MCX Silver March is expected to rise towards Rs 259,500 level as long as it stays above Rs 254,000 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to trade with the positive bias and rise towards $4530 level on softening of US treasury yields across curve. Further, investors will remain cautious ahead of slew of economic data from US to get more cues on state of economy and interest rate trajectory. Additionally, demand for safe haven may continue to rise on escalating geopolitical tension in Eastern Europe, Middle East and Venezuela. Furthermore, US President Donald Trump has warned of another strike if Caracas resist US efforts to open up its oil industry and stop drug trafficking and signaled possible action against Colombia and Mexico. Moreover, prices may rally on strong central bank demand for gold and dovish comments from Fed officials.

* MCX Gold Feb is expected to rise towards Rs140,000 level as long as it stays above Rs 137,000 level.

* MCX Silver March is expected to rise towards Rs 259,500 level as long as it stays above Rs 254,000 level

Base Metal Outlook

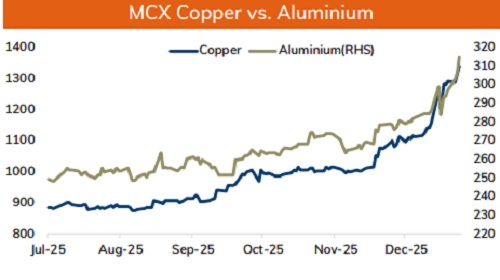

* Copper prices are expected to trade with a positive bias on optimistic global market sentiments. Further, prices may rally on supply concerns amid series of mine disruption and recurring protest. Additionally, fears of US tariff on refined copper led to supply tightness outside US market. Copper stocks in Comex continued to climb while stock at LME registered warehouses were still on decline. Meanwhile, further upside may be capped on weak demand from China. The Yangshan copper premium, a gauge of Chinese consumers' appetite for imported copper, declined to $43 a ton, down from above $50 by the end of 2025

* MCX Copper Jan is expected to rise towards Rs 1345 level as long as it stays above Rs 1315 level. A break above Rs 1345 level may open doors for Rs 1350-Rs 1355 level

* MCX Aluminum Jan is expected to rise towards Rs318 level as long as it stays above Rs 311 level. MCX Zinc Jan is likely to hold support near Rs 312 level and rise towards Rs 319 level

Energy Outlook

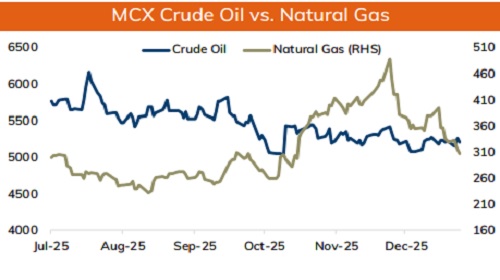

* NYMEX Crude oil is likely to trade with negative bias and slip further towards $55.5 level on strong dollar. Further, prices may move south as US President Donald Trump said Venezuela would turn over between 30 and 50 million barrels of crude to the US. Investors fear that if the oil from Venezuela flows into the market sustainably then it could add supply to an already oversupplied market. Moreover, API data showed rise in gasoline and distillate stockpiles, signaling weak fuel demand. While, crude oil inventories decreased by about 2.8M barrels for the week ending 2 nd January 2026

* WTI crude oil prices may move lower towards $55.5 level as long as it stays below $57.10 level. MCX Crude oil Jan is likely to slip further towards Rs 5100-Rs5070 level as long as it stays below Rs 5320 level.

* MCX Natural gas Jan is expected to slip towards Rs 290 level as long as it stays below Rs 320 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631