Khelo Bharat Niti 2025 : A Strategic Boost for India`s Sports Goods Industry by CareEdge Ratings

Synopsis

* India’s sports goods manufacturing industry is globally recognised for producing over 300 categories of items including sportswear, gym equipment, and all other sports-dedicated equipment. The industry employs around five lakh people and contributes to India’s export earnings, making it a priority under national initiatives like Make in India.

* India exports ~60% of its sporting goods, with major production clusters located in Jalandhar (Punjab) and Meerut (Uttar Pradesh), which collectively contribute around 75–80% of the country’s total production. In addition to these legacy hubs, emerging manufacturing regions such as Tamil Nadu, Maharashtra, West Bengal, Delhi, and Jammu are developing capabilities in niche segments. These include sportswear, indoor sports accessories, and synthetic materials.

* With more inclination towards sports and fitness, the Indian sports equipment manufacturing market is witnessing healthy growth, driven by factors such as rising disposable incomes, urbanisation, and government initiatives promoting sports participation. The market is further fueled by the expansion of e-commerce platforms, making sports equipment more accessible to consumers across the nation.

* The Union Cabinet's approval of Khelo Bharat Niti 2025 (National Sports Policy – 2025) on July 1, 2025, marks a pivotal move towards positioning India as a global sports leader, with aspirations for the 2036 Olympic Games. Replacing the 2001 policy, this initiative is expected to stimulate growth in the sports goods manufacturing sector and enhance business opportunities for companies in the industry. Policies and schemes will be developed to actively encourage extensive participation from the private sector in sports development activities.

* To incentivise this contribution, the policy will incorporate Return on Investment (ROI) considerations for private entities, making their involvement in sports development both attractive and sustainable. Integrating sports equipment manufacturing sector with national schemes such as “Make in India” and “Atmanirbhar Bharat” will be emphasised under the Niti to create better sports infrastructure, job opportunities, and enhance product quality and market competitiveness.

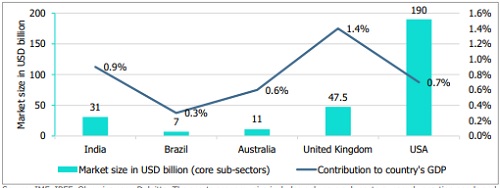

Indian Sports Market Size

India's sports market, currently valued at approximately USD 52 billion, with core sub-sectors1 accounting for USD 31 billion and allied sub-sectors2 contributing USD 21 billion, is on track for growth, projected to reach a compound annual growth rate (CAGR) of 10–12% through 2030. This momentum is being driven by increased government spending, the widespread adoption of digital technologies, and a growing supply of high-quality sports content across multiple disciplines. These trends are further supported by shifting lifestyle preferences toward health and fitness, as well as rising disposable incomes. Currently, the sports sector accounts for approximately 0.9% of India’s GDP, comparable to that of many top sporting countries. Given its close association with other sectors, such as media, telecom, education, real estate and tourism, the multiplier effect of incentivising the sports sector is sizable. More importantly, it makes a significant contribution to a country's overall health and well-being. With ample room for expansion, supportive policy reforms and infrastructure development are expected to enhance this contribution in the coming years. Exhibit 1 below shows the sports market size and contribution to GDP.

Exhibit 1: Sports Market Size and Contribution to GDP of Major Sporting Countries

India’s Sports Goods Manufacturing Hubs

India’s sports goods manufacturing base is rooted in craftsmanship and diversified across equipment types, including cricket bats, hockey sticks, tennis rackets, gym gear, and aquatic sports items. The production ecosystem is primarily driven by Micro, Small and Medium Enterprises (MSMEs) operating within designated industrial clusters. Meerut, in Uttar Pradesh, is the largest cluster, hosting over 35,200 registered sports goods manufacturing units, and accounts for 40 per cent of India’s total sports goods exports. Products manufactured here include inflatable balls, cricket and football gear, gym and fitness equipment, as well as protective gear. The cluster benefits from pre-independence historical linkages with European and American buyers and has seen increased adoption of technology in quality testing and logistics.

