Markets Near Inflection Point as Macro Stability and Trade Deals Improve Visibility: PL Asset Management

According to PL Asset Management, the asset management arm of PL Capital Group (Prabhudas Lilladher), despite near-term volatility, India’s macroeconomic backdrop remained stable in January 2026. With valuations normalising, domestic liquidity staying robust and internal risk indicators stabilising, PL Capital believes the market is transitioning from a phase of correction to one of emerging opportunity.

Indian equities entered a consolidation phase in January 2026 amid global de-risking, currency pressures and commodity volatility. The Nifty 50 declined 3.10% during the month as investors turned cautious ahead of the Union Budget, elevated US bond yields and continued foreign institutional investor outflows. FIIs remained net sellers to the tune of ?31,393 crore, while strong domestic institutional inflows of ?43,793 crore and record SIP contributions of ?31,000 crore underscored the resilience of domestic liquidity.

Industrial production accelerated to a two-year high, GST collections rose to ?1.93 lakh crore in January, and forex reserves climbed to a record $709 billion. Inflation continues to remain within the RBI’s comfort band, providing policy flexibility. Importantly, equity valuations have moderated toward their long-term average range of approximately 19–20x earnings, materially improving the medium-term risk-reward profile.

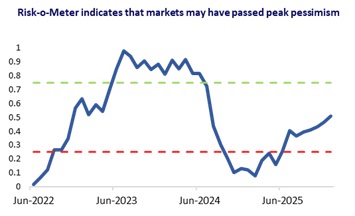

While the correction exposed narrow market participation, leading quantitative indicators suggest markets may be transitioning from consolidation toward early recovery. Breadth weakened during January, with a smaller proportion of stocks sustaining upward trends and leadership remaining concentrated. However, internal risk gauges are stabilizing. The firm’s proprietary Risk-O-Meter indicates that markets may have moved past peak pessimism, with systemic stress conditions moderating

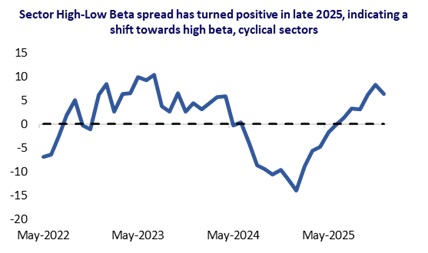

The Sector High-Low Beta spread, which turned positive in late 2025, signals a rotation toward higher beta and cyclical sectors — historically an early marker of improving risk appetite. Factor leadership trends have also shifted, with Value outperforming in recent months, suggesting investors are gradually repositioning portfolios ahead of broader participation. Additionally, equities are trading near multi-cycle relative lows versus gold, reinforcing the case for improving forward return probabilities as volatility stabilizes.

Policy & Trade Catalysts Strengthen Structural Outlook

Beyond market technicals, the macro-policy backdrop is turning constructive. Union Budget 2026 maintains policy continuity with a balanced focus on fiscal prudence and growth, sustaining capex, infrastructure, and manufacturing reforms that improve earnings visibility across industrial and export-led sectors. With inflation contained and external balances stable, macro fundamentals remain anchored.

While the India–EU FTA remains a key structural positive with earnings impact expected from FY27 onwards, the recently announced India–US trade deal marks a significant near-term catalyst, with US tariffs on Indian goods reduced from 50% to 18%, materially improving export competitiveness across key sectors.Together, policy clarity, stronger trade linkages, and valuation normalization toward 19–20x earnings suggest Indian equities may be transitioning from correction to early recovery.

