Daily Derivatives Report By Axis Securities Ltd

The Day That Was:

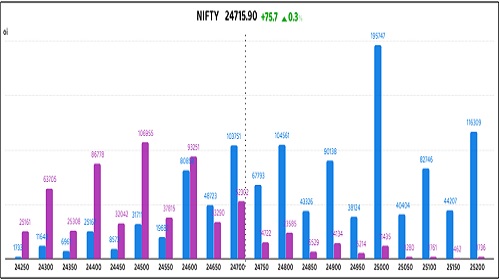

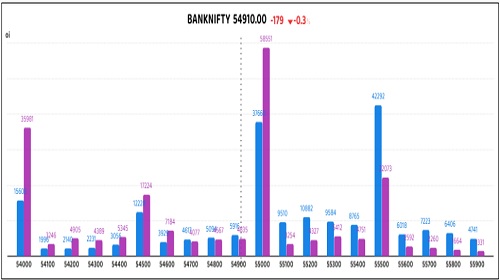

Nifty Futures: 24,715.9 (0.3%), Bank Nifty Futures: 54,910 (-0.3%).

Nifty futures were boosted on Wednesday by softer retail inflation data from the U.S. and the domestic economy in April, leading to a stabilisation in the opening hours. However, the initial gains diminished during the session, although closing 76 points higher. Contrarily, Bank Nifty futures ended lower by 179 points, underperforming the broader market. Domestic inflation data raised optimism for potential rate cuts by the Reserve Bank of India, while positive U.S. inflation figures and easing U.S.-China trade tensions eased global recession concerns. Most sectoral indices on the NSE traded in the green, except the Nifty Private Bank index. Improved sentiment from reduced geopolitical tensions and recession fears supported the market, aided by a weaker U.S. dollar boosting metal stocks. On the domestic front, the India Meteorological Department confirmed the southwest monsoon is proceeding as expected, with initial landfall over the Andaman Sea and parts of the southern Bay of Bengal. The Indian rupee closed higher at 85.28 against the U.S. dollar, strengthened by lower crude oil prices and a weaker dollar index. The rupee settled six paise stronger compared to Tuesday's close of 85.34. The India VIX also declined significantly by 5.4% to 17.23, indicating a lower outlook for price volatility. The Nifty futures premium fell from 62 to 49 points, while the Bank Nifty premium decreased from 148 to 109 points.

Global Movers:

US equities had a mixed outing yesterday, with the S&P 500 rising a mere 0.1% and the Nasdaq gaining 0.6%. Fatigue is setting in given the pace of the rally witnessed since the early April crash lows, especially with the S&P now turning positive on a year-to-date basis. Meanwhile, strategists are concerned that momentum readings have gone from very oversold to near overbought in very little time and therefore, the risk of the rally stalling is growing. Talking markets, the VIX ended 2% higher, the dollar rose a little, the 10-year treasury yield ended above 4.5%, Gold dropped 2.3% and finished below $3200 while nymex oil fell for a second day on an increase in stockpiles and Iran expressing openness to a nuclear deal that will help lift US sanctions on Iranian crude.

Stock Futures:

Yesterday saw a significant uptick in trading activity for Titagarh Rail Systems, Aditya Birla Capital, Asian Paints, and REC Limited. This surge was reflected in heightened trading volumes and marked price fluctuations, showcasing a growing interest among investors.

Titagarh Rail Systems experienced a notable 8.2% surge to a monthly closing high, accompanied by robust trading volume that marked a three-month peak, despite the absence of any publicly disclosed news or corporate events. This price action, coupled with a significant long addition in the derivatives market, suggests the entry of strong, informed investors. Indeed, futures data revealed a long build-up, defined by a 7.9% increase in open interest alongside the price gain, adding 535 new contracts and 3.3 lakh shares to reach a total open interest of 7,334 contracts. Examining the options landscape, the put-call ratio remained stable at 0.51, with total call option open interest at 6,694 contracts (an addition of 481 contracts) and put option open interest at 3,392 contracts (an addition of 151 contracts). Consequently, the confluence of substantial price appreciation, elevated volume, and bullish derivative positioning signals strong underlying sentiment and potential for further upside, warranting close monitoring of subsequent trading activity and news flow for confirmation.

Aditya Birla Capital shares rallied sharply by 6.6%, achieving their highest gain this month on the back of the highest trading volume in seven months. This surge followed the company's announcement of its Q4 FY25 standalone total income of ?3,879 crore, reflecting a 10% year-over-year increase, alongside a 4.5% YoY growth in standalone net interest income. However, the company's standalone profit after tax (PAT) saw a substantial 44% year-over-year decline, settling at ?654 crore compared to ?1,182 crore in the same period last year. Derivative analysis indicates a Long Addition, with a marginal increase of 0.2 lakh shares in open interest, bringing the total futures open interest to 23,814 contracts with a minimal addition of seven contracts. Therefore, while the strong revenue growth and positive price action are encouraging, the significant drop in PAT warrants careful consideration, and the tepid increase in futures open interest suggests a cautious outlook on sustained upward momentum.

