Spot gold is likely to rise on safe-haven demand and increasing bets on a Fed rate cut -ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to trade higher amid safe haven buying and growing bets of Fed interest rate cut. Prices would also get support on increasing fiscal debt and trade tariff uncertainties. Further, economic uncertainty and delay in release of US economic data would bring more investors towards the safe asset class. Recent dovish comments from the US Fed members and renewed trade war concerns may push bullions towards new highs. Meanwhile, investors will keep an eye on speech from the US Fed chair Jerome Powell to get further clarity on the quantum of interest rate cut.

* Spot gold is likely to move higher towards $4200, as long as it holds above $4100. MCX Gold December is expected to hold the key support near Rs.123,000 level and move higher towards Rs.126,000 level.

* MCX Silver Dec is expected to hold support near Rs.152,000 level and rise towards Rs.158,500 level. Strong physical demand and safe haven appeal will support prices to hold firm.

GOLD

Base Metal Outlook

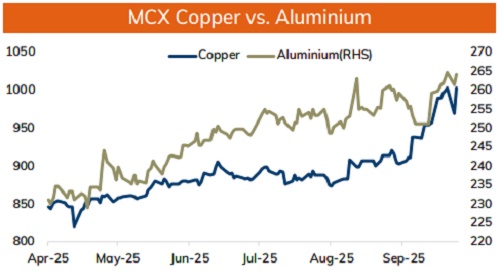

* Copper prices are expected to hold its gains and trade with a positive bias amid supply concerns. Further a better-than-expected trade data from China signals improved demand. Refined copper imports climbed by 485k tonnes, marking the highest level this year. Imports of copper concentrate remained strong at 2.59mt despite lower treatment charges. One of the key factors that would support prices is supply tightness. The International Study group has changed its forecast for a surplus in 2026 to 150k deficit due to lower availability copper concentrate. Meanwhile, investors will eye on key economic numbers from China.

* MCX Copper Oct is expected to hold support near Rs.990 and move back towards Rs.1020 level.

* MCX Aluminum Oct is expected to rise towards Rs.267 level as long as it stays above Rs.261 level.

* MCX Zinc Oct looks to rise towards Rs.297 as long as it holds key support at Rs.290.

Copper

Energy Outlook

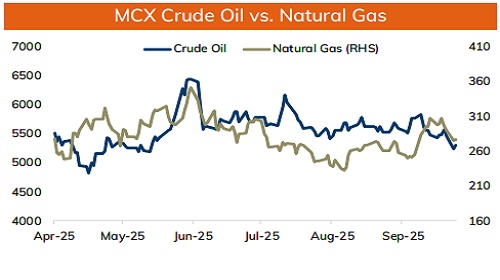

* Crude oil is likely to extend its rebound towards $61 per barrel due to improved risk sentiments and strong demand outlook from China. Meanwhile OPEC in its latest report kept its outlook for the oil market unchanged as the group continues to add additional supply to the market. It expects oil demand to grow by 1.3 million barrel per day this year. Meanwhile, easing geopolitical tension in the Middle East and extension to US Government shutdown would check the upside in oil prices

* MCX Crude oil Oct is likely to rise towards immediate resistance at Rs.5380, as long as it holds above Rs.5200 level. NYMEX crude oil is likely to move in the band of $58 and $60 per barrel. A move above $60 would open the doors towards $61 per barrel mark.

* NYMEX Natural Gas is expected to trade higher amid forecast of colder US weather. Meanwhile, higher storage levels and sluggish export demand would restrict any major upside. MCX Natural gas Oct is expected to rise towards Rs.280 level as long as it holds above Rs.268 level.

Crude oil

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631