Daily Derivatives Report 06 June 2025 by Axis Securities Ltd

The Day That Was:

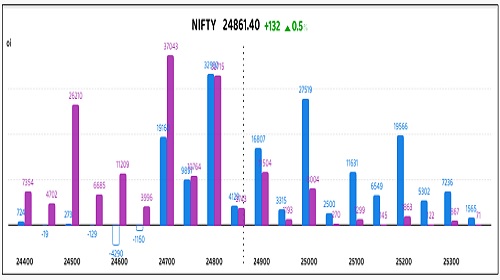

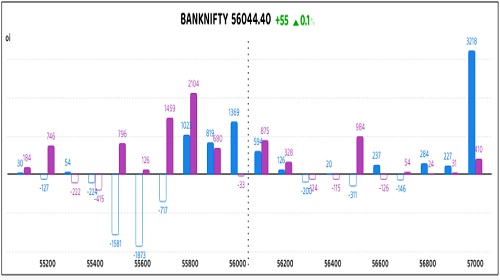

Nifty Futures: 24,861.4 (0.5%), Bank Nifty Futures: 56,044.4 (0.1%).

Nifty futures notably gained 132 points yesterday, despite retreating from intraday highs, primarily propelled by substantial buying in the pharma and realty sectors. The market exhibited significant volatility coinciding with the weekly expiry of the Nifty F&O series; however, sentiment remained robust. Bank Nifty futures also extended their rally for a second consecutive session, advancing 55 points, buoyed by positive global sentiment and growing expectations of an RBI rate cut. Sectoral performance was diverse, with realty leading the market with a strong 1.9% increase, closely followed by pharma, which surged 1.3%. The infra, IT, and metal indices also posted respectable gains, ranging from 0.38 to 0.58 per cent. Conversely, PSU Bank, media, and auto shares experienced declines. Investor attention stays sharply centred on the upcoming RBI policy decision, while also closely observing bond markets, trends in Brent crude, and changing global trade dynamics developments. Market volatility, as indicated by India VIX, eased considerably, falling 4.2% to 15.08. Concurrently, the rupee strengthened against the U.S. dollar, closing at 85.79, appreciating from its previous close of 85.90, primarily due to mild dollar inflows and positive movements in most Asian currencies. Nifty futures premium increased to 111 points from 109, while Bank Nifty premium moderated from 313 to 284 points.

Global Movers:

US stocks ended down yesterday, with the S&P 500 finishing 0.5% and the Nasdaq 100 closing 0.8% lower. Elsewhere, the public spat between Musk and President Trump over the latter's tax bill hit Tesla hard, with the stock dropping over 14%. Meanwhile, President Xi Jinping and Trump agreed to more trade talks after the latter said they cleared certain pending disputes and he accepted China's invitation to visit. In markets, the VIX rose nearly 5%, the dollar index fell for the third day in four while the US 10-yr treasury yield recovered from a near-one month low, gold dropped on Trump-Xi talks as the demand for safe havens reduced somewhat, silver jumped to the highest in 13 years while oil was steady near $63 as trade tensions thinned out.

Stock Futures:

In yesterday's session, Hindustan Zinc, Central Depository Services, Eternal Ltd, and RBL Bank experienced significant price fluctuations accompanied by high trading volumes, indicating heightened investor interest and robust market activity.

Hindustan Zinc exhibited a robust performance, closing with a significant 5.3% price appreciation, thereby decisively breaching its four-month high on the highest single-day trading volume of the current month. This substantial surge in market capitalization was primarily catalysed by a notable escalation in silver prices, as July-expiry silver futures on the Multi Commodity Exchange (MCX) impressively jumped nearly 3% to register an all-time high of Rs 1.04 Lc per Kg, while silver's spot price on the MCX concurrently reached Rs 1.01 Lc per Kg. As a recent entrant into the F&O segment, HindZinc experienced a "Long Addition" coupled with price gains, alongside a massive 23.9% surge in open interest. The current futures open interest now stands at an unprecedented 9,921 contracts, reflecting a fresh accretion of 1,911 contracts, which translates into 23.4 Lc shares, marking the highest single-day addition since its F&O segment inception. This substantial build-up in derivatives data, particularly the record open interest and significant long additions, strongly indicates a pervasive bullish sentiment and substantial speculative interest accumulating in Hindustan Zinc's futures contracts.

Central Depository Services (CDSL) surged by 4.7% amid robust trading volume, closing near its yearly peak, propelled by strengthened investor interest stemming from the flow of recent mainboard IPOs. This resurgence in primary market activity has demonstrably uplifted broader capital market sentiment. CDSL's derivatives intricate positioning signals a short covering, evidenced by price appreciation coupled with a marginal 1.3% dip in open interest. Futures open interest currently stands at 36,360 contracts, reflecting a shedding of 495 contracts, or 1.7 Lc shares. Furthermore, option metrics reveal a total call open interest of 24,725 contracts and a yearly high put open interest of 20,929 contracts. Notably, call options declined by 33 contracts, compared with a significant accretion of 1,890 contracts in put options. The derivatives landscape indicates a decisive bullish tilt, with aggressive put accumulation underscoring robust downside protection and conviction among market participants.

