EcoFlash - RBI MPC October 2025: Policy repo rate held at 5.50% amid stable inflation and robust growth by Shalini Shirsat, Economist, PL Capital

The RBI’s decision to maintain the policy repo rate at 5.50% while retaining a neutral stance strikes a careful balance between supporting sustained domestic growth and managing emerging external risks. This pause underlines RBI’s confidence in the inflation trajectory, which has moderated significantly due to food price corrections and GST rationalisation, allowing policy space to remain accommodative. However, the sustained inflation projection above 4% in the latter part of FY26 and early FY27 suggests that the RBI remains cautious about premature monetary easing. The upward revision in GDP forecasts reflects resilient consumption and investment momentum, but ongoing global uncertainties, including tariff-related trade barriers, continue to cloud the outlook. The RBI’s data-dependent approach, with room for a modest rate cut only if conditions improve, appropriately balances growth support with prudence against upside inflation risks and external volatility, a stance that is likely to foster macroeconomic stability amid evolving complexities.

Key Insights:

* The Monetary Policy Committee (MPC) unanimously decided to keep the policy repo rate unchanged at 5.50%, retaining the neutral stance. This pause reflects the RBI’s recognition of sharply moderated inflation and sustained domestic growth, while remaining cautious amid rising external uncertainties.

* Growth Outlook: India’s economic momentum remains robust, with Q1 FY26 GDP growth at 7.8%, supported by strong consumption, government expenditure, and investment activities. Favorable monsoon conditions, healthy kharif sowing progress, and elevated capacity utilization underpin rural demand and fixed investment. Services and manufacturing PMI indices reflect strong business confidence. Despite domestic resilience, external sector headwinds from trade tensions and tariff uncertainties temper the near-term outlook. The MPC revised FY26 real GDP growth projection upwards to 6.8% with Q2 at 7%, Q3 at 6.4%, and Q4 at 6.2%. Real GDP growth for Q1 FY27 is projected at 6.4%.

Exhibit 1: RBI Revises FY26 GDP Growth Upward to 6.8%

Source: RBI, PL

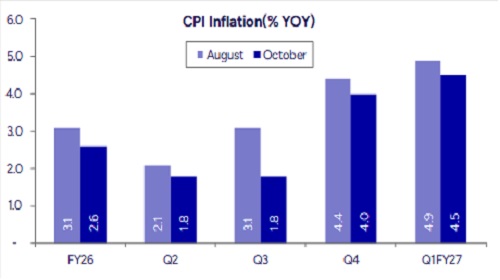

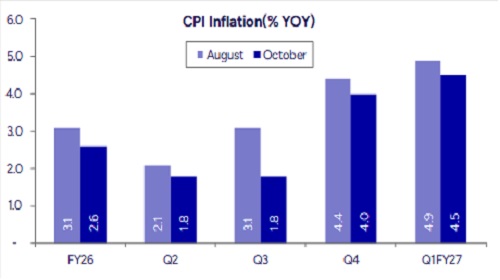

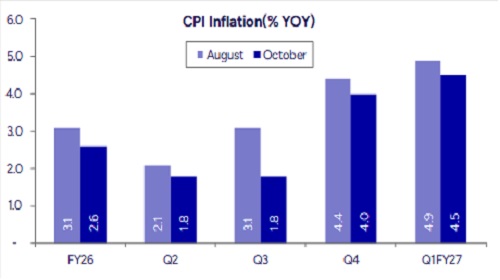

* Inflation Dynamics: Headline inflation has moderated significantly to 2.6% for FY26, well below previous projections, primarily aided by a sharp decline in food prices and GST rate rationalization. Core inflation remains contained, with moderate upward risks from commodity price pressures. The RBI expects inflation to stay aligned with CPI inflation for 2025-26 is now projected at 2.6% with Q2 & Q3 at 1.8% and Q4 at 4.0%. CPI inflation for Q1FY27 is projected at 4.5%, showing a slight uptick in Q4 FY26 and Q1 FY27 due to base effects and seasonal factors. Downside inflation risks from supply improvements are balanced by uncertainties from weather and global commodity markets.

Exhibit 2: RBI Lowers FY26 Inflation Forecast to 2.6%

Source: RBI, PL

Liquidity and Financial Conditions: System liquidity remains in comfortable surplus, aided by staggered CRR cuts and active liquidity management measures. Monetary transmission has strengthened, evidenced by broad-based softening in lending and deposit rates across sectors. Scheduled Commercial Banks and NBFCs maintain robust capitalization and improved asset quality. Bank credit growth is steady, supplemented by rising non-bank financial flows, supporting economic activity.

Regulatory and Structural Announcements

* The RBI Governor outlined several regulatory measures aimed at strengthening compliance, improving credit flow, managing foreign exchange, enhancing customer protection, and developing financial markets.

* The Expected Credit Loss (ECL) framework is slated to come into effect from 1 April 2027. This timeline provides banks sufficient time to transition smoothly, with a glide path available until 31 March 2031 to mitigate its impact on their balance sheets.

* Revised BASEL III norms, particularly those concerning credit risk and capital requirements, will also be implemented from 1 April 2027.

* Banks may benefit from lower deposit insurance premiums as RBI plans to adopt a risk-based structure. Under this system, financially sound banks would pay reduced premiums, replacing the current flat-rate model.

* The RBI has removed guidelines that previously capped credit supply to large borrowers via market mechanisms. This change is expected to encourage banks to increase lending to large corporates by eliminating exposure limits at individual banks.

* Banks will be allowed to extend INR-denominated loans to residents in Nepal, Bhutan, and Sri Lanka, promoting the use of the rupee in cross-border transactions and expanding banks’ overseas business.

* Banks will be given enhanced flexibility in managing current accounts, cash credit accounts, and overdraft accounts, which could expand their business opportunities.

* Banks will be required to offer digital services for Basic Savings Bank Deposit (BSBD) accounts, aiming to improve customer convenience.

* Several measures have been introduced for the operation of foreign currency accounts, facilitating easier access for exporters.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271