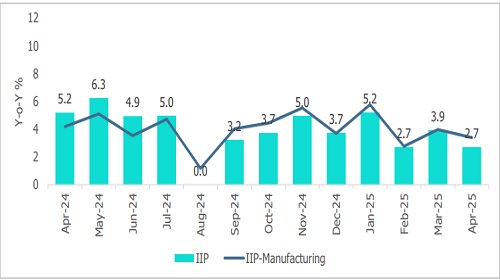

IIP-April 2025 : India`s industrial production grew by a higher than expected 2.7% in April from an upwardly revised 3.9% in the previous month by CareEdge Ratings

India’s industrial production grew by a higher than expected 2.7% in April from an upwardly revised 3.9% in the previous month. The manufacturing sector witnessed a relatively steady growth of 3.4%, supporting overall IIP growth. In contrast, a contraction in mining output and a moderation in electricity output weighed on the industrial performance. On the consumption side, consumer durable goods output recorded an encouraging growth, while the performance of consumer non-durables continued to remain weak.

Exhibit 1: Index of Industrial Production

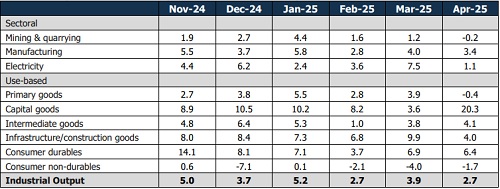

The manufacturing sector grew by 3.4% in April (Vs 4% in March). Year-on-year, output increased in 16 out of 23 subcategories. Notably, basic metals, which constitute the largest component (12.8% weight), saw an output growth of 4.9% (Vs 8.7% in March). Among the export-oriented segments, wearing apparel saw an uptick, registering a growth of 10.8% (Vs 1.3% in March). However, moderation was seen in the growth of textile output, and leather and related products remained in the contractionary zone. Electricity output moderated to 1.1% (Vs 7.5% in March) while mining output contracted by 0.2% (Vs growth of 1.2% in March). In terms of use-based classification, the output of infrastructure and construction goods showed some moderation in growth compared to the previous month (4% vs 9.9% in March). Moreover, capital goods output rose by a sharp 20.3% on the back of a supportive base. On the consumption side, the output of consumer durable goods increased by 6.4% (Vs 6.9% in March), while growth in output of consumer non-durables continued to remain in the contractionary zone for the third consecutive month

Table 1: Component-wise Breakup of IIP Growth (Y-o-Y %)

Way Forward Going ahead, the domestic consumption landscape remains a key monitorable due to the prevailing unevenness in demand recovery. Urban demand remains a concern, while a favourable agricultural performance and expectations of a normal monsoon support rural demand. The continued improvement in the inflation scenario, led by an easing of food inflation, remains positive for the overall demand recovery. Centre’s capex contracted by 4% during JanFeb FY25 following a pick-up in Q3. Given this weak momentum, the pace of capex revival remains a critical watch out going ahead. Though the US has put the reciprocal tariffs on a 90-day hold, we expect global economic uncertainty to persist going forward. This is likely to weigh on both the private investment and consumption impulses. Nevertheless, expectations of a further rate cut by the RBI amid easing price pressures are expected to offer some support.

Above views are of the author and not of the website kindly read disclaimer