US Tariff Impact on India Likely to be at 0.3-0.4% of GDP by CareEdge Ratings

India Faces Higher Reciprocal Tariffs Compared to Its Peers

On August 1, 2025, the US is set to lift the temporary pause on the reciprocal tariffs announced on multiple trading partners earlier this year. Leading up to the August deadline, several economies have announced trade deals with the US, thereby negotiating a lower level of reciprocal tariffs. Vietnam, Indonesia, and the Philippines are among the Asian peers with which the US has announced a trade deal. With the India-US trade deal yet to be finalised, the US has imposed a 25% reciprocal tariff on India starting August 1, 2025. Furthermore, there is a possibility of an additional penalty on India due to its trade links with Russia. Given this scenario, the relative tariff advantage India held under the April round of announcements has now reversed, with India facing relatively higher tariffs compared to several of its Asian peers, such as Vietnam (reciprocal tariff of 20%), Indonesia (19%) and South Korea (15%) – (See Exhibit 1).

Exhibit 1: Tariff Rates for Select Economies

Potential Impact of Reciprocal Tariffs on India

The erosion of India’s tariff advantage relative to some of its Asian peers poses a challenge for India’s export prospects. However, the fact that India is a domestically driven economy with exports of merchandise and services accounting for 21% of GDP as of FY25, should offer some comfort. Furthermore, the share of merchandise exports alone is lower at 11% of GDP. In contrast, several other Asian economies exhibit significantly higher merchandise and services export dependency, such as Thailand (at 70% of GDP) and Vietnam (at 86%). Not only is India’s overall export dependence relatively low, but its merchandise export exposure to the US is also low at around 2% of GDP, offering additional resilience. Overall, factoring in the higher reciprocal tariffs and additional penalty on India’s exports to the US, we estimate the potential direct impact on India’s GDP to be around 0.3-0.4%

In terms of India’s external position, persistent weakness in the global demand scenario amid ongoing tariff restrictions is expected to weigh on India’s merchandise export performance, which is projected to contract by ~4% in FY26. The decline is expected mainly due to a sharp contraction in the value of oil exports (by around 15.5%), while non-oil exports are expected to contract only mildly (by around 0.8%). We project the current account deficit (CAD) to remain manageable at 0.9% of GDP in FY26. Any diversification in India’s oil imports away US Tariff Impact on India Likely to be at 0.3-0.4% of GDP

from Russia is expected to have a minimal impact on India’s CAD, as the price differential between Russian Ural and Brent Crude has significantly narrowed to around USD 3 per barrel from an average of USD 20 per barrel in 2023

Sectoral Impact

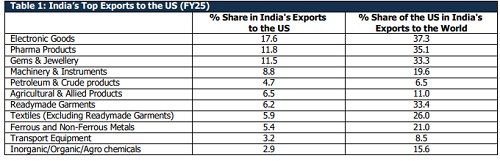

India’s merchandise exports to the US stood at USD 87 billion in FY25. Electronic goods accounted for the largest share of exports at 17.6%. This was followed by pharma products (11.8%) and gems & jewellery (11.5%).

The US accounts for 37% of India’s total electronic exports. Select items from this sector have been temporarily exempted from the 25% US tariffs. Additionally, India’s pharma exports to the US (accounting for 35% of India’s total pharma exports) have also been excluded from the tariffs. However, the overarching risk of sector-specific tariff action remains. India has one of the highest numbers of US FDA-approved manufacturing facilities catering to the generic medicine requirements of the US. While tariff uncertainties persist, the sector's fundamental competitive advantages offer some resilience.

The US accounts for nearly 33% of India’s total gems & jewellery exports. Given the discretionary nature of gems & jewellery exports, the sector could face the heat of reciprocal tariffs. In particular, the polished diamond segment might be affected harder, given that it is already facing pressure from the lab-grown diamonds segment.

