Nifty rose early, hit 5-day high, then fell on RBI policy caution - ICICI Direct

Nifty : 24751

Technical Outlook

Day that was…

* Indian equity benchmarks extend gains for second day ahead of RBI monetary policy. The Nifty settled at 24,751, up 0.53%. Market breadth was in favor of advances, with an A/D ratio of 1.50:1, as the broader market outshined. Sectorally, Realty, Pharma and Healthcare stole the show, whereas, PSU Bank, Auto, and Nifty Pvt bank were the laggards

Technical Outlook:

* Nifty opened on the positive note after an initial upmove in the first half where it touched previous five day’s high, the index witnessed profit booking ahead of the RBI policy meet. This led to the formation of green candle with wicks on both the sides, signaling volatility. However, India VIX cooled off 4% and closed at 15.08 indicating, positive bias.

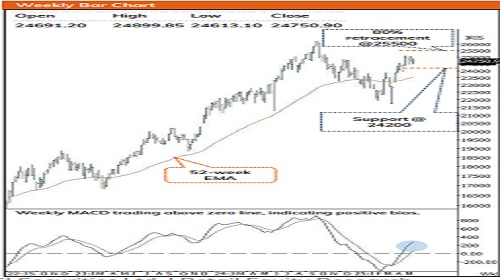

* In today’s session all eye will be on RBI policy meet. Post RBI event sustainability above 24,500 on a closing basis would drive Nifty gradually towards upper band of consolidation (25100). Eventually, we expect index to challenge 25100 and open the doors for 25500 levels. Key point to highlight is that, Nifty is trading in a broader consolidation area of 24500-25100 from past 18 session, despite this the broader market outperformed backed by improving sentiment indicating index consolidation as healthy. After Tuesday’s sizeable bearish candle, the lack of follow-through momentum below the lower band of consolidation indicates inherent strength and supportive buying at lower levels. In the interim, bouts of volatility are expected, with stock specific movements to continue. Consequently, rate-sensitive sectors like Financials, Auto, and Realty will be in focus.

* Key thing to highlight is that, the index has staged a strong 15% rally from April lows. Post that, Nifty has been consolidating over past two weeks wherein it corrected 3%. The elongation of rallies followed by shallow retracement is a key ingredient of a structural bull market. Any decline should be used as buying opportunity.

* On the broader market front, the ratio chart of Nifty 500 / Nifty 100 has staged a strong rebound after finding support from multi years range breakout area. The rising ratio line highlights relative outperformance of the broader market compared to large caps. Meanwhile sector rotation underpinned by improvement in market breadth augurs well for durability of ongoing optimism in the midcap and small cap space. Additionally, market breadth has improved from previous session notably, with 51% of Nifty 500 stocks now trading above their 200- DMA, compared to a low of 25% in May. This clearly indicates a broadening of market participation.

* Key monitorable which would validate our positive bias going ahead:

* a) RBI's commentary on rate cut

* b) The cool off in US 10-year Yields, Dollar Index and Brent crude augurs well for emerging markets.

* c) Bilateral Trade Agreement between India and US

* The index is consolidating between (25100-24200). We maintain our support base at 24200 as it is the gap zone support (24378-24164) and 38.20% retracement of recent rally (21743-24944).

Nifty Bank : 55761

Technical Outlook

Day that was :

* The Bank Nifty extended gain for second session ahead of RBI Meet . The index settled at 55 ,761 , up 84 points . The Nifty Pvt Bank index underperformed the benchmark, and closed on a flat note at 27 ,342 , down 26 points .

Technical Outlook :

* The index started the day on a positive note, and after an initial upmove, profit booking emerged near 56000 levels and decline towards day’s low only to close on a flat note . The daily price action formed a Doji candle, signaling a breather ahead of the RBI policy meet .

* In today’s session all eye will be on RBI policy meet . Post RBI event Bank Nifty needs decisive close and sustenance above the all -time high of 56100 level that would accelerate the move towards the 57 ,000 mark, which represents the 138 .20 % external retracement of the decline from 56 ,098 to 53 ,483 . Meanwhile, strong support is placed at 54 ,500 –54 ,800 , which marks the 61 .80 % retracement of the recent up -move (53 ,483 –55 ,903 ) and coincides with the gap area seen on 12th May (54 ,055 –54 ,442 ) . Concurrently, volatility is expected to persist ahead of the RBI monetary policy, and any decline from current levels would offer incremental buying opportunities .

* Structurally, the Bank Nifty is witnessing an elongation of rallies followed by shallow retracements, signifying a robust price structure . The recent up -move of 14 % is stronger compared to the previous month’s 9 % rise . Additionally, the declines are becoming shallower, with the recent one being 4 . 6 % versus 5 . 4 % in March 2025 . Furthermore, the index broke out of an eight -month falling trendline and surpassed its lifetime high, highlighting continued strength .

* The PSU Bank index underperformed the benchmark and witnessed profit booking ahead of the RBI policy meet and closed on a negative note . The index broke out from an eleven -month falling trendline on 19th May and, since then, has been forming a higher -high -low structure, indicating strong upside momentum . While the Bank Nifty is trading near its all -time high, the PSU Bank index is still trading ~14 % below its all -time high, presenting a compelling case for a catch -up move . Meanwhile, immediate support on the downside is placed at 6 ,700 , which is the 38 .20 % retracement of the rally from 7th April 2025 to 3rd June 2025 and coincides with the 20 -day EMA

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631