MCX Copper March is expected to rise further towards Rs.915 level as long as it stays above Rs.900 level - ICICI Direct

Bullion Outlook

* Gold is expected to continue with its upward trend amid weakness in dollar and softening of US treasury yields. Yields and dollar may move further south as US Federal Reserve signaled 2 rate cuts by the end of the year and sees slower economic growth and higher inflation. Moreover, demand for safe haven may increase on escalating geopolitical tension in Middle East after Israeli military resumed ground operations in the central and southern Gaza Strip. Additionally, expectation of disappointing economic data from US would be supportive for gold prices

* Spot gold is likely to rally further towards $3080 level as long as it stays above $3020 level. Only break below $3020 level prices may correct further towards $3000/$2980 levels. MCX Gold April is expected to rise towards Rs.89,200 level as long as it stays above Rs.88,500 level.

* MCX Silver May is expected to rise towards Rs.101,000 level as long as it trades above Rs.99,000 level.

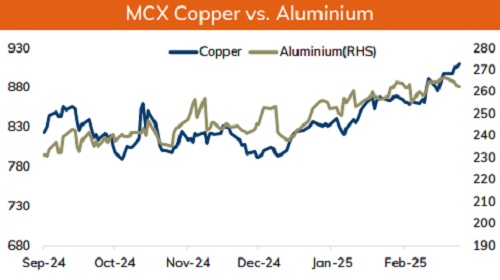

Base Metal Outlook

* Copper prices are expected to trade with positive bias on weakness in dollar and rise in risk appetite in the global markets. Further, prices may move north on signs that supplies in China are tightening. US President Donald Trump tariff threats on imports has lured supplies to US. Moreover, persistent decline in inventories at LME registered warehouses, signal demand. Additionally, China left its benchmark lending rates unchanged. Meanwhile, all eyes will be on slew of economic data from US to gauge economic heath of the country.

* MCX Copper March is expected to rise further towards Rs.915 level as long as it stays above Rs.900 level. A break above Rs.915 level prices may rally further towards Rs.920 levels

* MCX Aluminum March is expected to slip further Rs.260 level as long as it stays below Rs.265.0 level. MCX Zinc March is likely to move further south towards Rs.272 level as long as it stays below Rs.280 level

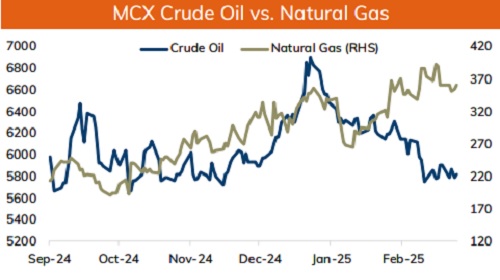

Energy Outlook

* NYMEX Crude oil is expected to trade with positive bias and rally further towards $68 level on weakness in dollar and optimistic global market sentiments. Further, prices may move up on drawdown in fuel inventories in US, signaling demand. Additionally, risk premium may increase on escalating geopolitical tension in Middle East after Israel resumed ground operations in the central and southern Gaza Strip, a day after there airstrike killed more than 400 people in Gaza, threatening 2-month ceasefire. Meanwhile, sharp upside may be capped as investors fear that potential global trade war will lead to slower economic growth, denting fuel demand

* MCX Crude oil April is likely to hold support near Rs.5700 level and rise back towards Rs.5900 level. A break above Rs.5900 prices may rally further towards Rs.5950/Rs.6000 level.

* MCX Natural gas March is expected to hold the support near Rs.350 level and rise further towards Rs.375 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631