MCX Copper Feb Seen Weak Below Rs.1230 Rs.1180 Key Support - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to trade with positive bias amid weak dollar and decline in US treasury yields. Further, softer than expected inflation data from US reinforced expectation that US Federal Reserve would deliver at least two rate cuts in 2026. U.S. rate futures priced in about 63 bps of easing this year. Additionally, prices may rally on safe haven demand following escalating geopolitical tension in Middle East and Eastern Europe. Further, gold demand from China stayed strong ahead of Lunar New Year. Moreover, market anticipates that foreign investors will reroute their dollar assets into precious metal after Bloomberg reported that Chinese regulators have advised financial institutions to curb holdings of U.S. Treasuries because of concerns over concentration risks.

* MCX Gold April is expected to rise towards Rs.158,500-Rs.159,000 level as long as it stays above Rs.153,000 level.

* MCX Silver March is expected to slip towards Rs.232,000-Rs.229,000 level as long as it stays below Rs.255,000 level.

Base Metal Outlook

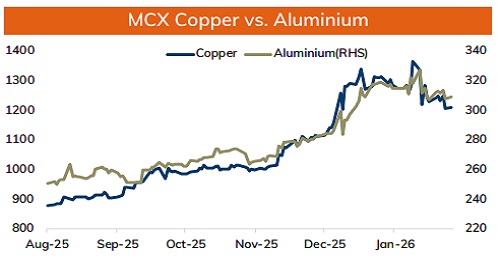

* Copper prices are expected to trade with negative bias amid weak global market sentiments and signs of weak demand in China ahead of Lunar New Year holidays. Additionally, persistent rise in inventories at LME registered warehouses would hurt prices. Furthermore, Yangshan copper premium, which reflects Chinese appetite for imported copper, was at $33 a ton, still too low to indicate strong demand. Additionally, investors will remain cautious ahead of economic data from Europe to gauge economic health and demand outlook

* MCX Copper Feb is expected to slip towards Rs.1180 level as long as it stays below Rs.1230 level. A break below Rs.1180 level prices may be pushed towards Rs.1267-Rs.1155 level

* MCX Aluminum Feb is expected to slip towards Rs.302 level as long as its stays below Rs.312 level. MCX Zinc Feb is likely to face stiff resistance near Rs.327 level and slip further towards Rs.318 level

Energy Outlook

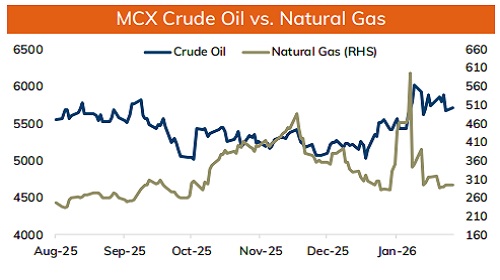

* NYMEX Crude oil is likely to trade with negative bias amid risk aversion in the global markets and prospect of rising supply as OPEC+ is leaning towards a resumption in production increases. Moreover, all eyes will be on negotiation between US and Iran & Russia and Ukraine. Any positive outcome would hurt prices as it would reduce the risk premium. Moreover, U.S. also eased sanctions on Venezuela’s energy sector issuing 2 general licenses that allow global energy companies to operate oil and gas projects in the OPEC member and for other companies to negotiate contracts to bring in fresh investments.

* NYMEX Crude oil is likely to face stiff resistance near $63.50 level and slip towards $62 level. MCX Crude oil March is likely to slip towards Rs.5600-Rs.5540 level as long as it stays below Rs.5850 level.

* MCX Natural gas Feb is expected to slip towards Rs.270-Rs.260 level as long as it stays below Rs.310 level

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631