Gold is expected to hold the support near $2925 and move higher towards $2975 amid tariff concerns - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Gold is expected to hold the support near $2925 and move higher towards $2975 amid tariff concerns. In a latest measure the Trump administration launched new trade and investment measures against China, which could increase safe haven demand. Further, increasing ETF holdings indicates rise in investor interest which could support prices to trade higher. Meanwhile, focus will remain on key economic numbers from US, which could bring further volatility in price.

* Gold price is likely to hold the key support of 10 day EMA at $2925 and move towards $2975. Unwinding of OI at ATM calls indicates an upward movement. MCX Gold April is expected to hold the support Rs.85,600 and move towards Rs.86,500 level. A move above Rs.86,500, would open the doors towards Rs.87,000.

* Spot silver, is expected hold the support near 20 day EMA at $32 mark and rebound towards $33.00. MCX Silver March is expected to rise towards Rs.96,500, as long as it holds above Rs.94,500.

Base Metal Outlook

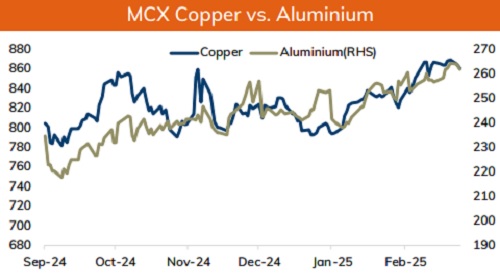

* Copper prices are expected to remain under pressure amid resurgence of tariff threats on China. Further, ample stocks in China would also reduce supply concerns. Negative treatment charges indicates larger extent of overcapacity in refined production. Meanwhile, focus will remain on any key economic numbers and any stimulus measure from China.

* MCX Copper March is expected to face the hurdle near Rs.870 and move lower towards Rs.858.

* MCX Aluminum March is expected to face the hurdle near Rs.264 level and move lower towards Rs.260 level. Weaker than expected economic numbers from US and a strong dollar would weigh on prices. Meanwhile, sanction on Russian imports by European nation would limit its downside. MCX Zinc March is likely to slip towards Rs.268, as long as it stays under Rs.272.

Energy Outlook

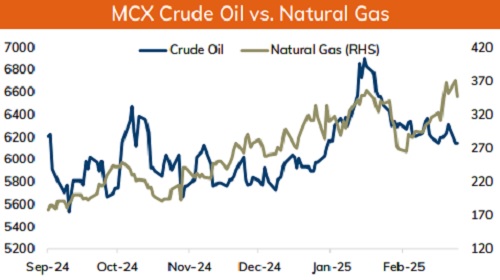

* NYMEX Crude oil is likely to face the hurdle near $72 and move lower towards $69 amid easing risk premiums and hopes of supply improvement from Iraq. Meanwhile, focus will remain on OPEC+’s decision on April output rise. A further delay in output rise beyond April would provide some support to oil prices. Again, new US sanctions on Iran would also limit its downside. Moreover, investor will eye on the Russia-Ukraine peace deal and tariff measures from US.

* On the data front, addition of OI has been observed in ATM and OTM call strike, which suggests stiff resistance near $72. On the downside $70 would act as immediate support. A move below $70 would weaken it further towards $69. MCX Crude oil March is likely to face stiff resistance near Rs.6250 and move lower towards Rs.6000. A move below Rs.6000 would open the doors towards Rs.5900.

* MCX Natural gas March is expected to move lower towards Rs.335, as long as it trades under Rs.358.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631