India Strategy : Q3FY26 earnings : signs of robust recovery by Emkay Global Financial Services Ltd

The positive 3QFY26 earnings trend reinforces our positive stance on Indian equities. Despite the labor code hit, the BSE-500 delivered a 16% PAT growth, outperforming the Nifty 50 (8%). We remain bullish on Indian equities, with the announcement of the India-US trade deal marking an inflection point for the markets. We maintain a Nifty target at 29,000 for Dec-26E, with SMID lenders, new-age/internet companies, and discretionary consumption being our favored themes.

Visible consumption recovery – early days yet

We see healthy signs of a consumption recovery, with revenue growth accelerating from 16% to 20% sequentially in 3QFY26 – the first quarter after the GST cut. Autos was the key driver with strong growth expansion (14% to 21%), but staples remained weak with growth flat at ~13% YoY. Jewelry growth gathered significant pace, led by gold price inflation. Retail growth was flat, while Hotels and QSR segments stabilized (details in Exhibit 11 and Exhibit 12).

Significant hit from labor codes

The new labor codes make it mandatory for basic salaries to be raised to 50% of overall CTC – which pushed up gratuity costs for many companies. Our data compilation shows a ~5% hit to overall PAT this quarter – with technology taking the biggest hit at 13%, and Discretionary, at 6.5%, being the other notable sector. This is a one-off, non-cash charge and has artificially distorted reported earnings. It has also depressed the ‘surprise ratio’ – the share of negative surprises fell from 47% to 27% for Nifty if we adjust for the labor code impact.

Broad earnings recovery

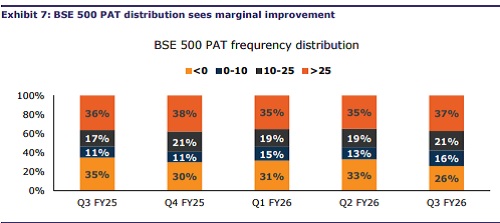

Despite the labor code hit, overall earnings remained robust. BSE-500 reported a 16% YoY PAT growth, with Energy (40%) and Discretionary (26%) the key drivers. Technology was the biggest laggard at 7% (all headline figures, including the labor code hit). Nifty earnings were much weaker at 8% (14% adjusted for the labor code hit). EBITDA margin for BSE-500 dropped by 35bps QoQ. However, topline growth touched double digits for the first time in the past 8 quarters, led by a sharp recovery in consumption. The PAT growth distribution was also robust – the share of companies delivering >25% PAT growth inched up slightly to 37% in Q3 from 35% in Q2, while the share of negative growth companies dropped sharply from 33% to 26%. Overall, we see strong signs of a consumption-led earnings growth recovery.

Earnings momentum stable

Earnings forecasts largely held up during the Q3FY26 results season, with negligible changes to FY26 (-0.3%) and FY27 (-0.9%) earnings forecasts for the Nifty. The consensus still points to a broader recovery in earnings, with 47% of our consensus universe (504 stocks; covered by 5+ analysts) slated to post >25% PAT growth in FY27, vs 32% in FY26. The Q3 earnings reinforce this bullish outlook, and we see limited risks. Rising commodity prices are the key monitorable, but it impacts a small section of the market, and a large part of this could be passed on if demand remains robust.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

.jpg)