Trade Deficit : Deficit surge once again led by precious metals by Emkay Global Financial Services

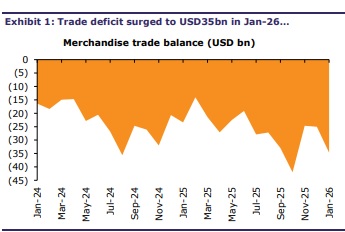

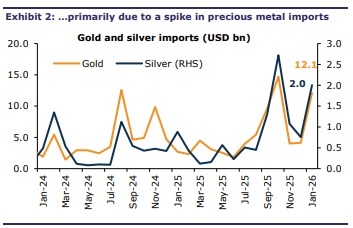

The goods trade deficit surged in Jan-26 to USD35bn (Dec-25: USD25bn), led by another price-led spike in gold (USD12bn; 192% MoM) and silver (USD2bn; 164% MoM) imports. Thus, total imports rose to USD71bn. Exports declined to USD37bn, but core imports also declined. Exports to the US fell 4% MoM and were down 6% YoY for Sep-25–Jan-26. We expect the recent trade deal to help boost US exports imminently. Major tariff-hit export sectors have also seen better-than-expected growth so far, led by higher shipments to China and other Asian nations. Services surplus rose to a record USD24.3bn in Jan-26, with Dec25 also seeing a significant upward revision. With better-than-expected export performance (both goods and services) for FY26TD, along with the impending US tariff relief, we maintain FY26E/FY27E CAD/GDP at 1.1%/1.2%, respectively

Goods deficit spike led by precious metals

The goods trade deficit spiked to a three-month high of USD35bn (vs USD25bn in Dec25), far higher than our estimate (Emkay: USD28bn). This was due to a surge in imports (USD71.2bn; 12% MoM), led by gold (USD12.1bn; 192% MoM) and silver (USD2bn; 164% MoM). Exports declined 5% MoM (USD36.6bn), with oil exports falling 14% MoM. Oil imports also declined, albeit marginally (USD13.4bn; -7% MoM). For 10MFY26TD, total goods exports were at USD366bn (~2% YoY), while total imports have risen ~7% to USD650bn, even as oil imports remain lower (USD148bn; -4% YoY). As a result, the 10MFYTD26 deficit stands at USD283bn (vs USD247bn for the same period last year).

Core imports declined MoM; core export growth trend remains healthy

Core imports declined 1% MoM to USD44bn, but core exports also fell (USD30bn; -5% MoM), leading to the rise in core deficit, albeit modestly, to USD13.3bn. Core exports over 10MFY26 were at USD296bn (4% YoY), while core imports stood at USD430bn (9% YoY). Notably, trends for tariff-affected sectors for FY26TD remain mixed. Gems and Jewelry exports were down 4%. Textiles exports saw near-flat growth, while Marine Products’ exports continue to see strong growth (15% YoY FYTD). Among major export categories, Electronics (30% YoY for 10MFY26) remains a strong growth performer, followed by Drugs and Pharma (6% YoY) and Engineering Goods (6% YoY).

US exports dip again, but trade deal likely to help boost exports ahead

Exports to the US declined 4% MoM (USD6.6bn), as did RoW exports (USD30bn; -5% MoM). Exports to the US were up ~6% to USD72bn for FY26TD. However, we believe the recent India-US trade deal will provide a fillip to exports once the headline tariff rate is reduced to 18%. RoW exports were up ~1% for FY26TD (USD294bn), having risen 4% YoY over Sep-25-Jan-26. This was led by sharp growth in exports to Spain (80%), China (58%), Hong Kong (34%), Vietnam (27%), and the UAE (13%), among others, in the past five months after the US tariff imposition. While this is a welcome trend, we think the reduction in US tariffs will lead to an immediate shift toward US exports.

Services surplus hits record in Jan-26 after a sharp upward revision for Dec-25

Services surplus rose to a record-high of USD24.3bn in Jan-25 from the upward-revised USD22.7bn in Dec-25 (USD18.1bn earlier). Thus, services surplus for 10MFY26 stood at ~USD181bn, up 18% YoY, with gross services exports (USD354bn) growing 11%. For Jan-26, exports (USD43.9bn) rose 5% MoM while imports (USD20bn) rose 3%. Despite services exports facing AI-led headwinds, growth has remained extremely strong so far.

FY26E/FY27E CAD/GDP maintained at 1.1%/1.2%

Exports, specifically core exports, have held up far better than expected, amid the punitive US tariffs. While precious metal imports have spiked, prices have corrected in Feb-25, and we expect imports to moderate immediately. The India-US trade deal should also lead to an improvement in US exports imminently, in our view. Given these trends, we maintain CAD/GDP at 1.1% for FY26E and 1.2% for FY27E. However, we still think that there is likely to be heavy volatility ahead, especially around precious metals and the details of the trade deal. Additionally, we expect services export growth to slow in FY27E, after staying robust in FY26E.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

More News

Market Watch : Gift Nifty signals a muted start, despite US indices closing strong by Geojit...

.jpg)