Diwali Stock Picks 2025 : Buy Transformers & Rectifiers (India) Ltd For Target Rs.794 by Ventura Securities Ltd

Business Model - Transformers & Rectifiers India Ltd (TARIL) manufactures various transformers including – power transformers (upto 1200 KVA), furnace transformer, special transformer, distribution transformer, rectifier transformer and reactors.

The government is focused on expanding India's power infrastructure by increasing power generation capacity from 485 GW to 900 GW by 2030, reflecting a CAGR of 13.9%. This growth will necessitate a transformation capacity of 2,700 GVA by 2030, a 15.4% CAGR from the current 1,370 GVA. This expansion is driving significant growth across the power sector value chain, especially in the transformer segment, which is poised to see a market opportunity of ~INR 1.0 tn over the next 5 years—double the current market size. Additionally, the push for ‘Make-in-India’ & ‘Atmanirbhar Bharat’ is driving up demand for industrial transformers, while the expansion of off-grid power capacities in the C&I segment and the rise of green hydrogen is fueling demand for specialty transformers. Transformer manufacturers are ramping up investments to meet this surge in demand, with TARIL leading the way due to its diverse portfolio, which spans power, industrial, and specialty transformers, and its investments to secure full backward integration. TARIL exports to countries across Asia, Africa & the Middle East, but the share of exports to total revenue is expected to stay under 10%, with a primary focus on the domestic market.

TARIL currently has an installed capacity of 40.2 GVA (operating at 65% utilization), with expansion plans in place. The first phase, adding 15 GVA, is set to begin production in Sept 2025, followed by another 22 GVA for Extra High Voltage transformers, expected to commence in Feb 2026, bringing total capacity to over 77.2 GVA by FY27. The expansion is backed by a capex of INR 550 cr, supported by INR 500 cr raised through a QIP in FY25. Additionally, TARIL is on track to achieve 100% backward integration in CRGO processing, coil, bushing and pressboard by Q1FY27, which is expected to enhance operational efficiency and increase gross margins from 30% in FY25 to 40% by FY28.

With expanded capacity and complete backward integration, TARIL is well-positioned to capture future growth opportunities. Management is targeting $1 bn (~INR 8,600 cr) revenue by FY28, with EBITDA expected to outpace revenue growth, driven by cost efficiencies from backward integration. As topline expands, margin gains and working capital savings should help the company turn net debt-free within 18–24 months, lowering interest costs and enabling net earnings to grow faster than EBITDA.

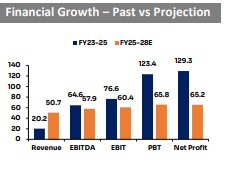

However, we believe TARIL’s $1 bn revenue goal and 40% gross margin target by FY28 is aggressive and could be delayed due to global economic uncertainty stemming from ongoing tariff wars, which may weigh on India’s economic and manufacturing growth. Accordingly, we factor in the revenue milestone of INR 8,600 cr by FY29 (deferred by 1 year) and the 40% gross margin target by FY31 (deferred by 3 years). Over FY25–28E, we forecast revenue, EBITDA & net profit to grow at a CAGR of 50.7%, 57.9% & 65.2%, respectively, reaching INR 6,900 cr, INR 1,290 cr & INR 967 cr. EBITDA & net margins are projected to improve 246 bps & 339 bps to 18.7% & 14%, respectively, by FY28E.

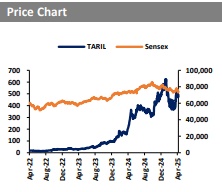

Valuation call – At the CMP of INR491, TARIL is trading at FY28 P/Eof 15.2X.We recommend BUY with a DCF price target of INR757 (23.5X FY28 P/E), representing an upside of 54.2%.

SMS subject to Disclosures and Disclaimer goo.gl/8bCMyQ

SEBI Registration No.: INH000001634

.jpg)

.jpg)