India`s Government Debt Consolidation Stays on Track by CareEdge Ratings

Global Government Debt Continues to Climb

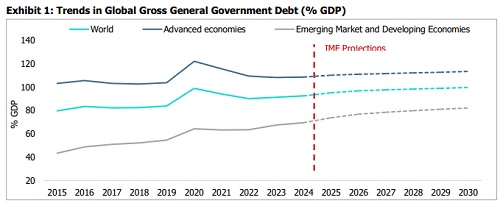

In the post-pandemic era, the most pressing issue in the global context has been the rising gross general government (GGG) debt. Prior to the COVID-19 shock, global government debt levels had already been elevated, and the pandemic disruption prompted a further synchronised increase in debt levels across advanced as well as emerging economies. The International Monetary Fund (IMF) projects that global government debt will rise to 97.5% by 2027, approaching 100% by the end of this decade. This remains notably higher compared to the prepandemic average of 82.2% seen during 2015-19 (Refer to Exhibit 1).

Geopolitical tensions and changing policy priorities have emerged as the key forces shaping the current global landscape. Governments worldwide are grappling with the growing fiscal burden stemming from higher spending towards defence, rising tariff uncertainties, climate risk mitigation, ageing and social security costs. Moreover, the global growth outlook remains weak, putting significant pressure on government debt.

While government debt levels continue to climb globally, India’s general government debt consolidation is expected to stay on track, supported by continued fiscal consolidation by the Centre and relatively healthy growth. However, India’s elevated interest burden continues to pose a key challenge in the medium term.

India’s General Government Debt Consolidation Stays Intact

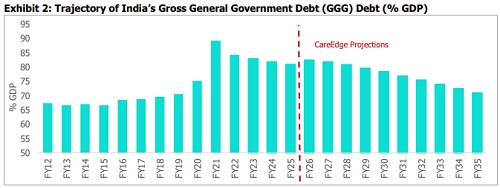

Following the COVID-19 pandemic and the related fiscal pressures, India’s general government debt surged to 89% in FY21. Post-pandemic, India’s gross general government (GGG) debt-to-GDP ratio has been on a downward trajectory, moderating to an estimated 81% in FY25(Refer to Exhibit 3). Despite the decline, India’s general government debt remains well above the pre-pandemic average of 69% seen during FY15-19.

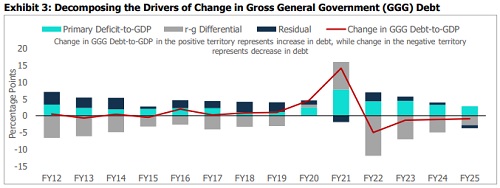

Since the pandemic peak, India’s general government debt-to-GDP is estimated to have moderated by 8 percentage points. A decomposition of the change in gross general government (GGG) debt-to-GDP ratio indicates that nominal GDP growth rates exceeding the effective nominal interest rate have been the key drivers of the moderation in India’s debt levels in the post-pandemic period. Additionally, the narrowing of the primary deficit in the aftermath of the pandemic has further supported the downward trajectory of government debt. (Refer to Exhibit 3).

India’s gross general government (GGG) debt-to-GDP is estimated at around 81% in FY25 and could edge up marginally in FY26, as lower inflation dampens nominal GDP growth. However, the medium-term debt dynamics remain intact with India’s GGG debt-to-GDP projected to moderate to around 77% by FY31 and further to 71% by FY35 (Refer to Exhibit 2).

Factors Underlying India’s Government Debt Trajectory

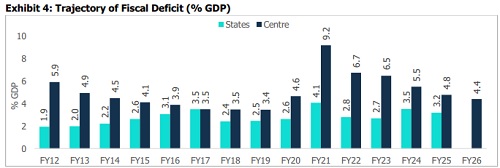

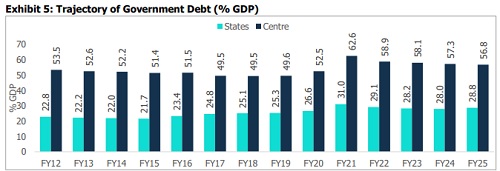

The government debt consolidation at the general government level has been supported so far by the Centre’s commitment to lowering the fiscal deficit following the pandemic spike. The COVID-19 pandemic-led disruptions to economic activity and the roll-out of several relief measures had pushed the Centre’s fiscal deficit to 9.2% of GDP in FY21 from 4.6% in the previous year. The Centre successively brought down the fiscal deficit to 4.8% of GDP in FY25 (Refer to Exhibit 4). With fiscal consolidation and healthy GDP growth, the Centre’s debt-to-GDP ratio is estimated to have moderated to 56.8% in FY25 from 62.6% in FY21 (Refer to Exhibit 5).

