Daily Derivatives Report By Axis Securities Ltd

The Day That Was:

Nifty Futures: 24,418.4 (0.0%), Bank Nifty Futures: 55,241.8 (-0.5%).

Nifty futures initially exhibited upward momentum, driven by optimistic U.S.-India trade prospects and renewed foreign fund inflows. However, they sharply reversed course, ultimately concluding marginally lower by 7 points. Bank Nifty also traded in red with a price cut of 268 points in tandem with broader indices. This unexpected flat performance on a weekly expiry, preceding the Maharashtra Day market holiday, was primarily driven by significant declines in Bajaj Group equities and escalating geopolitical concerns stemming from heightened India-Pakistan tensions following Prime Minister Modi's directive for decisive military action post the Kashmir attack. Concurrently, the India VIX dramatically surged 5%, breaching the 18 mark and signalling increased market apprehension. Sectorally, Realty, Pharma, and Auto demonstrated robust gains, contrasting with notable downturns in PSU Bank, Media, and Consumer Durables. In currency markets, the Indian Rupee powerfully appreciated, reaching a year-to-date peak of 84.4875 against the U.S. dollar, reflecting underlying resilience amidst global economic currents. The Nifty futures premium dropped from 89 to 84 points, while the Bank Nifty premium rose from 118 to 155 points.

Global Movers:

US stocks gained for the eighth straight day, as big tech earnings boosted investor sentiment. The S&P 500 gained 0.6%, while the Nasdaq 100 rose 1.1%. Meanwhile, President Trump said that he is hopeful that a fair deal with China will come through. Retail investors are liking the reduced uncertainty, as they set a new record for the largest monthly inflow of nearly $40 billion in April, according to data from JP Morgan. Talking markets, the VIX dropped slightly, the dollar rose for a third day, the 10-year treasury gained for the first time in eight days, bitcoin jumped, Gold fell to the $3200 area on reduced haven demand, while nymex oil recovered from its slump after Trump threatened more sanctions against buyers of oil from Iran.

Stock Futures:

Wednesday's trading session saw a significant rise in volume for Indraprastha Gas, HDFC Life Insurance, Bajaj Finserv, and Exide Industries, accompanied by heightened price volatility, indicating strong market activity and growing investor interest in these stocks.

Indraprastha Gas witnessed a notable increase of 4.2% in its stock value, representing the largest single-day gain in two months and the highest daily trading volume since early January, driven by an upgrade from a local brokerage institution forecasting a 21% upside. Although there was a 10% rise in net sales, the firm experienced a 9% decline in net profit for Q4 FY25 compared to the prior year, with EBITDA margins contracting to 13% from 15%. The derivative scenario shows a Long Addition, characterized by a price increase alongside a minimal 0.1% rise in open interest, resulting in a total future open interest of 10,691 contracts with an insignificant addition of five contracts. In the options segment, the put-call ratio has decreased from 0.77 to 0.69, with call option open interest at 4,960 contracts (an uptick of 337 contracts) and put option open interest at 3,418 contracts (a drop of 137 contracts). While the options positioning indicates an emerging bullish bias, the modest increase in futures open interest points to a lack of robust conviction, suggesting potentially limited upward momentum for IGL.

HDFC Life Insurance recorded a significant appreciation of 3.8% in its stock price, characterized by persistent upward movement and a close at its intraday peak, supported by considerable trading volume, driven by strong Q4 FY25 earnings. The company disclosed a 16% year-on-year (YoY) growth in standalone net profit to ?475 crore, alongside a 16% YoY rise in net premium income to ?23,766 crore, and a 9.7% YoY increase in Annualised Premium Equivalent (APE) to ?5,186 crore. Derivative analysis presents a Long Addition, evidenced by the price gain and a 1.6% rise in open interest. The current futures open interest stands at 26,165 contracts, with a substantial addition of 405 contracts (equivalent to 4.5 lakh shares), the highest in the past five sessions. In the options segment, total call option open interest is at 10,109 contracts, and put option open interest is at 6,261 contracts, with additions of 2,054 and 2,876 contracts respectively, resulting in the put-call ratio increasing to 0.62 from 0.42, indicating that traders are increasingly hedging their positions following a nearly 6% rally in the previous three trading sessions. This convergence of positive earnings and derivative activity suggests an enhancement of bullish sentiment in the stock.

Bajaj Finserv experienced a marked decline of 5.5% in its stock price, representing the most substantial single-day decrease since early June 2024, accompanied by significant trading volume, triggered by its earnings announcement. Despite a 14% increase in consolidated net profit, this figure did not meet consensus estimates, compounded by the company's indication of a broader slowdown in credit growth and the effects of new surrender regulations in the Life Insurance sector, alongside an accounting adjustment for long-term contracts in the General Insurance business. Elevated non-performing assets (NPAs) within the lending sector contributed further to investor concerns. Derivative analysis suggests a Short Addition, characterized by a price decrease and a 3.6% increase in open interest, equating to 4.3 lakh shares. Option positioning shows a total open interest of 19,120 call option contracts and 9,779 put option contracts, yielding a put-call ratio of 0.51, with significant additions of 8,604 call option contracts and 3,055 put option contracts. This low put-call ratio and substantial call option activity imply active hedging or bearish positioning by traders anticipating potential price fluctuations or further downside.

