Reduce Equitas Small Finance Bank Ltd For Target Rs. 55 By Emkay Global Financial Services Ltd

Returns to profitability, but still not out of the woods

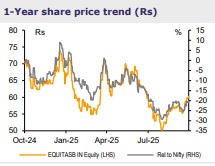

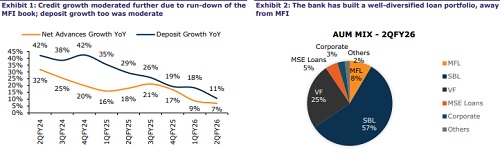

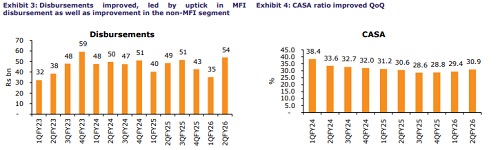

After posting a loss in Q1, Equitas SFB returned to profitability with a modest PAT of Rs 241mn, supported by stable NII and controlled opex, though partly offset by lower other income and higher provisions. Credit growth remained modest at 8.5% YoY, reflecting the ongoing rundown of the MFI portfolio and the new CV segment. NIM contracted further by 26bps QoQ due to the cascading impact of the MFI portfolio decline and rate cuts. Gross slippages remained elevated at Rs6.0bn (7.1%), though strong recoveries and NPA sales to ARCs helped maintain the GNPA ratio at 2.9%—below 3%, keeping it eligible for a universal bank license. The management optimistically expects loan growth of ~15% in FY26 and of ~20% thereafter, driven by a diversified portfolio and wider product reach, while MFI stress is anticipated to ease by 4Q. Factoring in slower growth and elevated stress, we further cut our earnings; retain REDUCE and TP of Rs55, valuing the bank at 1x Sep-27E ABV. Equitas plans to raise tier I (equity capital) of Rs12.5bn to shore up its capital buffer (tier I: 16.4%).

Modest growth with further margin compression

Equitas reported a modest 8.5% YoY AUM growth, driven by a continued rundown of its MFI portfolio (now ~8% of loans vs 16% YoY) and new CV segment, while non-MFI segments saw healthy growth. The bank has resumed MFI disbursements (expects Rs10bn in Q3), introduced individual MFI loans, and remains cautious on KTK with conservative credit norms. NIM contracted by 26bps QoQ to 6.3% due to the cascading impact of the MFI portfolio rundown; however, with improving MFI disbursements, lower OD flows, and funding cost benefits, yield and NIM are expected to improve and reach ~6.5% by FY26 with a steady-state range of 6.5-7%. Equitas targets ~15% loan growth in FY26 and ~20% thereafter, aided by a diversified portfolio and broader product reach.

Stable asset quality aided by NPA sales to ARC

Gross slippages remained elevated at Rs 6.0bn (7.1%), though higher recoveries and NPA sales to ARCs helped keep the GNPA ratio stable at 2.92% (below 3%). The mgmt indicated that the MFI and non-MFI portfolios would improve from Q3, with fresh OD flows moderating (Rs300mn in Sep vs Rs240-250mn in Oct). MFI stress is projected to normalize by 4QFY26, while the bank plans to utilize the standard asset provision created in Q1FY26 over the next nine months, to manage provisions and support profitability. Credit costs are expected to remain at 1.5-1.7% in the near-to-medium term.

We retain REDUCE and TP

Factoring in the slower growth and elevated stress, we further cut our earnings estimates. We retain REDUCE with a TP of Rs55, valuing the bank at 1x Sep-27E ABV. The bank plans to raise tier I (equity capital) of Rs12.5bn to shore up its capital buffer (Tier I at 16.4%). Key upside potential to our rating: Better than expected growth/margin trajectory; earlier than expected improvement in NPA formation.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354