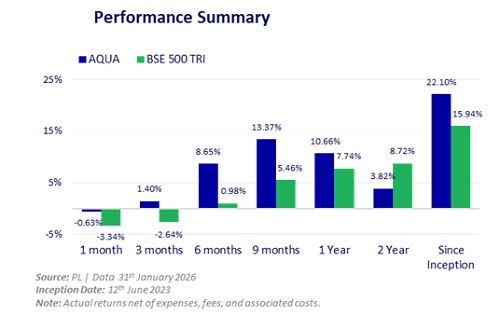

Against this backdrop, PL Asset Management’s AQUA strategy demonstrated resilience in a declining market.AQUA delivered a return of -0.63% in January, significantly outperforming its benchmark, the BSE 500 TRI, which declined -3.34%.The outperformance was driven by the strategy’s systematic overweight to Value and Quality factors, which outperformed during the month as investors rotated toward fundamentally resilient and attractively valued companies. Exposure to profitable, balance-sheet-strong businesses helped cushion downside volatility, while selective positioning in higher beta cyclicals captured early rotation signals.

By maintaining disciplined large-cap exposure alongside selective mid- and small-cap allocation aligned to factor strength, AQUA effectively reduced drawdown while preserving upside participation. Since inception on June 12, 2023, AQUA has generated cumulative returns of 22.10%, comfortably ahead of the benchmark return of 15.94%, reflecting consistent factor-driven alpha generation across market cycles.

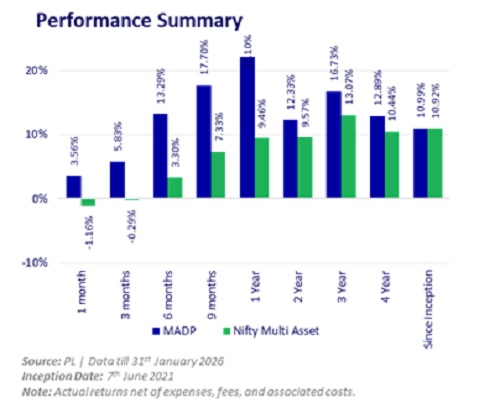

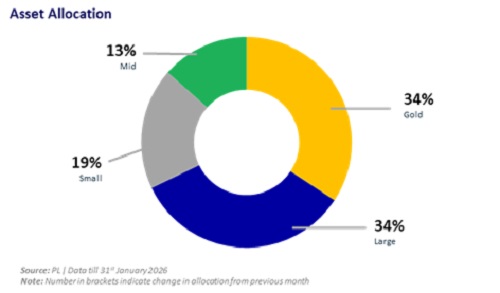

The Multi Asset Dynamic Portfolio (MADP) strategy delivered particularly strong performance in January, generating returns of 3.56%, while its benchmark declined 1.16%. MADP follows a disciplined, rule-based multi-asset allocation framework that dynamically calibrates exposure across equities and gold based on macro signals, valuation metrics and volatility regimes. Importantly, the strategy has not only delivered strong absolute returns but has done so with superior risk efficiency. Over the past year, MADP has delivered 22.1% returns, significantly outperforming its benchmark return of 9.46%. Over a three-year period, the strategy has generated annualized returns of 16.73% versus 13.07% for the benchmark.

Crucially, this performance has been achieved with lower standard deviation compared to standalone allocations to Nifty and Gold, reflecting better volatility management and more stable return compounding. By dynamically balancing equity and gold exposures, the strategy has historically reduced drawdowns during stress periods while capturing upside during recovery phases.

Commenting on the strategy, Mr. Siddharth Vora, Head - Quant Investment Strategies & Fund Manager, PL Asset Management said, “Markets appear to be moving from correction toward early normalization, supported by improving valuations and macro stability. In AQUA, our systematic overweight to Value and Quality factors helped contain downside and drive relative outperformance during January’s volatility. In MADP, dynamic allocation across equities and gold enabled us to deliver strong returns with lower realized volatility than standalone asset classes. With Budget clarity and strengthening trade linkages enhancing earnings visibility, we remain constructively positioned for the next phase of recovery.”

Through AQUA’s factor-driven equity discipline and MADP’s dynamic multi-asset framework, PL Asset Management remains positioned to navigate volatility while participating in potential recovery with calibrated risk management.

Above views are of the author and not of the website kindly read disclaimer