Asian Paints' stock price experienced a notable 2% decline, marking its second consecutive losing session and reaching a monthly low on substantial trading volume. This downward pressure intensified following reports of the Reliance group's potential divestiture of its entire 4.9% stake, acquired in 2008 for approximately ?500 crore. Derivatives data corroborated this bearish sentiment, revealing a Short Addition defined by a price decrease coupled with a significant 11% surge in open interest. The total futures open interest now stands at 71,098 contracts, with a substantial addition of 7,059 contracts representing 14.1 lakh shares. Furthermore, options positioning indicated a shift towards bearish sentiment, as the put-call ratio declined from 0.70 to 0.61, with call option open interest at 38,288 contracts (an addition of 6,754 contracts) and put option open interest at 23,297 contracts (an addition of 1,320 contracts). Consequently, the confluence of a declining stock price, high trading volume, and bearish derivative indicators, particularly the significant short build-up in futures and the falling put-call ratio, strongly suggests increased selling pressure and a potentially continued downward trend in the stock.

REC Limited's stock price fell by 3%, extending its losing streak to a second day, accompanied by the highest single-day trading volume since July 2024. This pronounced selling pressure aligned with the company's downward revision of its assets under management (AUM) growth guidance to 11-13%, down from the previous forecast of 15-17%, as announced during their post-earnings call. Despite this adjustment, REC anticipates maintaining its net interest margins within the 3.5% to 3.75% range. Derivative analysis confirmed this bearish sentiment, revealing a significant Short Addition defined by a price decrease and a substantial 17.3% increase in open interest, marking the largest single-day percentage change this year. The current futures open interest stands at 69,954 contracts, reflecting a significant addition of 10,334 contracts, equivalent to 103.3 lakh shares. Consequently, the combination of a declining stock price, record trading volume, reduced growth outlook, and a strong short build-up in the futures market indicates considerable bearish momentum and suggests the potential for further price weakness.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR)rose to 0.89 from 0.85 points, while the Bank Nifty PCR fell from 0.83 to 0.82 points.

Implied Volatility:

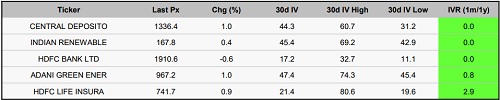

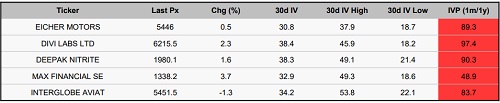

Dixon Technologies (India) and Ramco Cement have experienced notable fluctuations in their stock prices, with their implied volatility rankings closely aligned at 86 and 83, respectively. Currently, Dixon Technologies (India) has an implied volatility of 45%, while Ramco Cement stands at 36%. This rise in implied volatility indicates that options are becoming more expensive, prompting traders to adopt risk management strategies in light of market developments. In contrast, CDSL and IREDA have the lowest implied volatility rankings, exhibiting implied volatilities of 44% and 45%, respectively. These figures suggest their options may appeal to investors interested in long positions.

Options volume and Open Interest highlights:

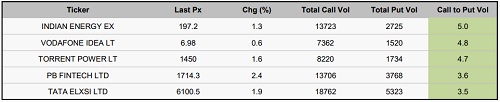

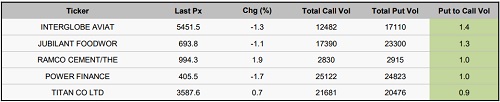

IEX and Torrent Power of India demonstrate a positive market outlook, shown by their robust call-to-put volume ratios of 5:1 each. This indicates strong demand for call options, suggesting market expectations of price rises. However, the noticeable call skew may imply potential overvaluation within the options market. Conversely, Interglobe Aviation and Jubilant FoodWorks exhibit a significant put-to-call volume ratio, where increasing put volumes suggest a risk-averse sentiment due to fears of possible price drops. Nonetheless, high put volumes might also indicate an oversold condition, providing contrarian trading opportunities. Regarding market positioning, ACC and UPL reveal considerable open interest in call options, while Yes Bank and Canara Bank show significant open interest in put options. This trading behaviour suggests potential price volatility, which could act as a resistance level or lead to upward price movement. (This data considers only those stock options that saw a minimum of 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

Yesterday's trading session in equity derivatives painted a distinct picture compared to prior activity. Within index futures, a net change of 6,308 contracts held by clients indicated a potential shift towards a more cautious or bearish stance in this segment. Conversely, both Foreign Institutional Investors (FIIs) and proprietary traders exhibited an inclination towards long positions, adding 1,697 and 4,803 contracts, respectively, hinting at a divergence in sentiment from the client segment. Turning to stock futures, the data revealed a continued bullish bias among retail clients, who increased their holdings by a significant 12,263 contracts. FIIs, however, displayed minimal activity in this segment, adding a negligible 20 contracts, indicating a largely neutral stance on individual equities in this session. Proprietary traders also added to their long positions in stock futures, albeit with a smaller increment of 1,108 contracts, aligning with the bullish sentiment observed among clients.

Securities in Ban for Trade Date 15-May-2025:

1) CDSL

2) HINDCOPPER

3) MANAPPURAM

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

Stocks With High Call Volume To Put Volume

Stocks With High Put Volume To Call Volume

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Morning Nifty and Derivative Comments 25 February 2024 By Anand James, Geojit Financial Serv...