Spot Silver is likely to face stiff resistance near $31 level and dip further towards $30 - ICICI Direct

Bullion Outlook

* Spot gold is likely to rise further towards $2790 level on softening of US treasury yields following US President Donald Trump comments on lower interest rates and weaker than expected economic data from US. Further, prices may rally on rise in demand for safe haven following uncertainty surrounding potential tariffs plans. Furthermore, Trump administration said they will impose sweeping measures on Colombia after country turned away 2 US military aircraft with migrants being deported

* Spot gold is likely to rise towards $2790 level as long as it trades above $2740 level. MCX Gold February is expected to rise further towards Rs.80,400 level as long as it stays above Rs.79,500 level

* Spot Silver is likely to face stiff resistance near $31 level and dip further towards $30. A break below $30 level prices may slip further towards $29.50 level. MCX Silver March is expected to slip towards Rs.90,000 level as long as it trades below Rs.92,500 level

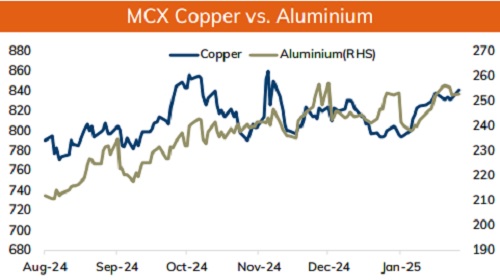

Base Metal Outlook

* Copper prices are expected to trade with negative bias on disappointing economic data from China and risk aversion in the global markets. Data showed that activity in manufacturing sector remained in contractionary phase in January, hurting demand for base metal. Additionally, all eyes will be on US President Donald Trump tariffs plan at the start of the week where US Fed is widely expected to keep rates unchanged. Meanwhile, decline in LME inventories would cushioned sharp fall in prices

* MCX Copper February is expected to slip towards Rs.830 level as long as it stays below Rs.845 level. A break below Rs.830 level copper prices may slip further towards Rs.825 level

* MCX Aluminum Feb is expected to face stiff resistance near Rs.254 level and slip back towards Rs.248 level. MCX Zinc Feb is likely to slip towards Rs.267 level as long as it stays below Rs.273 level

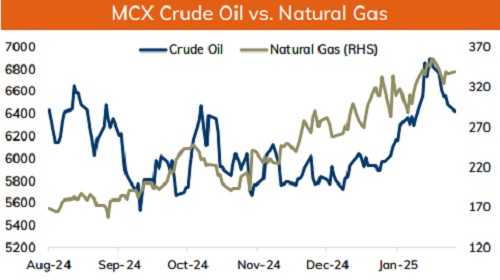

Energy Outlook

* NYMEX Crude oil is expected to trade with negative bias and slip further towards $72.50 level as US President Donald Trump called on OPEC to reduce oil prices. Further, prices may slip on easing tensions in the Middle East following ceasefire between Hamas and Israel. Moreover, US President Donald Trump plan to maximize US oil and gas production has raised concerns of higher output when market is expected to remain in surplus this year. Additionally, disappointing economic data from China will hurt prices

* NYMEX Crude oil is likely to slip further towards $72.50 level as long as its stays below $75.0 level. MCX Crude oil Feb is likely to slip further towards Rs.6250 level as long as it stays below Rs.6500 level.

* MCX Natural gas Feb is expected to slip further towards 285 level (20-Day EMA) as long as it stays below 300 level. A break below 285 level prices may dip further towards 280 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631