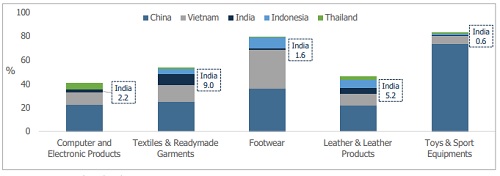

Exhibit 2: Share of Select Economies in US Imports (CY2024)

Although India held a competitive edge over other Asian exporters under the April 2025 tariff announcements, that advantage has now somewhat reversed. China remains a key supplier to the US, accounting for a large share in its imports of electronics, textiles and readymade garments (See Exhibit 2). China faces reciprocal tariffs of 30%, marking a notable reduction compared to the tariff of 145% announced in April. Additionally, Vietnam and Indonesia hold a comparatively high share in US imports across sectors such as footwear, textiles, leather and products. With the US having announced trade deals with Vietnam and Indonesia, both economies are now positioned to benefit from lower tariffs. While at present, a trade deal between India and the US remains under negotiation, India is likely to remain cautious about opening sensitive sectors such as agriculture and dairy, suggesting that a final trade deal may take some time to conclude.

Outlook for Rupee and Policy Rate

The rupee has depreciated sharply against the US dollar and is now at a record low. It has weakened by around 2% so far this year, making it Asia’s worst-performing major currency (See Exhibit 3 & 4). The currency has come under pressure from the 25% US tariff on India’s exports and concerns about the possibility of an additional penalty linked to India’s trade ties with Russia. In addition, persistent FPI outflows and recent dollar strength have also weighed on the rupee. However, the RBI is expected to intervene to limit currency volatility.

July marked the second consecutive month of net FPI outflows, driven by the equity segment, although the debt segment recorded inflows. Net FPI outflows (equity + debt) of USD 0.6 billion were recorded in July, following USD 0.9 billion of outflows in June.

Meanwhile, the US Fed kept interest rates unchanged at its July meeting, as expected. However, Fed Chair Powell’s hawkish remarks, highlighting low US unemployment and a resilient labour market, have lowered market expectations of a rate cut in September. The dollar index has appreciated by around 3% over the past month, although it remains about 8% lower on a CYTD basis.

We expect the rupee to remain under pressure in the near term. However, we maintain our forecast for USD/INR to trade in the 85–87 range by end-FY26, supported by a weaker dollar and India’s manageable current account deficit. A strengthening yuan should also help ease some pressure on the rupee. In addition, India–US trade negotiations are expected to continue and could provide some reprieve.

On the domestic monetary policy front, we do not anticipate further RBI rate cuts unless downside risks to growth materialise. The RBI has already front-loaded easing with a larger-than-expected 50 bps policy rate cut in June and shifted its stance to neutral, signalling limited room for further easing. As a result, we expect the RBI to maintain a status quo at its August policy meeting. Furthermore, the lack of clarity on US trade policy may also prompt the RBI to adopt a wait-and-watch approach in the near term.

Exhibit 3: Movement in Indian Rupee Exhibit 4: CYTD Currency Performance

Conclusion

India’s relative tariff advantage for its exports to the US compared to several Asian peers, such as Vietnam, Indonesia, and South Korea, has effectively reversed following the 25% US tariff, along with the possibility of an additional penalty linked to India’s trade ties with Russia. However, our analysis suggests that the direct export loss from these higher tariffs could be limited to around 0.3-0.4% of India’s GDP. India’s largely domestic-driven economy and its relatively low share of goods exports to the US (at about 2% of GDP) should provide some cushion. Moreover, India’s services exports remain outside the scope of these tariffs and should continue to support the external sector.

That said, indirect spillovers through weaker investor sentiment, capital outflows and currency pressures cannot be ruled out. Global uncertainty around tariffs remains high, including questions about the legality of the US tariffs and the possibility of an extension of the US-China trade truce.

India-US trade negotiations are expected to continue and could bring some relief. Still, India is likely to remain cautious about opening sensitive sectors such as agriculture and dairy, suggesting that the talks may take some time to conclude. Against this backdrop, it is too early to determine the clear winners and losers from the evolving tariff landscape. Volatility in global financial markets is likely to persist, and tariff-related developments will be critical to watch in the coming months.

Above views are of the author and not of the website kindly read disclaimer