A noteworthy aspect of Central finances is the continued focus on capital spending in the post-pandemic period. Centre’s capex to GDP rose to 3.2% in FY25 from an average of 1.7% seen during FY15-19. On the revenue front, the support from higher-than-expected RBI dividend transfers has helped provide additional fiscal space in recent years. On the other hand, the Centre’s performance on the disinvestment front has remained lacklustre. The recently introduced GST reforms are a positive step towards simplifying and rationalising the existing tax structure. While the GST rationalisation is expected to result in some revenue loss, it is also expected to boost the buoyancy in tax collections. We expect the moderation in Centre’s debt to continue and reach around 50±1% by the end of FY31, in line with the Government’s fiscal anchor as stated in the last Budget. While fiscal consolidation is likely to continue, laying a debt trajectory will give the Government the flexibility to manoeuvre the fiscal deficit target for each year depending on the growth prospects.

At the state level, the aggregate fiscal deficit remains elevated above the 3%-mark (Refer to Exhibit 4). Additionally, the cash transfer schemes run by several states remain concerning in the context of already elevated state deficits. Going forward, we expect state deficits to remain elevated as the fiscal implications of these freebies remain a critical monitorable. Eight major states implementing such schemes have cumulatively budgeted approximately Rs 1.5 trillion for them. The aggregate state debt remains sticky at around 28% of GDP, as against the pre-pandemic level of 25.3% (FY19). This highlights the need for a clear roadmap for fiscal and debt consolidation at the subnational level (Refer to Exhibit 5).

Overall, India’s general government debt level is estimated to continue declining gradually, supported by the Centre’s continued commitment to fiscal consolidation and the sustenance of GDP growth momentum of around 6.5% in the medium term. While sticky aggregate state debt remains concerning in the midst of the dole out of freebies by some states, it is not alarming as yet.

India’s General Government Debt Trajectory Bucks the Trend Across Other Major Economies

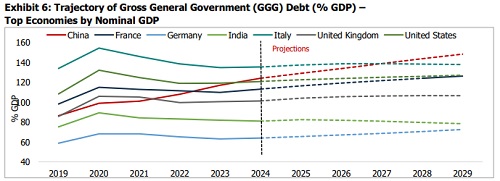

A cross-country comparison reveals that government debt levels remain elevated across major economies, with Japan’s debt-to-GDP ratio, estimated at 237% in 2024, standing as the highest among them. This is followed by Italy (at 135%), the US (121%), France (113%) and China (124%) (Refer to Exhibit 6). While China’s official general government debt is estimated at 60.5% of GDP (2024), the country’s augmented debt (which includes offbudget debt of local governments), as estimated by the IMF, is notably higher at 124% of GDP in 2024 and is projected to rise to 148.2% by 2029.

The US, the world's largest economy, is also facing mounting debt pressures. The federal government debt has risen to USD 37.4 trillion, much ahead of the earlier expected timeline. The Congressional Budget Office’s January 2020 projections expected gross federal debt to cross over USD 30 trillion by 2030. However, the pandemic-related disruptions have resulted in a sooner-than-expected acceleration in the federal government debt. Looking ahead, the tax and spending bill, known as the One Big Beautiful Bill (OBBB), announced by President Donald Trump, could potentially further increase debt levels.