Exide Industries reported a substantial drop of 5.4%, marking its second-largest decline in two months, coupled with the highest single-day trading volume during the same period, triggered by its earnings report. The company noted an 11% year-on-year (YoY) reduction in net profit, despite a 4% increase in revenue from operations. At the operating level, EBITDA decreased by 9.6%, with the EBITDA margin contracting to 11.2% from 12.3% in Q4 FY24, primarily due to heightened raw material costs, particularly a significant rise in antimony prices over the last six months, adversely impacting sequential margins. Derivative analysis illustrates a pronounced Short Addition, evidenced by the price decline and a considerable 12.6% surge in open interest. The current futures open interest totals 13,787 contracts, with a notable addition of 1,546 contracts, equating to 27.8 lakh shares, marking the highest single-day open interest addition for the year. This strong bearish sentiment within the futures market underscores the unfavourable reaction to Exide Industries' financial performance.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) rose to 1.16 from 1.13 points, while the Bank Nifty PCR fell from 0.95 to 0.94 points.

Implied Volatility:

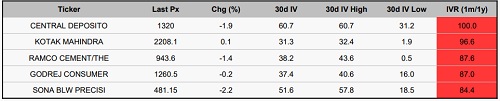

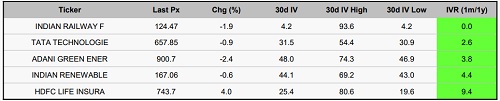

Kotak Bank and CDSL have experienced notable fluctuations in stock prices, as reflected in their implied volatility rankings of 97 and 100. The implied volatility for Kotak Bank has increased to 31%, while CDSL's has reached 61%. This rise indicates that options are becoming more expensive, leading traders to implement risk management strategies to navigate these changes. Conversely, IRFC exhibits the lowest implied volatility rankings, with Tata Technologies at just 3. Their implied volatilities stand at 4% and 32%, respectively, suggesting that these options may offer better prospects for investors looking to take long positions.

Options volume and Open Interest highlights:

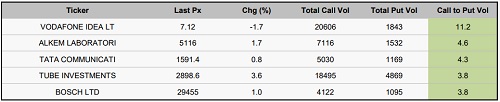

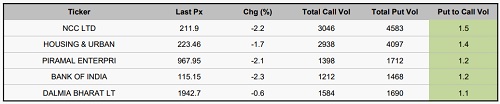

Vodafone Idea and Tube Investments of India demonstrate a positive outlook, shown by their impressive call-put volume ratios of 11:1 and 4:1, respectively. These figures suggest strong demand for call options, indicating market expectations for rising prices. On the other hand, this steep call skew could imply potential overvaluation within the options market. In contrast, NCC and HUDCO present a notable put-call volume ratio, with increasing put volumes highlighting a risk-averse attitude fueled by worries over possible price drops. Nevertheless, substantial put volumes might signify an oversold situation, presenting contrarian trading possibilities. Regarding positioning, Tata Technologies continues to reveal considerable open interest in both call and put options, indicating potential price volatility that could either serve as a resistance level or drive prices up. (This data considers only those stock options that saw a minimum of 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In Wednesday's session, index futures activity reveals a notable divergence in participant sentiment. While clients exhibited a substantial contraction of 6,132 contracts out of a total change of 9,051, indicating a bearish inclination or profit-booking, Foreign Institutional Investors (FIIs) displayed a strong bullish conviction by augmenting their positions by a significant 7,897 contracts. Proprietary traders also contributed to the net positive change, adding a modest 1,154 contracts, suggesting a cautiously optimistic or opportunistic stance. This contrasting behaviour underscores the nuanced undercurrents shaping index futures market trends. In the realm of stock futures, the dynamics present a starkly different picture. Against a backdrop of 41,284 contracts changing hands, clients registered a pronounced reduction of 21,664 contracts, signalling a considerable bearish bias or unwinding of long positions. Conversely, FIIs demonstrated aggressive bullish accumulation, absorbing the client selling with an equivalent addition of 41,284 contracts, revealing a strong affirmative outlook on underlying equities. In contrast to their index futures activity, Proprietary traders trimmed their positions by 6,907 contracts, potentially reflecting a more selective or risk-averse approach within the stock-specific domain.

Nifty

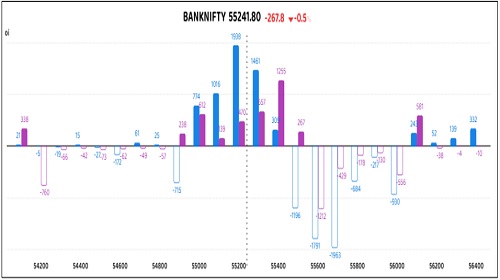

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

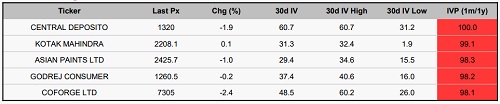

Stocks With High IVP:

Stocks With Low IVP:

Stocks With High Call Volume To Put Volume

Stocks With High Put Volume To Call Volume

Call Open Interest Relative to Record High

Put Open Interest Relative to Record High

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)