MCX Gold Feb is likely to face strong resistance near Rs.136,500 and move lower towards Rs.133,500 - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is expected to remain volatile amid sign of easing geopolitical tensions between Russia and Ukraine. An easing geopolitical risk could bring profit booking in the bullions. At the same time, ongoing tensions in the Middle East and rising frictions between the US and Venezuela continue to underpin gold’s defensive appeal. Meanwhile, For the day, spot gold is likely to remain in the band of $4300 and $4370 per ounce. Only a move below $4300 per ounce it would fall towards $4250 per ounce.

* MCX Gold Feb is likely to face strong resistance near Rs.136,500 and move lower towards Rs.133,500. A move below Rs.133,500, it would correct towards Rs.131,500.

* Spot International Silver is hovering near $73 per ounce after falling nearly 9%. A move below the support of $70, would bring correction towards $68.50, else we may see price to consolidate in the broad range of $70 and $75.80. MCX Silver March is expected to move in the range of Rs.220,000 and Rs.232,500. Below Rs.220,000 it would turn bearish towards Rs.218,000

Base Metal Outlook

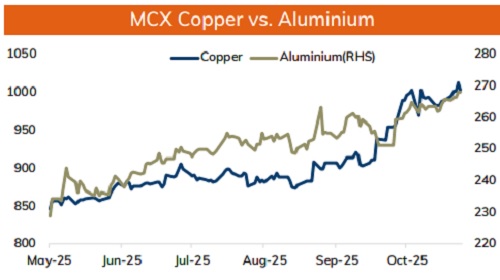

* Copper prices are expected to hold its ground and move higher, driven by acute supply tightness and robust demand from both China and the United States. A primary catalyst for this rally is the planned 10% output reduction for 2026 by China's leading copper smelters to address industry overcapacity and negative processing fees. Prices would also get support on concerns over potential US tariff reviews in 2026, which would again increase supply tightness in the global markets. Meanwhile, profit booking could limit its upside.

* MCX Copper January is expected to hold support near Rs.1200 and move higher towards Rs.1275 level. Only move below Rs.1200 level it may fall towards Rs.1180-Rs.1175 level.

* MCX Aluminum Jan is expected to hold support near Rs.288 and move towards Rs.297 level. Only a move below Rs.288 it would slip towards Rs.284-282 zone. MCX Zinc is likely to remain the band of Rs.300 and Rs.312. Only a move below Rs.300 it would turn bearish towards Rs.296.

Energy Outlook

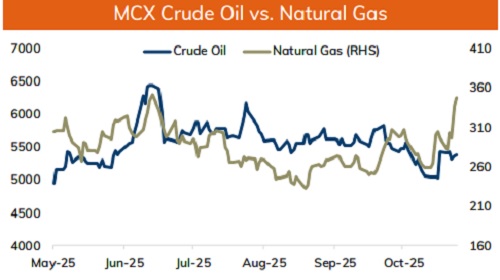

* NYMEX crude oil is expected to face hurdle near $59 per barrel and move lower towards $56.50 on sign of supply improvement. Meanwhile, renewed tension in the Middle East and ongoing geopolitical tension in Venezuela could counter improved supply outlook. Venezuela reportedly began shutting wells in a key oil-rich region due to US blockade aimed at financially pressuring the country. US President Donald Trump said US could support another major strike on Iran were it to resume rebuilding its ballistic missile or nuclear weapons programs

* On the data front, a strong put base at $55 would act as strong support. On the upside a strong call base at $60 would act as major hurdle. MCX Crude oil Jan is likely to face hurdle at Rs.5300 and move lower towards Rs.5100 level. Only move above Rs.5300 it would rise towards Rs.5380.

* MCX Natural gas Jan is expected to hold support at Rs.340 and move higher towards Rs.370 level. Cold weather forecast in US and strong export numbers would help prices to move higher.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631