MCX Silver Sep is expected to rise towards Rs 114,000 level as long as it trades above Rs 111,500 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

• Spot Gold is expected to rise further towards $3400 level as demand for safe haven may increase after U.S President Donald Trump new tariffs on Canada, Mexico, EU and other trading partners rekindled trade tensions. U.S President ramped up his tariff assaults on its major trading partners. He said U.S will impose tariff of 35% on Canada, 30% on Mexico and EU and blanket tariffs of 15% or 20% on most other trading partners starting 1 st August. Targeted countries have less than 3-weeks now to reach a deal with Washington. Meanwhile, sharp upside may be capped on strong dollar and rise in U.S treasury yields. Further, investors are worried that businesses could start passing down the costs to consumers, increasing inflation

• Spot gold is likely to rise further towards $3400 level as long as it holds above $3320 level. MCX Gold Aug is expected to rise towards Rs 98,500 level as long as it stays above Rs 97,300 level

• MCX Silver Sep is expected to rise towards Rs 114,000 level as long as it trades above Rs 111,500 level.

Base Metal Outlook

• Copper prices are expected to trade with a negative bias on strong dollar and weak global market sentiments. Market sentiments are hurt amid fears of renewed trade tension after U.S President Doanld Trump slapped new tariffs on Canada, Mexico and EU. Further, investors fear that tit for tat approach increased the risk of broader global trade war, which may have adverse effect on economic growth denting demand for industrial metal. Meanwhile, sharp fall may be cushioned as U.S President Donald Trump said 50% tariff on imported copper would be effective August 1 but refrained from giving any details.

• MCX Copper July is expected to slip further towards Rs 874 level as long as it stays below Rs 890 level. A break below Rs 874 level prices may slide further towards Rs 870level

• MCX Aluminum July is expected to rise towards Rs 251 level as long as it stays above Rs 248 level. MCX Zinc July is likely to move south towards Rs 256 level as long as it stays below Rs 261 level.

Energy Outlook

• Crude oil is likely to slip back towards $67 amid strong dollar and weak global market sentiments. Further, prices may dip as investors are worried that latest tariff announcements by U.S President Doland Trump threaten global economic growth and oil demand. Additionally, market will keep a close eye on trade data from China, any signs of weaker demand will hurt prices. Meanwhile, sharp fall may be cushioned as IEA said global oil market may be tighter than it appears. Further, investors are worried that U.S may impose more sanctions on Russian oil, affecting global supplies. Moreover, European Union envoys are on the verge of agreeing an 18th package of sanctions against Russia that would include a lower price cap on Russian oil.

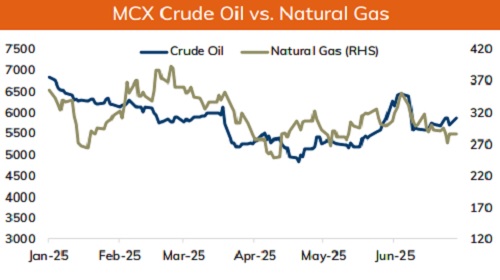

• MCX Crude oil July is likely to slip back towards Rs 5700 level as long as it stays below Rs 5950 level.

• MCX Natural gas July is expected to rise towards Rs 300 level as long as it stays above Rs 280 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631