Jalandhar, in Punjab, is the second major hub, comprising over 3,000 units. It is known for manufacturing handstitched balls and protective gear. Jalandhar’s manufacturers serve clients across Europe and North America, having integrated digital sourcing and order management platforms.

In addition to these legacy hubs, emerging manufacturing regions such as Tamil Nadu, Maharashtra, West Bengal, Delhi, and Jammu are developing capabilities in niche segments, including sportswear, indoor sports accessories, and synthetic materials.

Indian Sports Goods Exports Continue Upward Trend

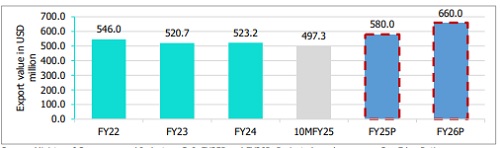

The consistent rise in India’s sports goods exports over recent years reflects strong global demand and manufacturing capabilities. During 10MFY25 (referring to the period from April 1, 2024, to January 31, 2025), the export value reached USD 497.3 million. CareEdge Ratings expects the export growth trajectory to continue, reaching approximately USD 660.0 million in FY26. Further, with GoI initiatives, the industry is well poised to register consistent growth in the future years. The same is also evident from Exhibit 2, which presents a yearly trend of sports goods exported by India.

India exports sports goods to over 150 global markets. Over the last three years, the US and the UK have consistently led in import volumes, followed by Australia and Germany. These markets together account for around two-thirds of India’s overall sports exports.

Exhibit 2: Trend in Value of Sport Goods Exported From India

Key Growth Drivers for Indian Sports Equipment Industry

Increasing Government support and better sports infrastructure

Initiatives such as the Fit India Movement (2019) and Khelo Bharat are encouraging sports and fitness activities, boosting the demand for sports equipment. The “Make in India” scheme promotes domestic manufacturing with incentives, subsidies, and allows 100% FDI in sports goods manufacturing. The development of sports infrastructure, including stadiums, gyms, and fitness centres, is making sports facilities more accessible, driving demand for sports equipment.

Skilled labour availability at competitive costs

India has a large pool of skilled labour, which is essential for manufacturing of high-quality sports goods like footballs, cricket balls etc. Additionally, competitive labour costs make India an attractive destination for sports goods manufacturers.

Increasing health awareness along with rising disposable income

As more Indians become aware of the importance of health and fitness, there's a growing demand for sports equipment to support physical activity and participation in sports . Additionally, with increasing disposable incomes, consumers have more purchasing power to spend on sports equipment, leading to higher expenditure on sporting goods and accessories

Growing viewership and interest in sports and growth of Ecommerce

There is a consistent increase in viewership of Indian Premier League, Pro Kabaddi League, Indian Super League etc. Brands are willing to sponsor sports teams and advertise. Money is flowing into the sports industry from both advertising and merchandise. The rise of e-commerce platforms offers opportunities for market expansion, allowing consumers from Tier 2 and Tier 3 cities to conveniently access a wide range of sports equipment and accessories.

Key Challenges in the Indian Sports Equipment Industry

Highly competitive industry

The Indian sports equipment market is highly competitive due to the presence of a large unorganised sector, including small-scale manufacturers and local vendors. This intensifies competition and puts downward pressure on prices, affecting the profitability of organised players. Additionally, Indian sports goods often face stiff competition from manufacturers in countries like China and Vietnam, which have lower cost of production.

Exposed to high price sensitivity

Indian consumers often prioritize affordability, opting for cheaper alternatives over premium brands. This preference poses a challenge for premium brands, which may struggle to compete in a market where numerous lower-priced options are available.

Distribution challenges

Inefficient distribution networks, especially in rural and semi-urban areas, pose challenges in reaching a wider consumer base. This limits market penetration and growth potential for sports equipment manufacturers.

Exposed to regulatory risks

Adhering to regulatory standards, including safety and quality certifications, can be difficult for manufacturers, particularly smaller companies. Failure to comply with these regulations may lead to legal issues, reputational damage, and loss of market share. Additionally, there is often a lack of awareness or understanding of intellectual property rights among manufacturers, leading to risks of patent infringement or unauthorised copying of designs.