Eternal Ltd.'s equity experienced a significant rally of 4.6%, extending its gains for the second consecutive session and closing decisively above its four-month high, underpinned by robust trading volumes. This positive price action was primarily driven by Morgan Stanley's bullish initiation, citing Eternal's leadership across food delivery and quick commerce, its efficient cost structure, and a fortified balance sheet that mitigates future equity dilution risk. A key determinant for this optimistic outlook is the expanding addressable market within quick commerce. From a derivatives perspective, Eternal has witnessed a short covering, characterised by price appreciation alongside a 2.1% reduction in open interest. Current futures open interest stands at 99,090 contracts, reflecting a shedding of 2,120 contracts, equivalent to 42.4 Lc shares. Notably, the stock has observed a sustained unwinding of positions since the commencement of the current expiry, culminating in a 25% decrease in open interest, translating to 670 Lc shares, concurrent with a 13% price gain. This persistent unwinding of short positions, even as the price escalates, underscores a strong short squeeze and a capitulation of bearish bets, reinforcing the underlying bullish momentum in the stock.

RBL Bank's share price depreciated by 3%, marking its lowest weekly close despite a recent "BUY" recommendation from a domestic brokerage firm that cited improving growth and asset quality prospects. This price action was accompanied by a short addition, with a marginal 0.7% increase in open interest. Current futures open interest stands at 29,016 contracts, reflecting a modest addition of 192 contracts, equivalent to 4.8 Lc shares in open interest. In the options segment, the put-call ratio registered 1.02, indicating a slight bias towards puts. Total call option open interest is at 3,728 contracts, while put option open interest reached a yearly high of 3,819 contracts. This activity involved a decrease of 378 call option contracts and a substantial addition of 745 put option contracts. The aggregate derivative data suggests a bearish sentiment prevails, with significant put option accumulation providing downside hedging and reflecting a cautious, if not outright negative, outlook among market participants, notwithstanding the underlying fundamental upgrade.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) rose to 0.98 from 0.73 points, while the Bank Nifty PCR rose from 0.81 to 0.83 points.

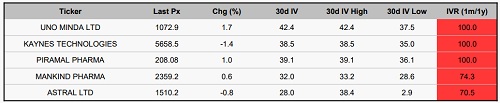

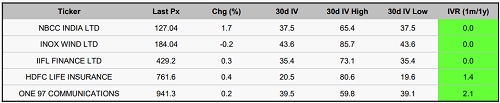

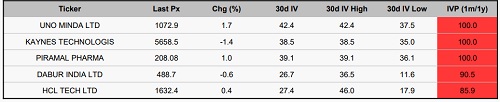

Implied Volatility:

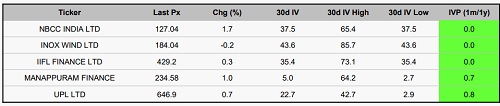

Uno Minda and Kaynes Technology have experienced notable stock price fluctuations, with both companies topping the implied volatility (IV) rankings at 100. Uno Minda currently holds an IV of 42%, while Kaynes Technology follows closely with 39%. This surge in IV has driven option premiums higher, prompting traders to refine their risk management strategies in response to changing market dynamics. On the other hand, NBCC and Inox Wind Ltd exhibit the lowest IV rankings, with IV levels at 38% and 44%, respectively. Their comparatively stable volatility makes them attractive options for investors considering long positions in an ever-evolving market.

Options volume and Open Interest highlights:

Mazagon Dock and Computer Age Management Services (CAMS) are exhibiting strong bullish signals, with call-to-put volume ratios of 5:1 and 4:1, respectively. This indicates a significant preference for call options, suggesting investor confidence in their future price appreciation. However, this pronounced skew towards calls might also hint at overvaluation in their options pricing, urging caution for traders considering entry. In contrast, Canara Bank and Punjab National Bank show a more defensive posture. Their high put-to-call volume ratios and increased put option activity suggest investor concerns about potential price declines. This elevated put volume could, however, signal an oversold condition, potentially presenting contrarian trading opportunities. Meanwhile, Bharat Dynamics and Hindustan Zinc are experiencing notable open interest in both call and put options, pointing to heightened volatility. This is closely followed by CDSL on the put side. These levels of open interest could act as crucial resistance points or catalysts for price movements, creating avenues for volatility-based trading strategies. (This data considers only those stock options that saw a minimum of 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In the index futures segment, a total of 9,554 contracts experienced a change in open interest. Retail clients modestly added 34 contracts, while Foreign Institutional Investors (FIIs) significantly reduced their exposure by decreasing 4,053 contracts. In stark contrast, Proprietary traders exhibited strong conviction, aggressively adding 9,520 contracts. This dynamic indicates a notable divergence in sentiment among participant categories, with proprietary desks accumulating long positions, possibly anticipating an upward trajectory in the index, while FIIs are scaling back their exposure. Conversely, in stock futures, a total of 15,327 contracts witnessed a change in open interest. Retail clients were the primary accumulators, adding all 15,327 contracts. Meanwhile, both FIIs and Proprietary traders reduced their positions, decreasing 6,339 contracts and 2,924 contracts respectively. This suggests retail participants are actively building long positions in individual stocks, potentially driven by specific stock-centric narratives, while institutional and proprietary players are unwinding their existing exposures, implying a more cautious or profit-booking stance in the stock futures segment.

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633