Natural Gas Futures Slide for Fourth Straight Session on Warmer Outlook - HDFC Securities

GLOBAL MARKET ROUND UP

Gold and silver advanced on Monday buoyed by geopolitical risks that continue to underpin safe-haven demand and act as a tailwind for bullion, particularly following heightened U.S. actions against Venezuela. In addition to this, US President Donald Trump's confrontational rhetoric regarding Colombia and Mexico has raised further concerns about potential regional instability in Latin America, which in turn has increased demand for traditional safe-haven commodities. We expect recovery likely to extend in bullion for today’s session.

Meanwhile, the dollar index steadied around 98.4 on Tuesday following a volatile previous session marked by geopolitical jitters and heightened uncertainty over the Federal Reserve’s policy path. The market also assessed ISM data showing the sharpest contraction in US factory activity since 2024 in December.

Crude oil prices settled higher on Monday, supported by rising geopolitical risks across Russia, the Middle East, Nigeria, and Venezuela. Additional support came after OPEC+ reaffirmed on Sunday its decision to pause further increases in group oil production during the first quarter. Markets also continued to assess the impact of recent U.S. actions toward Venezuela on global oil supply; however, the overall effect appears limited, as years of underinvestment have reduced Venezuelan output to less than 1% of global production, constraining its influence on the broader market.

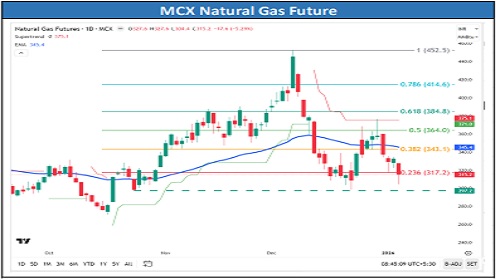

Natural gas futures extended their losing streak to a fourth consecutive session as updated weekend weather forecasts further reduced cold expectations for the first half of January. This sharp shift in the winter weather outlook has materially reshaped the first-quarter 2026 natural gas market narrative, weighing heavily on near-term demand expectations. Copper surged to a fresh record high on the LME, supported by tightening supply conditions and resilient demand from energy-transition–related sectors.

Gold

* Trading Range: 136300 to 140150

* Intraday Trading Strategy: Buy Gold Mini Feb Fut at 138025-138050 SL 137425 Target 138780/139450

Silver

* Trading Range: 242900 to 251450

* Intraday Trading Strategy: Buy Silver Mini Feb Fut at 249900-249925 SL 247750 Target 252900/253780

Crude Oil

* Trading Range: 5025 to 5320

* Intraday Trading Strategy: Buy Crude Oil Jan Fut at 5205 SL 5125 Target 5275/5319

Natural Gas

* Trading Range: 287 to 333

* Intraday Trading Strategy: Sell Natural Gas Jan Fut at 317-317.80 SL 329 Target 304/294

Copper

* Trading Range: 1294 to 1350

* Intraday Trading Strategy: Buy Copper Jan Fut at 1319 SL 1306 Target 1336/1345

Zinc

* Trading Range: 306 to 322

* Intraday Trading Strategy: Buy Zinc Jan Fut at 312.0-312.50 SL 307.80 Target 315.80/317.5

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133