Opening Bell : Benchmarks likely to get cautious start amid mixed Asian cues

Indian equity benchmarks are likely to get a cautious start amid mixed Asian cues after a meeting between Russian and U.S. officials raised hopes of an end to the three-year war in Ukraine. Some support may come amid a healthy buying by FPIs/FIIs. On February 18, foreign investors net bought India shares worth Rs 4,786.56 crore. Meanwhile, Hexaware Technologies shares are set to debut on the stock markets today.

Some of the key factors to be watched:

Unemployment rate in urban areas dips to 6.4% in December quarter: the National Sample Survey Office (NSSO) has stated that the unemployment rate for people aged 15 years and above in urban areas dipped to 6.4 per cent in the October-December quarter.

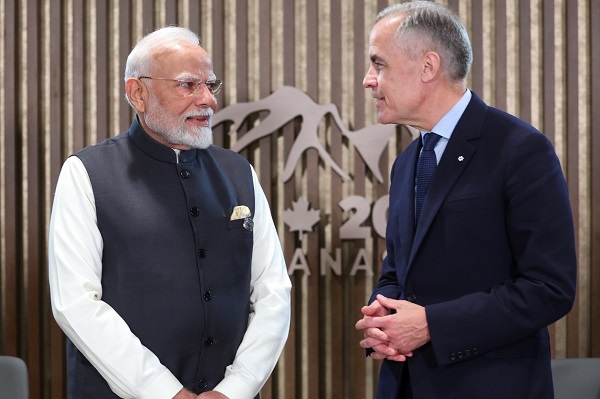

India, Qatar aim to double bilateral trade to $28 billion in five years: India and Qatar have agreed to double bilateral trade to $28 billion over the next five years and announced elevation of their relationship to the level of strategic partnership as Prime Minster Narendra Modi held talks with Amir Sheikh Tamim Bin Hamad Al-Thani.

India, UAE trade grows 21.35% to $80.51 billion during Apr-Jan in FY25: The commerce ministry data showed that the bilateral trade between India and the UAE grew 21.35 per cent to $80.51 billion during the April-January period this fiscal year.

Real estate industry stocks will be in focus: Industry bodies Ficci and Assocham have demanded that real estate developers should be allowed to claim Input Tax Credit (ITC) under the Central Goods and Services Act (CGST) on commercial assets constructed for leasing purposes.

There will be some buzz in insurance sector stocks: A private report indicated that India’s insurance sector has witnessed significant growth and development over the past few years with the domestic insurance market grown at a CAGR of 17 per cent over the last 2 decades and is expected to reach a size of $222 billion by 2026.

On the global front: The US markets ended the volatile trading session in green terrain on Tuesday with earnings season winding down, US Federal Reserve minutes on tap, and geopolitical uncertainties churning in the background. Asian markets are trading mixed on Wednesday amid a slew of economic data releases, and ahead of the release of the US Fed's latest policy minutes.

Back home, Indian equity benchmarks erased most of their losses and ended flat with negative bias on Tuesday driven by gains in Utilities, Oil & Gas and Power stocks. Finally, the BSE Sensex fell 29.47 points or 0.04% to 75,967.39, and the CNX Nifty was down by 14.20 points or 0.06% to 22,945.30.

Some of the important factors in trade:

India's economy to grow 6.4% in Q3: Traders got some respite as ICRA projected India's GDP to grow 6.4 per cent in the December quarter on account of enhanced government spending amid uneven consumption.

India will continue to review import duties, aim to be investor friendly: Finance minister Nirmala Sitharaman said reciprocal import duty cuts are a continuous thing and India will periodically review custom duties and anti-dumping duties as its in line with the country's ambition to be an investor friendly country.

US Treasury yields ticked higher: U.S. Treasury yields were higher after a day’s holiday, as investors looked toward the FOMC meeting minutes later this week and digested a bond selloff in Europe.

Above views are of the author and not of the website kindly read disclaimer

.jpg)