Khelo Bharat Niti 2025

The Union Cabinet has officially approved the Khelo Bharat Niti 2025 (National Sports Policy – 2025) on July 1, 2025, marking a transformative step in India’s journey toward becoming a global sporting powerhouse. Replacing the 2001 National Sports Policy, which was in effect for two decades, the new initiative sets forth a bold vision to position India as a serious contender on the international sports stage, including its aspirations for the 2036 Olympic Games. Aligned with the National Education Policy, it emphasises harnessing the economic potential of sports to drive national development.

Key objectives of the policy include:

* Establishing competitive sports leagues across disciplines.

* Developing sports infrastructure in both urban and rural areas to broaden access and participation.

* Encouraging manufacturing and distribution of high-quality sports equipment to boost industry competitiveness.

* Ensuring financial sustainability and operational excellence of sports facilities

For private players, the policy aims to monetise both hard assets (such as stadiums and arenas) and soft assets (like digital platforms and community programs) through a Public-Private Partnership (PPP) model. Effective management and strategic partnerships will enhance revenue streams and maintain high operational standards. Government initiatives, such as procurement programs, innovation hackathons, and sports incubator programs, will provide the necessary support for startups.

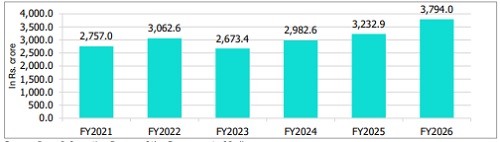

Consistent Increase In Budget Allocation to Ministry of Youth Affairs and Sports

The budget has seen a substantial increase since FY05, rising from Rs. 466 crore to Rs. 3,794.0 crore in FY25. The Khelo India Programme has been a key recipient of increased funding, receiving Rs. 1,000 crore in FY26. This is Rs. 200 crore higher than the grant of Rs 800 crore in FY25. The increase in budget by Rs. 200 crore is substantial, considering there are no major sporting events like the Olympics, Commonwealth Games, or Asian Games lined up for the next year. The ministry has also focused on youth empowerment, sports participation, and enhancing India's international sports standing through various initiatives. Following the approval of Khelo Bharat Niti on July 1, 2025, the budget is expected to increase further in the years to come. India is currently pursuing an ambitious bid to host the 2036 Olympic Games, for which a letter of intent has been submitted to the International Olympic Committee. Exhibit 3 below indicates yearly budget allocation trend.

Exhibit 3: GoI’s Budgetary Allocation to Ministry of Youth Affairs and Sports

CareEdge Ratings’ View

Puneet Kansal, Director, CareEdge Ratings, said, “Khelo Bharat Niti 2025 is poised to boost demand for sports equipment across various disciplines significantly. The sports goods manufacturing sector in India is set to benefit from the expansion of sports infrastructure in both urban and rural areas. This expansion would enable companies in the industry to generate higher revenue with increased capacity. Also, new manufacturing hubs are expected to flourish in the medium-term to cater to the expected increase in demand for the industry”.

“The policy explicitly supports the growth of sports equipment manufacturing, aiming to improve product quality and enhance market competitiveness that could include incentives like subsidies, tax benefits, or easier access to raw materials and technology. Integrating sports equipment manufacturing sector with national schemes such as “Make in India” and “Atmanirbhar Bharat” will be emphasised under the Niti to create job opportunities. The Niti focuses not only on improving sports infrastructure but also on integrating sports with education, promoting a healthier youth. This evolving sector presents an encouraging outlook for manufacturers, stakeholders, and Indian economy at large,” says Sandeep Aggarwal, Associate Director, CareEdge Ratings.

“Khelo Bharat Niti 2025 marks a transformative step in redefining India’s sports ecosystem, with a strong focus on job creation across sectors such as sports equipment manufacturing, coaching, broadcasting, event management, etc. While the global sports industry contributes approximately $600 billion annually, India’s current share remains modest and even moderate progress on this front could unlock substantial economic and social value. The policy promotes innovation through start-ups, encourages CSR investments, supports domestic manufacturing, and fosters public-private partnerships. It lays a comprehensive foundation for a thriving sports ecosystem—though its true impact will depend on effective and sustained implementation,” says Priti Agarwal, Senior Director, CareEdge Ratings.

Above views are of the author and not of the website kindly read disclaimer