Retail Sector Update : QSR - Growth moderation led by rains, festive shift; prefer JUBI By Emkay Global Financial Services

QSR: Growth moderation led by rains, festive shift; prefer JUBI

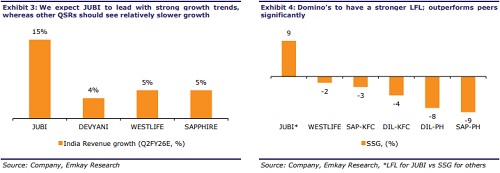

We expect overall revenue growth to moderate by ~250bps in 2QFY26 for western QSR chains, due to delayed recovery and one-off factors like incessant rains and lower number of non-veg eating days on festive preponement. Adjusting for these one-off factors, the consumption trends remain stable but muted (vs our expectation of an improvement). However, we stay constructive on QSRs, as we believe the correction in RM basket provides room for higher promotions and the cut in direct/indirect taxes has the potential to boost discretionary consumption in H2FY26. Despite a likely growth moderation for JUBI (15% in Q2 vs 18% in Q1), we expect its outperformance to continue (4- 5% expected for other QSRs), aided by new product launches, marketing edge, and loyalty program. These initiatives and the scope to increase convenience fee/packaging charge give us confidence about continued earnings growth for JUBI in H2, despite a high base. Our TP/ratings largely remain intact, as TP increases on account of the 3M rollover offset the impact of 5-7% earnings cut across QSR names, due to delayed recovery. However, we believe the Q2 disappointment is largely factored in, with 0-13% price correction across QSRs (3M). We remain in favor of JUBI, led by relatively better performance. Despite underperformance, we maintain BUY/ADD ratings on other QSR names, due to price correction and potential SSG revival in H2.

JUBI: Reiterate BUY on growth outperformance

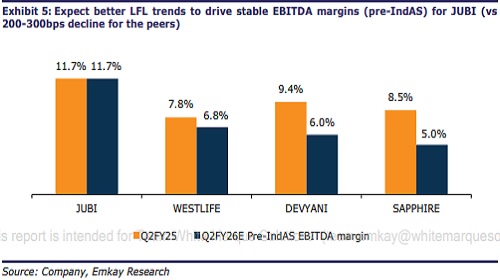

We expect Domino’s (JUBI) to outperform with 9% LFL vs SSG declines for most QSRs, barring Burger King, which is expected to report a low-single-digit SSG. In our view, JUBI is leading in the innovation game, which is driving the company’s growth outperformance (~15% growth in FY25 vs 4-5% growth for most peers). In addition, we expect better LFL trends to drive stable EBITDA margin (pre-IndAS) for JUBI (vs 100-350bps decline for the peers). With likely increase in disposable incomes on big cuts in direct/indirect taxes, we also see a scope for an increase in convenience fee/packaging charge, after an elongated phase of high promotions and value sharing with consumers. These JUBIspecific growth drivers give us confidence for continued earnings growth in H2, despite a higher base. We reiterate BUY on JUBI, with an unchanged TP of Rs825 (34x Sept-27 EBITDA), as 3-4% earnings cut is offset by rollover to Sep-27 earnings.

DEVYANI/SAPPHIRE should see greater impact due to higher non-veg salience

DEVYANI/SAPPHIRE should see greater impact due to higher non-veg salience We expect the impact of festive preponement to be relatively greater for Devyani/Sapphire due to higher non-veg salience in KFC. We expect Devyani/Sapphire to see a 3-4% SSG decline in KFC, which, along with an associated negative leverage, should lead to a ~350bps EBITDA margin (pre-IndAS) dip for Sapphire/Devyani. The margin dip for Devyani also has a component of BBK consolidation, which is currently at a quarterly loss run rate of ~Rs60mn (~80bps impact). However, we stay constructive on both, as we see potential for return of double-digit growth in H2FY26, helped by continued network expansion and SSG recovery. Our TP/ratings remain intact for Devyani/Sapphire, as the TP increases on account of the 3M rollover offset the impact of the 6-7% earnings cut, due to prolonged slowdown.

WESTLIFE: Maintain ADD on price correction and growth revival in H2FY26

Given the macro headwinds, we expect WESTLIFE to report sluggish topline growth of 5% in Q2. However, we remain confident of a better SSG trend in H2FY26, helped by new launches (Big Yummy burgers), brand extensions, all-day relevance, and premiumization. Westlife is also seeing differential growth trends across the two key operating regions, with the west region outperforming the south region by a margin. However, Westlife is taking targeted actions to improve growth in the South region, which gives us confidence of a potential recovery in H2. We keep Westlife’s TP unchanged at Rs775, as the impact of 7-8% cut in EBITDA for FY26/27 is offset by the rollover to Sept-27 earnings.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

More News

Telecom Sector Update : Tariff-hike-led SIM consolidation abates for private telcos; BSNL?s ...