, remaining a key driver of national decarbonization goals.

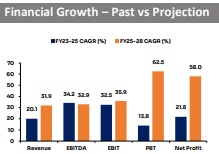

Robust capacity expansion over the next five years, deployment of advanced technologies, and focus on high-resource sites like Khavda should drive sustained growth in the forecasted period. Over FY25–28E, revenue, EBITDA, and net profit are projected to grow at a CAGR of 31.9%, 32.9%, and 58% to INR 25,705 Cr, INR 20,852 Cr, and INR 5,693 Cr, respectively, with EBITDA margins improving by 195 bps to 81.1% and net margins by 927 bps to 22.1%.

AGEL has received INR 9,350 cr from its promoter group after converting share warrants into equity, boosting promoter holding to 62.43%. This infusion will be used to repay shareholder loans and fund capital expenditure, supporting AGEL's goal of reaching 50 GW installed capacity by 2030.

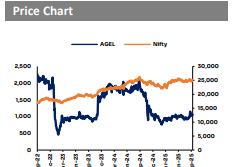

Valuation call – At CMP of INR 1,064, we recommend BUY for AGEL with a price target of INR 2,142 (22.9X FY27 EV/EBITDA), representing an upside of 101.3%.

SMS subject to Disclosures and Disclaimer goo.gl/8bCMyQ

SEBI Registration No.: INH000001634

.jpg)