Indian market after a two-day sprint, the bulls hit the pause button on Tuesday - Nirmal Bang Ltd

Market Review:

Indian market after a two-day sprint, the bulls hit the pause button on Tuesday. Sector indices on the NSE ended in a sea of red, with PSU banks and realty names taking the brunt of the sell-off. The S&P BSE Sensex shed 155.77 points, or 0.19%, to finish at 80,641.07. The Nifty 50 slipped 81.55 points, or 0.33%, to settle at 24,379.60.

Nifty Technical Outlook

Nifty is expected to open on a negative note and likely to witness range bound move during the day. On technical grounds, Nifty has an immediate support at 24300. If Nifty closes below that, further downside can be expected towards 24240-24170 mark. On the flip side 24470-24540 will act as strong resistance levels.

Action: Nifty has an immediate support placed at 24300 and on a decisive close below expect a fall to 24240-24170 levels.

Bank Nifty

Bank Nifty’s next immediate support is around 54100 levels on the downside and on a decisive close below expect a fall to 53840-53600 There is an immediate resistance at 54640-54900 levels.

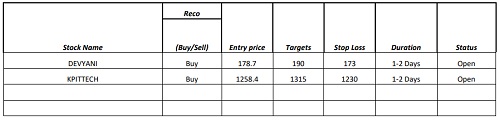

Technical Call Updates

Please refer disclaimer at https://www.nirmalbang.com/disclaimer.aspx

SEBI Registration number is INH00000176

More News

Daily Derivatives Report By Axis Securities Ltd