MCX Crude oil Oct is likely to rise towards Rs 5900 level as long as it stays above Rs 5600 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

• Spot Gold is likely to rise back towards $3780 level as demand for safe haven may continue to rise amid escalating geopolitical tensions in Eastern Europe and Middle East. Furthermore, prices may move up on expectations of 2 additional 25bps rate cuts at the remaining 2 Fed meetings this year and another in the first quarter of 2026 despite of cautious tone from Fed Chair Powell on further easing. As per CME FedWatch tool market is pricing in 92% probability of another 25bps cut at the central bank's October meeting and 75% probability in December. Meanwhile, investors will remain cautious ahead of slew of economic data from U.S to gauge economic health of the country and get hints on interest rate trajectory

• MCX Gold Oct is expected to rise back towards Rs 113,200 level as long as it stays above Rs112,200 level

• MCX Silver Dec is expected to face stiff resistance near Rs 135,000 level and correct towards Rs 132,700 level.

Base Metal Outlook

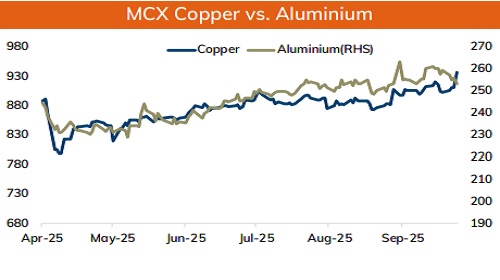

• Copper prices are expected to trade with a positive bias amid renewed concerns over supply disruption and signs of improving demand from China. Freeport-McMoRan declared force majeure on supplies from its Grasberg mine in Indonesia. As per media reports, the company expects 3 rd quarter sales to come in lower than guidance, down about 4%. Furthermore, phased restart and ramp-up of operations may occur in the first half of 2026. It also indicated that 2026 production could potentially be about 35% lower than previous estimates. Grasberg alone accounts for 3.2% of global mined copper. Prolonged disruption in mines could further boost prices

• MCX Copper Oct is expected to rise towards ?954 level as long as it stays above Rs 932 level.

• MCX Aluminum Oct is expected to rise towards Rs 259 level as long as it stays above Rs 254 level. MCX Zinc Oct is likely to move north towards Rs 288 level as long as it stays above Rs 282 level.

Energy Outlook

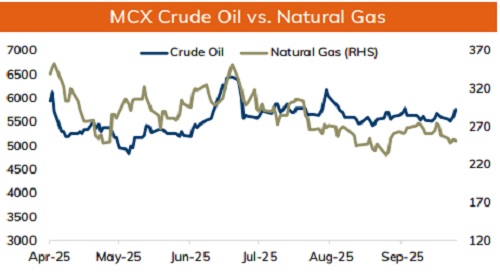

• Crude oil is likely to trade with positive bias and rise further towards $65.8 level amid escalating geopolitical tensions. Further, prices may move up on concerns over supply disruption as Ukraine has intensified drone strikes on Russia’s energy facilities. Ukraine’s military struck two oil pumping stations overnight in Russia’s Volgograd region. Moreover, Russia is seeing shortages of certain fuel grades as Ukrainian drone attacks reduce refinery runs, raising concerns over possible export restrictions on fuel. Additionally, Chevron’s curbed oil exports from Venezuela due to U.S. permit issues, supportive for the prices. Further, prices may move north as EIA weekly crude oil inventories data showed drawdown in oil stockpiles. U.S. crude inventories fell by a surprise 607,000 barrels last week

• MCX Crude oil Oct is likely to rise towards Rs 5900 level as long as it stays above Rs 5600 level.

• MCX Natural gas Oct is expected to rise towards Rs 287 level as long as it stays above Rs 272 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631