F & O Rollover Report - Axis Securities

Nifty

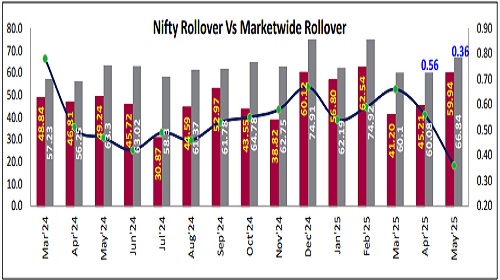

The Nifty May rollover stands at 59.9% on Tuesday, compared to 45.2%, on the same day of the previous expiry; this is higher than the three-month average of 49.6% and the six-month average of 50.8%. The rollover cost for May stands at 0.36% on Tuesday, compared to 0.56% on the same day of the previous expiry, indicating a lower cost associated with this month's rollover. Bank Nifty’s May rollover stands at 50.6% on Tuesday, compared to 56.4% on the same day of the previous expiry; this is lower than the three-month average of 58.2% and the six-month average of 59%. The market-wide March rollover stood at 66.8% on Tuesday, compared to 60% on the same day of the previous expiry, which is slightly above than the three-month average of 65% and the six-month average of 65.8%. The option data for the May series indicates a strong Call Open Interest (OI) at the 25,000-strike price, followed by 24,800. In contrast, a substantial concentration of Put OI is observed at 24,500, with additional levels at 24,200. This suggests the likely range for the current expiry is between 24,300 and 25,200.

Nifty Rollover Vs Market-wide Rollover

Stock & Sector Highlights

- ANGELONE, TATACONSUM, HINDCOPPER, HINDPETRO, and SIEMENS saw higher rollovers on Tuesday than the previous expiry day. - CHAMBALFERT, TVSMOTOR, RBLBANK, TATACOMM and DALBHARAT saw lower rollovers on Tuesday than on the same day of the previous expiry. - The highest rollover at the current expiry for the day is seen in TCS, TATACHEM, JSWSTEEL, TRENT, and ITC. - MANAPPURAM, CHAMBALFERT, TATACOMM, TITAGARH, and LUPIN have the lowest rollover in the current expiry for the day.

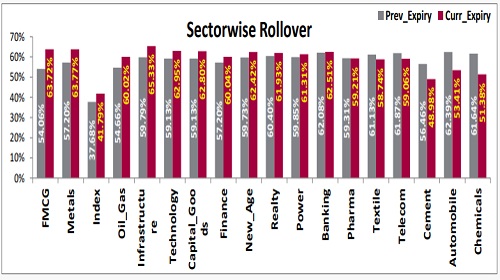

Sector-wise Rollover

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633