Weekly Commodity Derivatives Snapshot by Axis Securities

The Week That Was

* COMEX Gold extended its rally for an eighth consecutive week, marking its longest winning streak since 2020. The metal surged to a record high of $2,954 before retreating slightly to settle near $2,932, posting a solid 1.8% weekly gain. Safe-haven demand remained strong amid renewed trade tensions following former U.S. President Donald Trump’s tariff threats. A weaker dollar, which declined for the third consecutive week, provided additional support for gold..

* COMEX Silver sustained its bullish momentum for the fifth consecutive week, closing above $32.4 for the first time in four months—a significant technical breakout. The metal, which gained 21% in 2024, has extended its strength into 2025 with a 14% rise year-to-date. Similar to gold, silver benefited from escalating trade war concerns, as Trump’s proposed import tariffs heightened fears of global economic instability. The continued decline in the U.S. dollar further bolstered silver’s appeal as an alternative asset.

* NYMEX Crude Oil extended its losing streak to five weeks, slipping nearly 0.5% as bearish fundamentals continued to weigh on prices. The easing of geopolitical risks, particularly progress in the Russia-Ukraine peace talks, has diminished the war risk premium on oil. Meanwhile, rising U.S. crude inventories and refinery maintenance-driven declines in gasoline and distillate stocks added further pressure to the market.

* COMEX Copper ended its two-week winning streak, falling more than 2% last week as markets reassessed the impact of Trump’s tariff policies. While copper was not directly targeted, Trump’s decision to impose tariffs on lumber and forest products raised concerns about broader trade restrictions. However, his recent remarks on the possibility of a new trade agreement with China, the world’s largest copper consumer, provided a measure of optimism for future demand prospects.

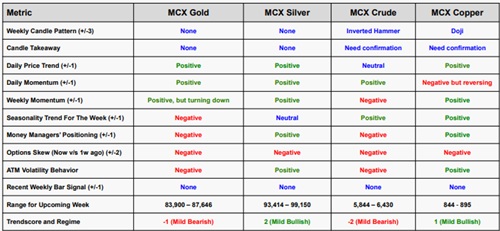

Summary View For The Week

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)