O/s Spreads Decline Marginally, Fresh Spreads Remain Flat by CareEdge Ratings

Synopsis

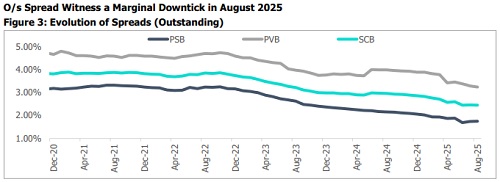

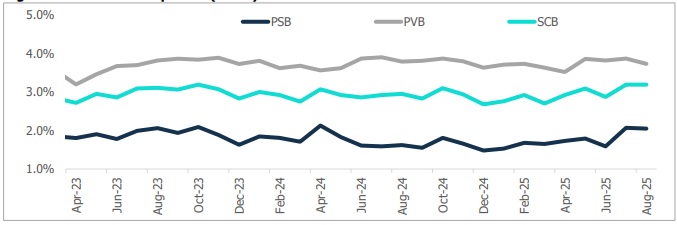

* In August 2025, the spread between the outstanding (o/s) weighted average lending rate (WALR – Lending Rate) and the o/s weighted average domestic term deposit rate (WADTDR – Deposit Rate) for scheduled commercial banks (SCBs) marginally declined by one basis point (bps) on a month-on-month (m-o-m) basis, to 2.45%.

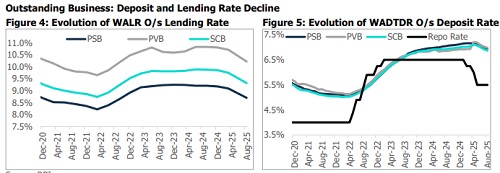

* The SCBs’ lending rate on o/s rupee loans fell by six bps m-o-m to 9.32%, driven by rate cuts, weaker credit demand and competitive pressures.

* The deposit rate on o/s rupee term deposits also decreased by five bps to 6.87%, driven by a six-bps reduction of foreign banks (FBs), a five-bps reduction in private sector banks (PVBs) and a four-bps reduction in public sector banks (PSBs), respectively.

* Additionally, in August 2025, the sharper fall in lending rates relative to deposit rates indicates stronger transmission on the credit side, as banks adjusted loan pricing more quickly in response to demand and competition, while deposit rates moved down gradually, given the slower repricing of liabilities.

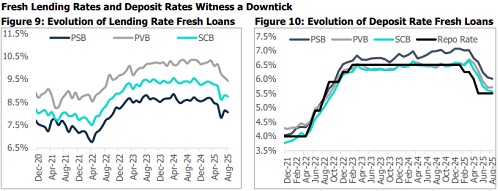

* In August 2025, SCBs’ fresh spread remained flat, standing at 3.19%, primarily as deposit costs remained sticky while lending rates faced pressure from competitive pressures and weaker credit demand. Surplus liquidity further limited banks’ ability to widen margins. Overall, spreads remained stable, supported by a shift in the loan mix toward MSME and other segments that offer higher returns. o As of August 2025, lending rate and deposit rates on fresh loans for SCBs marginally declined by five bps m-o-m to 8.75% and 5.56% respectively.

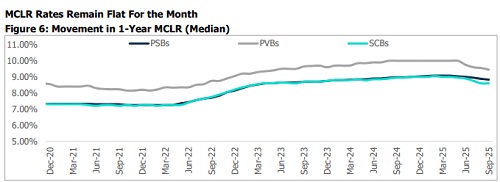

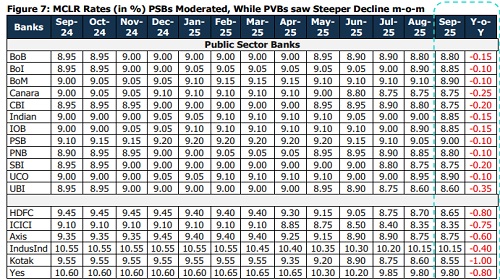

* In September 2025, the one-year median MCLR remained flat m-o-m to 8.60%. Furthermore, the MCLR of PSBs declined by five bps to 8.83%. In comparison, PVBs experienced a larger reduction than PSBs, declining by 10 bps to 9.45%. Meanwhile, FBs marginally increased by two bps to 7.05%, indicating transmission catchup among PVBs during the month.

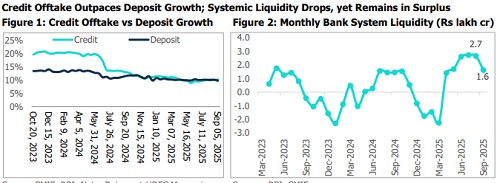

* Credit offtake rose 10.3% y-o-y in the fortnight ending September 05, 2025, attributed to rapid credit expansion to MSMEs. Additionally, large corporations have shifted some part of their borrowings to banks due to higher yields in the bond market. This growth stayed well below the 13.4% (ex-merger) seen in the same period last year, weighed down by a high base effect, subdued private capex, weaker corporate lending, and reduced credit flow to NBFCs. Deposits rose by 9.8% y-o-y, reaching Rs 236.7 lakh crore as of 05 September 2025. However, they remain lower than the 11.2% growth (excluding merger impact) seen last year. Time deposits grew by 8.8% year-on-year to Rs 207.8 lakh crore, accounting for 88.7% of total deposits, a slowdown from the 11.1% growth in the same period last year. Demand deposits, on the other hand, increased by 17.7% yo-y to Rs 28.9 lakh crore, making up 12.3% of the total deposits.

