Gold price to range between 7% decline and a 20% gain in FY26: SmartWealth.ai – a smallcase manager

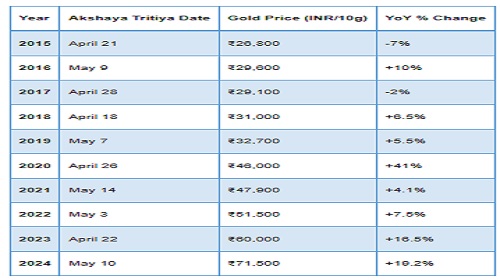

SmartWealth.ai – a smallcase manager – report on Gold reveals that over the past 10 years (2016–2025), the compounded annual growth rate (CAGR) of Gold has been approximately 12.3%, which has caught up with the 11.4% CAGR returns of Nifty50 index.

smallcase Manager SmartWealth.ai’s Diversified Momentum Investing (DMI) framework reveals that over the next month, Equities & Gold may exhibit following tendencies:

* Equities (Nifty 50) exhibit a mild downward bias, though volatility remains elevated. We estimate a potential range between a 7% decline and a 3% gain.

* Gold continues to show a slight upward bias, with an expected range between a 4% decline and a 5% gain.

Data indicates a potential for 3% to 7% modest increase in gold prices by the next Akshaya Tritiya in 2026. However, macro-economic and geo-political uncertainties could drive swings between a 7% decline and 20% gain over the current levels.

In such a regime, diversification and dynamic risk management are critical.

Gold, long treasured for its emotional, economic, and ornamental value, continues to shine as a timeless asset in investor portfolios. According to the report, over the period of 10 years of Akshaya Tritiya, Gold price has increased by 166.79%

Pankaj Singh, smallcase Manager, Founder & Principal Researcher, SmartWealth.ai said, “The past year has been an outlier in market behaviour. The Nifty 50 has delivered over 7% returns, while gold has surged by more than 30%. This profile of performance in equity and gold is exceptionally rare, with a historical probability of occurrence below 2%. Looking ahead, the market regime and geopolitical environment remain highly uncertain, making even short-term forecasts challenging. It is important to include gold in a portfolio—not necessarily in a traditional buy-and-hold manner, but at least as a dynamic diversifier and hedge.”

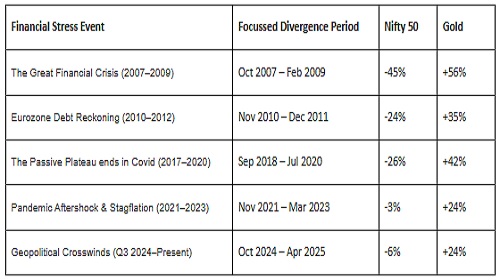

The smallcase Manager SmartWealth.ai’s report reveals that gold has consistently acted as a natural hedge during major equity market downturns over the past 20 years.

Gold has demonstrated its role as an effective buffer against equity market volatility during several key periods of financial stress such as The Great Financial Crisis (2007–2009), Eurozone Debt Reckoning (2010–2012), The Passive Plateau ends in Covid (2017–2020), Pandemic Aftershock & Stagflation (2021–2023), and Geopolitical Crosswinds (Q3 2024–Present).

“Gold tends to retain its value over time, making it a popular store of wealth when inflation erodes the purchasing power of fiat currencies. When a local currency weakens (especially the U.S. dollar), gold prices often rise, presenting an opportunity for preserving value in real terms. During times of crisis—such as recessions, wars, or financial system instability—investors often flock to gold as a "safe haven" asset. Gold often shows low or negative correlation with equities, so it can provide balance during stock market downturns”, added Pankaj Singh, smallcase Manager.

Akshaya Tritiya is considered an auspicious day for buying gold, investing, or starting new ventures, symbolizing lasting prosperity and good fortune.

Above views are of the author and not of the website kindly read disclaimer

.jpg)