Indian Companies Strengthening Market Position & Export-Led Growth by Kenneth Andrade, Old Bridge Capital Management

Below the Quote on Indian Companies Strengthening Market Position & Export-Led Growth by Kenneth Andrade, Old Bridge Capital Management

Synopsis

India is positioning itself as a global leader by leveraging its strengths in key sectors like pharmaceuticals, manufacturing, and IT. The country's cost competitiveness, improving manufacturing standards, and a cost led service sector efficiency have enabled Indian companies to expand globally, cementing their right to win in international markets.

As India shifts its focus towards making international trade as a larger part of its GDP, it is driving economic growth through foreign trade which increases employment in segments and thereby increasing domestic consumption.

An advantageous cost advantage will construct an export-driven approach creating a pathway to sustained income growth, allowing India to grow market share amidst changing global trade dynamics. This report explores how India is capitalizing on these opportunities while addressing risks such as overvaluation and global competition.

The Shifting Global Landscape

As global economies evolve and recalibrate, India has emerged as a key player with an inherent "right to win" in multiple industries. The nation's positioning, cost competitiveness, and manufacturing scale have enabled Indian businesses to thrive and expand their global presence. With a strategic emphasis on exports, India is on a trajectory of sustained economic growth.

India’s growing dominance in sectors such as pharmaceuticals and IT services underscores its global leadership. In a world reshaped by bilateral trade agreements, tariff barriers, and economic disruptions, India's ability to navigate these challenges while maintaining a competitive edge will ensure continued success.

Manufacturing Prowess: Building up this Decade

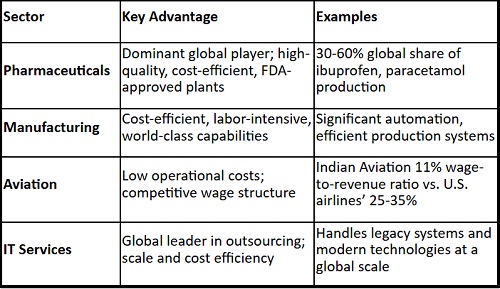

Indian companies have built formidable capacities and capabilities in sectors like pharmaceuticals and IT services/ GCC’s, which are crucial to the global economy. For example, India's pharmaceutical industry supplies a significant share of key OTC APIs such as ibuprofen and paracetamol, with Indian companies controlling 30-60% of the global market.

Indian manufacturing plants, certified to the highest standards by the FDA, offer world-class quality at a much lower cost seen in other countries. These plants are technologically advanced and are managing large-scale production without the burden of high western countries labour costs.

This manufacturing efficiency extends beyond pharmaceuticals. India's ability to provide high-quality services and products at competitive prices positions it as a critical player in global supply chains. Regardless of potential trade barriers, India’s cost advantages and large-scale production will continue to make it indispensable in the global economy.

Cost Efficiency in Service Sectors

India’s competitive advantage extends to service industries like aviation and IT, where cost-efficiency has played a pivotal role. The Indian aviation businesses are a prime example, with wage costs representing just 11% of its revenue—among the lowest globally—in line with or lower than large low cost carriers. By contrast, U.S. airlines operate with wage costs that range from 25-35% of revenue.

Similarly, India’s IT sector has become the go-to destination for outsourcing services. Global firms rely heavily on Indian service providers for both legacy systems and modern technology solutions. This capacity to deliver cutting-edge services at scale has enabled India’s IT firms to flourish internationally, building a robust service-based economy.

Expanding Global Market Opportunity

India’s "right to win" extends beyond its domestic market. Indian companies are expanding rapidly across international markets, seizing new opportunities in the U.S., Europe, and Asia. As Indian firms expand, they are no longer content with serving only developed markets but are increasingly focused on emerging economies that represent untapped potential.

The Role of Exports in Economic Growth

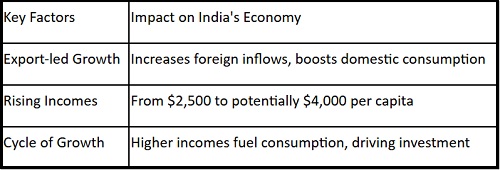

India’s economic future hinges on its ability to "export its way to prosperity." While domestic consumption is an essential driver of growth, India’s strategic focus on exports will generate significant foreign inflows, which will help boost domestic incomes and expand consumption.

As incomes rise and consumption increases, India will benefit from a virtuous cycle of growth. By prioritizing export-led growth, India will ensure that it remains competitive on the global stage while simultaneously driving economic development at home.

Risks and Challenges: Overvaluation and Global Competition

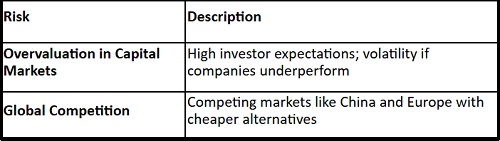

While India’s growth prospects are promising, there are risks. Overvaluation in capital markets presents challenges, as investor expectations have risen to precarious levels. Any underperformance or profit shortfall could lead to volatility, particularly for companies priced for perfection.

Additionally, global competition poses a challenge to India’s growth. With China stocks offering a lower valuation along with European stocks being relatively undervalued, global investors have alternatives. In the short term, this may divert some capital flows away from India.

India's Global Competitiveness

India's Expanding Global Market Opportunities

Strategic Focus on Export-Driven Growth

Risks and Challenges

Above views are of the author and not of the website kindly read disclaimer