Commodity Weekly Insights 17th December 2025 by Axis Securities

* Comex Gold settled near $4,300 per ounce on Friday, as it closed near its highest level in 2025. Prices rallied more than 2% last week, driven by the Federal Reserve’s third consecutive rate cut

* Comex Silver surged to a record high of $64 last week before settling around the $62 level, as the latest US Federal Reserve rate cut coincided with tightening physical market conditions

* WTI Crude fell nearly 5% as persistent concerns about oversupply weighed, and efforts toward a Russia-Ukraine peace deal reduced the geopolitical premium

* Comex Copper futures settled lower by almost 2% after hitting a multi-week high, supported by the Federal Reserve's interest-rate cut and hopes for further easing next year

The Week That Was

* Comex Gold settled near $4,300 per ounce on Friday, as it closed near its highest level in 2025. Prices rallied more than 2% last week, driven by the Federal Reserve’s third consecutive rate cut, which lowered interest rates and renewed demand for non-yielding assets such as gold. Additional support came from weakness in the U.S. dollar index. We expect prices to trade with a positive bias as long as $4,000 level is intact on the downside.

* Comex Silver surged to a record high of $64 last week before settling around the $62 level, as the latest US Federal Reserve rate cut coincided with tightening physical market conditions. Earlier this week, the Fed delivered a quarter-point cut and signalled a less hawkish outlook than markets had anticipated. Chair Jerome Powell indicated further rate hikes are unlikely, with projections pointing to one additional cut next year and another in 2027. Robust ETF buying and strong retail demand also supported silver, reinforcing forecasts of a market deficit next year. Industrial demand, particularly from solar, electric vehicles, and data centre infrastructure, contributed further to price strength.

* WTI Crude fell nearly 5% as persistent concerns about oversupply weighed, and efforts toward a Russia-Ukraine peace deal reduced the geopolitical premium. During the week, the IEA trimmed its surplus estimates, OPEC maintained its demand outlook, and U.S. crude inventories posted a draw, while the market reaction to the U.S. seizing a sanctioned tanker off Venezuela was fairly muted. Overall, the energy markets continue to trade in a sideways and volatile range, with crude consolidating in a narrow band. In the domestic market, we expect prices to remain range-bound between Rs 5,000 and Rs 5,600 over the coming months.

* Comex Copper futures settled lower by almost 2% after hitting a multi-week high, supported by the Federal Reserve's interest-rate cut and hopes for further easing next year. On the London Metal Exchange, copper futures were trading at $11,822 per metric ton after touching an intraday high of $11,952 earlier in the session. Prices have risen nearly 35% this year. Looking ahead, the combination of lower interest rates and stronger economic growth should boost copper demand in the coming months.

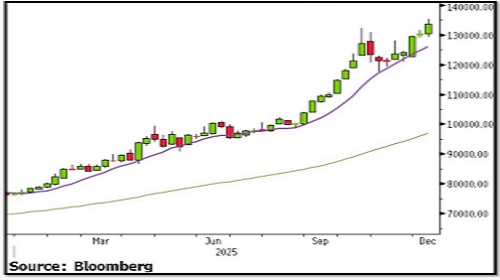

MCX Gold

Technical Outlook:

MCX Gold surged to the record high of Rs 1,35,000 level last week, extending its winning streak for five weeks in a row. Prices rallied by more than 2% to settle around the Rs 1,33,600 levels. The metal has been forming higher highs and higher lows over the past few months, signalling a positive trend for prices. On the weekly chart, it is comfortably placed above 9 and 60 EMAs, which indicate that momentum is strong on the upside. We expect the yellow metal to trade with a positive bias as long as the Rs 1,25,000 level is intact on the downside.

Recommendation:

We recommend buying MCX Gold around Rs 1,31,600, with a stop loss below Rs 1,28,000 and targets of Rs 1,35,000 and Rs 1,37,000

Current Market Price (CMP): Rs 1,33,600

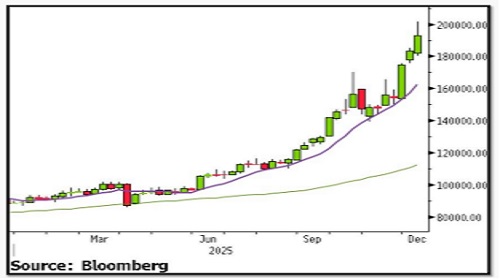

MCX Silver

Technical Outlook:

MCX Silver closed at a new record high, posting another weekly gain of 5%. The price structure continues to reflect higher highs, although the weekly RSI remains in the overbought zone, suggesting the possibility of temporary consolidation. A breakout above Rs 2,02,000 would likely extend the bullish momentum toward Rs 2,05,000 and Rs 2,08,000. On the downside, Rs 1,78,000 serves as a key support level.

Recommendation:

We recommend buying MCX Silver around Rs 1,88,500, with a stop loss below Rs 1,87,000 and targets of Rs 1,91,000 and Rs 1,95,000

Current Market Price (CMP): Rs 1,92,600

MCX Crude Oil

Technical Outlook:

MCX Crude Oil fell nearly 4% after failing to sustain near the multi-week high of Rs 5,450. On the weekly chart, it is trading below 20 and 60 EMAs, indicating the bearish trend. However, Rs 5,000 remains a strong support zone and has not yet been breached. As long as this support level holds, we expect prices to trade within a range of Rs 5,000 to Rs 5,600 over the coming weeks.

Recommendation:

We recommend buying MCX Crude Oil around Rs 5,100, with a stop loss below Rs 4,900 and targets of Rs 5,400 and Rs 5,700.

Current Market Price (CMP): Rs 5,230

MCX Copper

Technical Outlook:

MCX copper surged to a lifetime high of Rs 1,124 last week but failed to sustain near the record level due to profit booking. Prices eventually settled around Rs 1,098, still posting a gain of 0.4% and extending the winning streak to four consecutive weeks. On the weekly chart, copper remains comfortably positioned above the 20- and 60-week EMAs. We expect prices to trade with a positive bias in the coming week.

Recommendation:

We recommend buying MCX Copper around Rs 1,080, with a stop loss below Rs 1,050 and targets of Rs 1,125 and Rs 1,140.

Current Market Price (CMP): Rs 1,098

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633