IT Sector Update : Jul-Sep'25 Earnings Preview by JM Financial Services Ltd

Steady quarter but broader recovery still away

2QFY26 is expected to be another quarter of muted performance, the onground demand remains unchanged with no recovery in spending sentiment. Although the intensity of tariff uncertainties has de-escalated, Fortune-500 companies continue to stay behind the fence and avoid committing anything upfront. The cost-optimization projects are still being prioritized over the “RUN” initiatives, cost savings are being re-invested to the projects instead of infusing new dollars. The weakness in demand also tends to defer compensation revision for most of the names (except TCS) in Q2, despite the fact the improvement in margins would witness flat to marginal improvement, partly aided by INR depreciation. We expect median revenue growth of 0.8% QoQ in CC terms & 1.2% QoQ in USD terms. While currency volatility is limited in Q2, major currencies like EUR and GBP have strengthened against USD by 1% and 3% QoQ, respectively, which will translate into tailwinds to the tune of 20- 90bps QoQ in reported terms except LTTS & TATATECH.

Vertical-wise, BFSI should continue its growth momentum across IT Services, while Manufacturing and Consumer performance is expected to be on a weaker trajectory, as the challenges continue to persist within automotive and retail/CPG. Deal signing activities should be either flat or picking up slightly sequentially as slower decision making and weak sentiment weigh on deal closure activities. Structurally H2 tends to be weaker for IT Services, and with no incremental recovery in demand or client sentiment, we expect revenue guidance for Infosys and HCL Tech to largely remain unchanged, at least at the top-end. Q2 median margin improvement is expected to be flat on QoQ basis (PL coverage universe), on account of missing operating leverage, partly supported by INR depreciation against USD.

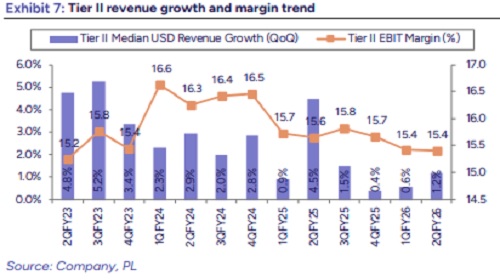

Tier I & II operating performance: We expect moderate Q2 performance with median growth of 1.4% QoQ for Tier I and 1.2% QoQ for Tier II companies. Within Tier I, Infosys (1.8% QoQ CC), LTIM (1.9% QoQ CC) and HCLT (1.5% QoQ CC) are likely to lead. TCS and TechM should see modest growth in the quarter while Wipro will witness another quarter of revenue decline. Within Tier II companies, ER&D firms will remain weak on auto softness & client specific issues. Growth within Tier II companies will be driven by Latent View and Persistent.

On the margins front we expect median margin to remain stable for both Tier I & Tier II companies at 16.8% & 15.4% respectively largely due to currency tailwinds & deferment of wage hike for most of the name.

Deal wins: We expect deal wins to remain steady with a slight uptick from Q1, despite an unchanged macro environment and fresh uncertainty from rising H-1B visa costs.

Valuation and View

The underlying demand environment remains unchanged, while discretionary spends continues to see execution deferrals. The conversion pace from TCV to revenue seems unlikely to have changed. The growth beyond BFSI also seems to be limited and is more selective, based on the regional presence and the nature of offerings within our coverage universe. The incremental pessimism is reflected in the IT Index (down 12% over last 3m), the IT stocks have corrected in the past few sessions; hence we are very selective in picking up the names from the basket.

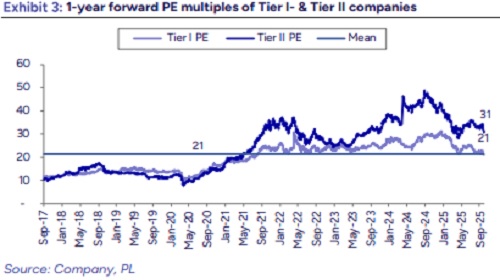

We continue to remain positive on INFY, PSYS and TCS, which are either less sensitive to discretionary spending or have low exposure to tariff-sensitive verticals. Given the stock price correction and achieving steady state, we are upgrading INFY/PSYS to BUY from ACCUMULATE earlier and KPIT to BUY from HOLD. We also upgrade HCLT to ACCUMUALTE and TechM to HOLD. The 1-year forward PE band of Tier 1 is flat to 10-year average PE while Tier 2 are trading at a premium of 47%, respectively to their 10-year average PE.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

.jpg)