* As per CareEdge Economics, as of the end of September 2025, the RBI continued to maintain surplus liquidity conditions in the banking system, with the average surplus remaining at around Rs 1.6 lakh crore. For the sixth consecutive month, systemic liquidity stayed in surplus. The liquidity surplus has narrowed in recent weeks due to tax outflows. Some of the surplus liquidity could also be offset by the unwinding of the RBI’s short forward book. However, the RBI is undertaking variable rate repo operations to support the liquidity conditions. Additionally, the CRR cuts that began this month, along with the maturity of government securities, are expected to provide some liquidity support. Surplus liquidity conditions would continue to ensure smoother transmission of the policy rates

As of August 2025, the outstanding spread between lending and deposit rates for SCBs declined marginally by one bps m-o-m to 2.45%. Weaker credit demand, particularly in high-yielding segments such as unsecured retail, and competitive pressures have pressured lending yields.

* As of August 2025, SCBs' outstanding lending rate decreased by six bps m-o-m to 9.32%, PSBs and PVBs by three and 10 bps to 8.70% and 10.22% respectively. The decline was largely driven by the RBI’s repo rate cut to 5.50%. Banks had to pass on the rate cuts but moderated the impact of falling yields by adjusting the loan mix. Meanwhile, the gradual repricing of deposits and surplus liquidity helped ease funding costs and protect margins. Meanwhile, the outstanding deposit rates of SCBs declined by five bps to 6.87%, which was attributed to surplus liquidity and the repricing of deposit portfolios toward lower market rates. PSBs, PVBs, and FBs declined by four and five bps, reaching 6.95% and 6.98% respectively.

On a m-o-m basis in September 2025, the one-year median MCLR remained flat for the month at 8.60%. Banks are now facing stickier funding costs, cautious repricing of liabilities, and efforts to protect lending margins. On a y-o-y basis, the MCLR is lower by 35 bps but continues to remain 40 bps above the pre-pandemic level of February 2020

* In August 2025, fresh spreads remained flat m-o-m, with SCBs standing at 3.19%, PVBs reducing by 14 bps to 3.73%, and PSBs marginally by two bps to 2.05%. The sharper drop in PVBs’ spreads was driven by their larger proportion of books linked to the EBLR. Additionally, fresh spreads are higher than outstanding spreads.

* As per Reserve Bank of India’s Monetary policy report of October 2025, the spread on fresh rupee loans was the highest for education loans, followed by other personal loans, and micro, small and medium enterprises loans. PSBs charged a lower spread than PVBs for housing, vehicle, education, and other personal loans.

* The lending rate on fresh loans for SCBs decreased by five bps m-o-m, to 8.75%. PSBs and PVBs saw a decline of seven and 14 bps, standing at 8.06% and 9.44% respectively, as of August 2025, attributed to competitive pressures and weaker loan demand. Additionally, fresh deposit rates for SCBs decreased by 14 bps m-o-m, reaching 5.61%. PSBs and PVBs saw a decrease of 17 and 21 bps, respectively, standing at 6.06% and 5.71% as of July 2025, attributed to banks cutting deposit rates to manage funding costs and protect their margins.

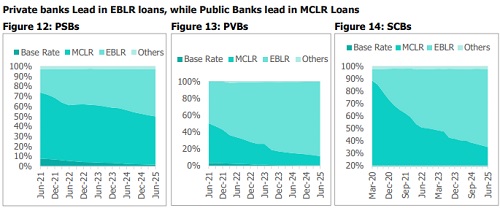

The share of External Benchmark Lending Rate (EBLR)- linked loans in total outstanding floating-rate rupee loans of SCBs increased and stood at 61.6% in June 2025 (compared to 57.5% in June 2024), while that of MCLR-linked loans stood at 33.8% in June 2025 (compared to 38.6% in June 2024). EBLR includes both repo-linked and treasury bill loans. Furthermore, compared to PSBs, PVBs have a higher share of EBLR (EBLR share as of Dec-24: PVBs, 85.9%; PSBs, 44.6%). Hence, the transmission of lending rates is faster in PVBs than PSBs.

Conclusion

According to Sanjay Agarwal, Senior Director, CareEdge Ratings, “In August 2025, SCBs witnessed a marginal decline in spreads amid the ongoing rate transmission and ample system liquidity, which reduced funding costs. The Fresh spreads are higher than the outstanding spreads. Thus, banks have been able to fight back and protect their margins thus far. The greater proportion of EBLR-linked loans, such as those tied to the repo rate or T-bills, in PVBs enabled faster transmission compared to PSBs. However, supported by the RBI’s liquidity measures, banks have lowered deposit rates, while demand for retail credit remains subdued. At the same time, margin pressures have tempered banks’ appetite for aggressive credit expansion, funding costs and stronger pricing power have managed to sustain relatively healthier spreads.”

Above views are of the author and not of the website kindly read disclaimer