Hold Praj Industries Ltd For the Target Rs.340 by Axis Securities Ltd

Worst Factored In; Recovery Awaited

Est. Vs. Actual for Q2FY26: Revenue: BEAT; EBITDA: BEAT; PAT: BEAT

Changes in Estimates post Q2FY26

FY26E/FY27E: Revenue: -1%/-5%; EBITDA: -30%/-24%; PAT: -46%/-31%

Recommendation Rationale

* Bio-energy Segment Waiting For The Next Push: Praj’s performance remained subdued, impacted by cautious sentiment in the domestic ethanol market. With the company having achieved the 20% ethanol blending target, further growth now hinges on the development of new avenues. The management continues to focus on diversifying into alternative opportunities and remains optimistic about regaining growth momentum once clarity emerges on future blending targets, including those related to diesel.

* Fixed Costs Hurting Margins: EBITDA margins remained under pressure during the quarter as fixed costs continued to rise amid muted revenue growth. Fixed expenses in the GenX business (~Rs 8.5–9 Cr per month) without corresponding revenue contribution have significantly impacted profitability, prompting the management to explore alternate revenue streams.

* Traction in International Business: The management remained optimistic about potential growth opportunities in the international business. The company indicated a healthy inquiry pipeline in the U.S., supported by the potential benefits of IRA 45Z tax credits. Additionally, management highlighted favourable policy developments in regions such as Latam, Indonesia, and Africa, which could serve as key growth catalysts going forward.

Sector Outlook: Cautiously Optimistic

Company Outlook & Guidance: The company continues to face execution delays in the domestic bio-energy business, while projects expected from the new GenX facility have been stalled or put on hold. In H2FY26, management expects progress on the delayed projects, with execution activity likely to improve as liquidity conditions ease for customers. Although the recovery timeline for the domestic bio-energy business remains uncertain, the company is actively working on developing new growth avenues to achieve its FY30 targets.

Valuation: 20x Sept’27E (Earlier Valuation: 20x FY27E)

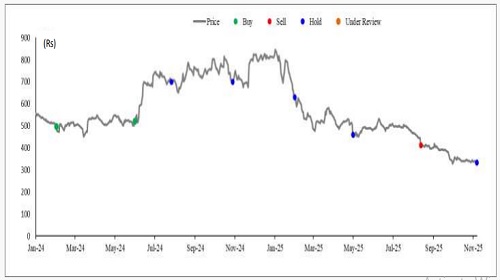

Current TP: Rs. 340/share; (Earlier TP: Rs 350/share)

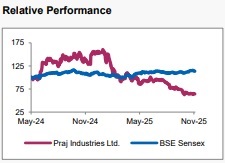

Recommendation: We upgrade our rating on the stock from SELL to HOLD as the stock has corrected significantly since our last report, reflecting right valuations.

Financial Performance: The company reported revenue of Rs 842 Cr, up 3% YoY and 31% QoQ, surpassing estimates by 19%. EBITDA stood at Rs 56 Cr, down 41% YoY and 57% QoQ, in line with expectations. EBITDA margin declined to 6.6% from 11.5% in Q2FY25. PAT came in at Rs 19 Cr, down 64% YoY but up 261% QoQ, reflecting an overall performance ahead of estimates. Order intake during the quarter stood at Rs 813 Cr, compared to Rs 795 Cr in the preceding quarter.

Outlook: Although Praj is expanding its portfolio and strengthening its existing capabilities, nearterm growth momentum is expected to remain subdued. The company has invested in the Mangalore GenX facilities, which are yet to achieve the anticipated utilization levels. Momentum is likely to pick up in the second half of FY27 as demand in the bioenergy segment normalizes and the Engineering and other businesses gain traction.

Valuation & Recommendation: Our revised estimates indicate a materially slower growth trajectory over the next few quarters, with recovery expected once customers gain clarity on their sustainable investment plans. We have rolled forward our estimates and now value the stock at 20x Sept’27E (earlier 20x FY27E), translating into a TP of Rs 340/share (revised down from Rs 350/share), implying an upside of 1% from the CMP. We upgrade our rating on the stock from SELL to HOLD as the key headwinds appear to be largely factored in.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633