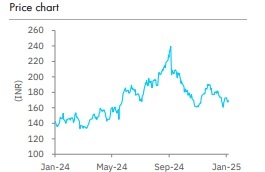

Reduce Torrent Pharmaceuticals Ltd For Target Rs. 3,382 By Elara Capital Ltd

India steady, glitches else where

Torrent Pharma (TRP IN) reported Q3FY25 revenue, EBITDA and PAT 6%-8% below our estimates. Domestic business continued with strong double-digit growth despite the slowdown in the overall market. Growth in the US business is yet to pick up and currency depreciation continued to hurt Brazil business growth (INR). RoW/other business was down YoY. We believe the business will show growth for the full year. We lower our core FY25E-27E EPS by ~3%. Trading at 47.2x FY26E core earnings, we see little upside to the stock. Neither do we see significant downside as the balance sheet de-leveraging and reducing interest expense (and consequently, faster EPS growth) should sustain the high valuation. We retain Reduce with TP unchanged at INR 3,382.

Strong growth in domestic business continues:

TRP continues to grow ahead of the industry in the domestic market, owing to high exposure to the fast-growing segments. Overall growth at 11.7% YoY in Q3 was significantly better than overall market growth at 6-7%. We expect TRP to continue growing faster than the market, and build in fullyear FY25E revenue growth estimate at 12.4%. With balance sheet de-leveraging underway, there are possibilities of inorganic upsides here as well.

LatAm – Currency continues to impact:

Revenue from the LatAm markets grew 8% in BRL terms, a bit lower than expected. However, BRL depreciation against INR impacted INR growth, which declined 6.7% YoY. The currency impact will continue to impact INR growth for 2-3 more quarters at current exchange rates, beyond which the base will normalize.

US yet to revive; insulin revenue down:

US revenue at USD 32mn was down 2.5% YoY in Q3, but remained at similar levels in the recent quarters. The management has indicated some pick-up in growth in FY26, with 6-7 launches planned. The recent clearance of the Dahej facility, a pick-up at the Indrad facility and the overall upcycle in the US market should help. TRP had reduced its focus on the US market during the height of pricing pressure in that market. With competitive scenario improving in the past two years, TRP is contemplating further R&D investments for that market. RoW and contract manufacturing revenues declined 17% YoY, mainly due to temporary shutdown in domestic insulin manufacturing facility – TRP has indicated revival in Q4.

Retain Reduce;

TP raised to INR 3,382: We lower our core FY25E-27E EPS by ~3%, as we build in slightly lower growth rate. TRP currently trades at 47.2x FY26E core earnings. We see little upside to the stock at these valuations. Neither do we see significant downside as the balance sheet de-leveraging and reducing interest expense (and consequent faster EPS growth) will sustain the high valuation. We retain Reduce and maintain our TP at INR 3,382, which is 40.4x FY27E core P/E plus cash per share. Slowdown in domestic business growth and currency fluctuations in the LatAm market are key downside risks. Value-accretive acquisitions in the domestic market will be key upside risks.

Please refer disclaimer at Report

SEBI Registration number is INH000000933