Diwali Stock Picks 2025 : Buy Ambuja Cements Ltd For Target Rs.794 by Ventura Securities Ltd

Strategic expansion and green initiatives to fuel growth

Business Model -With a consolidated installed capacity of 105 MTPA, Ambuja Cement Ltd (ACEM) is the second largest cement producer in India. The company and its subsidiaries were acquired by Adani Group in Sept 2022

The Indian cement industry is undergoing rapid consolidation as major players expand their dominance to capture market share and enhance economies of scale. Since its acquisition by the Adani Group, ACEM has aggressively expanded its cement production capacity from 67.5 MTPA in September 2022 to 105 MTPA in June 2025. The management remains focused on expansion projects and sustainability initiatives, with the near-term growth outlook underpinned by ongoing industry consolidation and rising cement demand from both urban and rural markets. ACEM is targeting 118 MTPA capacity by March 2026 and planning to incur capex of INR 9,000-10,000 cr during FY26. Under its Vision 2028 program, the company is targeting a capacity of 140 MTPA (from current 100 MTPA), green energy share of 60% and EBITDA/ton of INR 1500. Key brownfield expansion projects include Farakka (2.4 MTPA), Sankrail (2.4 MTPA), and Sindri (1.5 MTPA) grinding units, along with debottlenecking initiatives. Projects under execution include Bhatapara Line 3, Salai Banwa, Bathinda, Marwar, Maratha Line 2, Dahej Line-2, Kalamboli, Jodhpur (Penna IU), Krishnapatnam Penna, and Warisaliganj. With its sustained focus on capacity augmentation, digital transformation, and improved supply chain efficiencies, Ambuja is positioned to capture incremental market share and deliver value to stakeholders in FY26 and beyond.

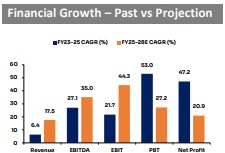

For FY25-28E, the ACEM’s consolidated sales volume, revenue, EBITDA, and net earnings are expected to grow at a CAGR of 12.5%, 17.5%, 35%, and 20.9%, respectively, reaching 92.9 mn tons, INR 56,958 cr, INR 14,706 cr, and INR 7,370 cr. EBITDA per ton is forecast to improve to INR 1,584, supported by a reduction in power costs and the benefits of operating leverage. Net margins are expected to improve by 107bps to 12.9%. As a result, return ratios – RoE and RoIC – are expected to improve by 308bps to 10.9% and 1267bps to 20.4% respectively due to improvement in operating profitability and cash flows.

ACEM launched ‘Adani Cement FutureX’ on Engineer’s Day 2025, a major initiative linking top engineering colleges and schools to foster next-gen leaders in the infrastructure sector. The program aligns with India’s Yogya Bharat Mission and Viksit Bharat 2047, addressing skill gaps and promoting employability. Key components include Smart Cement Labs, STEM activations, experiential learning, and collaborative R&D focused on decarbonisation and sustainability. The initiative offers internships, pre-placement offers, and youth engagement activities like hackathons. It positions ACEM as a leader in the industry, emphasizing sustainability and innovation in workforce development and nation-building.

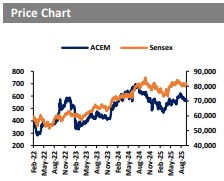

Valuation call – With FutureX initiatives, capacity expansion & cost optimization strategies, ACEM is well positioned to capitalize on infrastructure growth story. We recommend BUY with a price target of INR 794 (12.2X FY28 EV/EBITDA), representing an upside of 39.8%.

SMS subject to Disclosures and Disclaimer goo.gl/8bCMyQ

SEBI Registration No.: INH000001634

.jpg)