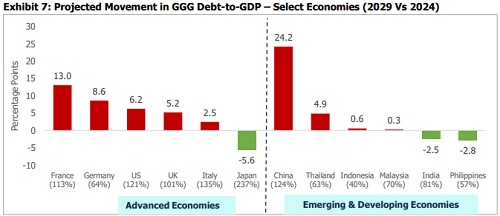

In addition to the already elevated levels of government debt across major economies, an assessment of their projected trajectories indicates a rising trend in economies such as France, Germany, the US, the UK, and Italy. In fact, for the next five years, the government debt is projected to rise in all major economies except Japan (Refer to Exhibit 7). However, it is important to note that Japan’s government debt-to-GDP is projected to moderate from a much higher level seen at around 237% in 2024. Among select emerging market and developing economies, government debt-to-GDP is projected to moderate for economies such as the Philippines and India, while it is projected to increase for economies such as China and Thailand.

India’s Government Debt Projected to Moderate, Yet Weak Debt Affordability Remains a Concern

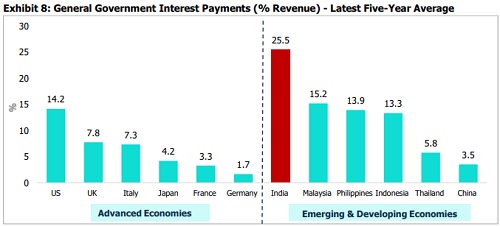

Although the moderating government debt level is a positive aspect for India’s fiscal position, it fares poorly in terms of debt affordability, with the combined interest payments of the Centre and State governments averaging 25.5% of revenue receipts over the last five years. A cross-country comparison reveals that India’s interest burden remains the highest among other economies (Refer to Exhibit 8). India’s general government interest payments (% revenue receipts) at 25.5% is much higher compared to other emerging economies such as Indonesia (at 13.3%), the Philippines (13.9%), followed by Thailand (5.8%) and China (3.5%) at much lower levels. Among advanced economies, this ratio was in the range of 7%-15% for the US, UK and Italy, whereas it was much lower for economies such as Japan (at 4.2%), France (3.3%) and Germany (1.7%).

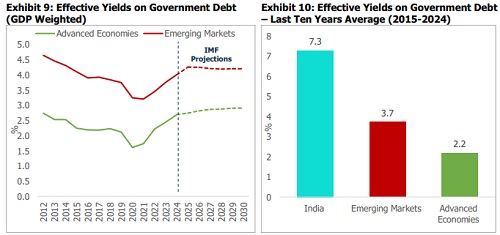

In addition to its already elevated debt burden, India’s weak debt affordability can be attributed to two key factors: (a) elevated interest rates and (b) a relatively narrow revenue base. Historically, advanced economies have benefited from lower effective interest rates on government debt, averaging 2.2% during the last decade, compared to emerging markets at 3.7% (Refer to Exhibit 9 & 10). Even among emerging economies, India’s effective nominal interest rate on general government debt was higher, at around 7%, during the last decade. (Refer to Exhibit 10).

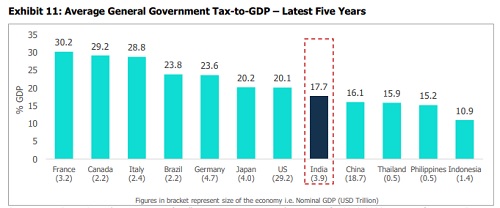

Another challenge in India’s fiscal landscape is its relatively lower tax base (tax-to-GDP ratio) (Refer to Exhibit 11). India’s general government tax-to-GDP averaged at 17.7% during the last five years, much lower compared to advanced economies such as France (30.2%), Canada (29.2%), Italy (28.8%), etc. However, India’s ratio is seen to be higher than that of some other emerging economies, such as China (16.1%), Thailand (15.9%), the Philippines (15.2%), and Indonesia (10.9%).

Summing Up

The current global landscape is marked by slowing economic growth, elevated levels of government debt, rising spending pressures and evolving policy priorities. While the government debt levels are projected to rise in almost all major economies, India’s government debt trajectory is set to chart a different course with debt levels projected to moderate – albeit gradually - over the coming decade. The consolidation in the centre’s fiscal deficit, while continuing with the emphasis on capital expenditure, is encouraging. However, stricter fiscal rectitude is also warranted at the state level. While the general government debt-to-GDP is likely to moderate gradually in the coming years, the high interest-to-revenue ratio will remain a pain.

Above views are of the author and not of the website kindly read disclaimer