Nifty Open Interest Put Call ratio fell to 0.87 levels from 1.01 levels - HDFC Securities

SHORT BUILD UP WAS SEEN IN BANK NIFTY FUTURES

Create Shorts with the SL Of 23600 Levels.

* On the day of union budget 2025-26, Nifty broke the four-session winning streak with a minor fall of 26 points or 0.11%, to close at 23482.

* Long Unwinding was seen in the Nifty Futures where Open Interest fell by 1.91% with Nifty falling by 0.11%.

* Short Build-Up was seen in the Bank Nifty Futures where Open Interest rose by 3.62% with Bank Nifty falling by 0.16%.

* Nifty Open Interest Put Call ratio fell to 0.87 levels from 1.01 levels.

* Amongst the Nifty options (06-Feb Expiry), Call writing is seen at 23500-23600 levels, indicating Nifty is likely to find strong resistance in the vicinity of 23500-23600 levels. On the lower side, an immediate support is placed in the vicinity of 23400-23300 levels where we have seen Put writing.

* Long build-up was seen by FII's in the Index Futures segment where they net bought worth 165 cr with their Open Interest going up by 1578 contracts.

Nifty :

Higher high has been witnessed, Closed above short term moving averages.

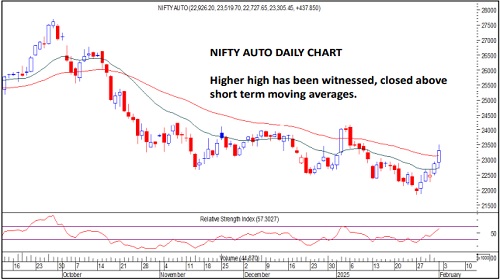

Nifty Auto :

Strong bull candle has been witnessed, Closed above short term moving averages. Positive momentum would continue.

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133