Market Round-Up: Gold Steady, Crude Volatile, Copper Hits New Record by HDFC Securities Ltd

GLOBAL MARKET ROUND UP

Gold closed with a modest decline in the international market, while domestic prices increased, supported by the weakness of the Indian currency. The rupee slipped to a fresh record low of 90.3040 yesterday and has depreciated more than 1% against the US dollar so far this week. The sharp decline in the rupee helped cushion domestic gold prices from the earlier correction in international markets. As global prices rebounded, the impact of the weaker rupee amplified the gains in the domestic market, resulting in a stronger upside compared to overseas levels.

Recent U.S. macroeconomic data indicate a gradual cooling in economic activity. The November ADP report revealed a surprising decline of 32,000 private sector jobs, significantly lower than the anticipated gain of 10,000, and the figure marks the third drop in four months. Furthermore, dovish comments from Federal Reserve officials have bolstered expectations for a 25-basis-point rate cut at next week’s FOMC meeting, which could create headwinds for the U.S. dollar while providing support for nonyielding bullion.

Crude oil prices moved higher after a fresh round of US–Russia talks failed to produce a breakthrough on ending Moscow’s war in Ukraine, raising concerns that restrictions on Russian oil supply may persist for longer. Adding to market volatility, President Trump reiterated that the US could begin striking drug cartels operating on Venezuelan territory “very soon,” intensifying geopolitical risks and keeping traders on edge. The elevated uncertainty continues to inject a risk premium into crude prices.

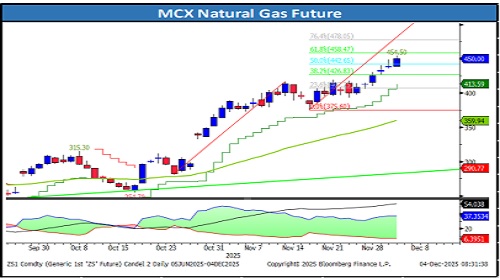

Natural gas prices reached almost three-year highs as cold mid-December forecasts raised demand for natural gas.

Copper surged to a new record high as a spike in orders to withdraw metal from London Metal Exchange warehouses heightened concerns that potential U.S. tariffs could lead to a global supply shortage

Gold

* Trading Range: 128450 to 130425

* Intraday Trading Strategy: Sell Gold Mini Jan Fut at 129750-129775 SL 130180 Target 129075/128625

Silver

* Trading Range: 178500 to 185425

* Intraday Trading Strategy: Sell Silver Mini Feb Fut at 184425-184450 SL 185505 Target 182075/180900

Crude Oil

* Trading Range: 5265 to 5480

* Intraday Trading Strategy: Sell Crude Oil Dec Fut at 5420-5425 SL 5480 Target 5335/5305

Natural Gas

* Trading Range: 435 to 465

* Intraday Trading Strategy: Buy Natural Gas Dec Fut at 444.50-445.50 SL 437.80 Target 456/461.0

Copper

* Trading Range: 1065 to 1105

* Intraday Trading Strategy: Buy Copper Dec Fut at 1077-1077.80 SL 1070.0 Target 1094/1099

Zinc

* Trading Range: 306 to 312.80

* Intraday Trading Strategy: Buy Zinc Dec Fut at 309-309.25 SL 306.8 Target310.75/312.0.

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133