MCX Crude oil Dec is likely to slip towards Rs 5100 level as long as it stays below Rs 5300 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to trade with the positive bias and rise towards $4100 level on weaking US treasury yields following disappointing economic data from US. Further, prices may rally on rising expectations of a December interest rate cut by the Federal Reserve. As per CME FedWatch tool traders are now pricing almost 70% chance of a rate cut in December, up from about 44% a week ago. On top of it, University of Michigan's US November 1-year inflation expectations were unexpectedly revised lower to 4.5% from the previously reported 4.7%. Meanwhile, sharp upside may be capped on strong dollar and ease in geopolitical tension

* MCX Gold Dec is expected to rise towards Rs 126,000 level as long as it stays above Rs 123,000 level. A break above Rs 126,000 will open doors for Rs 126,800 level

* MCX Silver Dec is expected to slip towards Rs 150,000-Rs 149,000 level as long as it stays below Rs 155,500 level

Base Metal Outlook

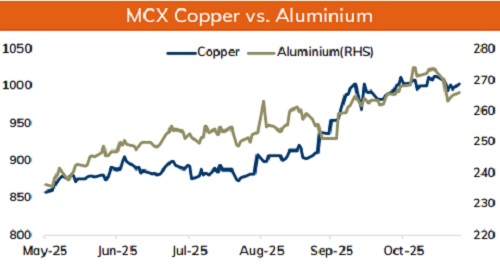

* Copper prices are expected to trade with a negative bias on strong dollar and weak global market sentiments. Further, disappointing economic data from major economies raised concerns over global economic growth, denting demand for industrial metal. Additionally, prices may slip on concern over soft demand in China. The Yangshan copper premium, a gauge of Chinese appetite for imported copper is at $34 a ton, down from a peak of above $100 in early May this year.

* MCX Copper Nov is expected to slip towards Rs 993 level as long as it stays below Rs 1007 level. A break below Rs 993 level prices may slip further towards Rs988 level

* MCX Aluminum Nov is expected to rise towards Rs 268 level as long as it stays above Rs 264 level. MCX Zinc Nov is likely to hold the support near Rs303 level and rise towards Rs 309 level

Energy Outlook

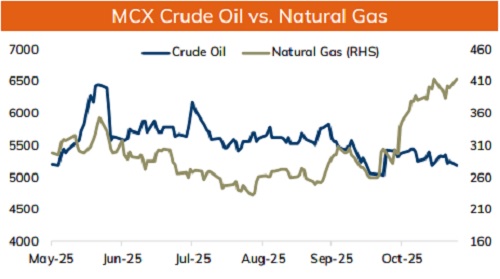

* Crude oil is likely to trade with negative bias and slip further towards $57.0 level on strong dollar, disappointing economic data from major economies and ease in geopolitical tension. Further, U.S. is trying to push to end war in Ukraine. End of war between Russia and Ukraine may lead to an end to sanctions on Russian energy exports, raising concerns over oversupply. Meanwhile, sharp fall may be cushioned as Russian President Vladimir Putin said that U.S. proposals for peace in Ukraine could be the basis of a resolution of the conflict but if Kyiv turned down the plan, then Russian forces would advance further. Additionally, investors are rising bets on December interest rate cut by the Federal Reserve. Lower interest rates could boost economic growth and oil demand

* MCX Crude oil Dec is likely to slip towards Rs 5100 level as long as it stays below Rs 5300 level.

* MCX Natural gas Dec is expected to slip towards Rs 410 level as long as it stays below Rs 431 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631