Debt & Forex Market Update - November 2025 by Careedge ratings

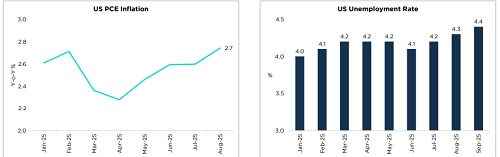

December Fed Rate Cut Expected

* US PCE inflation rose marginally to 2.7% in September, up from 2.6% in the previous month and has been on an uptrend from the low of 2.3% in April.

* Retail sales grew by 0.2% MoM in September, a four-month low, from a high of 1% in June, indicating cooling consumer demand.

* We expect the Fed to cut its policy rate by 25bps in December, amidst a sharp fall in the consumer confidence index, rising concerns about the weak labour market and dovish commentary by Fed members

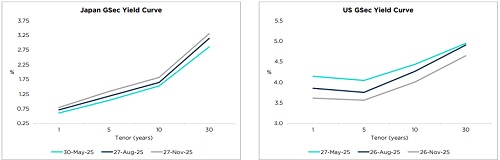

Yields Rise in Japan but Moderate in the US

* While yields have risen across tenors in Japan, it has reduced in the US in the past six months.

* Expectations of rate hike by BoJ and fiscal expansion in Japan has resulted in higher yields across tenors.

* However, expectations of rate cut in the US led to moderation of yields across tenors.

* Higher yields in Japan can impact fund inflows via carry trade. However, lower US yields can cushion its impact.

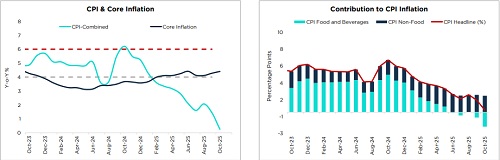

India’s CPI Inflation Eased to an All-Time Low

* CPI inflation eased to an all-time low of 0.3% in October, aided by the positive impact of the GST rationalisation and deflation in the food and beverages category.

* Core CPI rose to 4.4% amid double-digit inflation seen in precious metals. Excluding precious metals, core CPI inflation was benign at 2.5%.

* With food inflation subdued, we project an average inflation rate of 2.1% for FY26.

* From a monetary policy perspective, moderating inflation provides the RBI with more room to support growth amid external headwinds and uncertainty around the US trade talks. We expect a 25bps rate cut in December

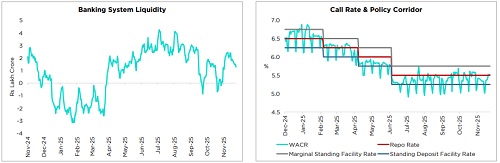

Liquidity Remains Comfortable

* Banking system liquidity stood at an average of Rs 1.9 lakh crore in November (up to 24 November). However, liquidity surplus narrowed recently due to tax outflows.

* The WACR averaged 12bps below the policy rate over the past month, reflecting comfortable liquidity conditions.

* As of mid-November, RBI has undertaken OMO purchases worth Rs 0.27 lakh crore.

* Near-term liquidity is expected to be supported by the final tranche of CRR cut, OMO purchases and expected uptick in government spending

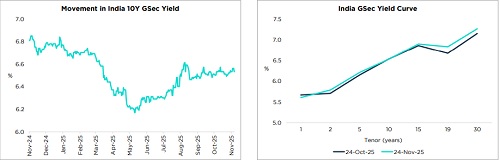

10Y Gsec Yield Remains Stable

* India’s 10Y G-sec yield was largely flat over the past month.

* The yield curve steepened as yields for higher tenors increased.

* Positive sentiment around the possible inclusion of Indian bonds in the Bloomberg Global Aggregate Index and expectations of a December rate cut amidst an all-time low inflation supported yields.

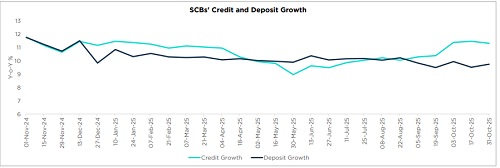

Bank Credit Growth Remains Faster Than Deposit Growth

* Both credit and deposit growth have seen a recent uptick

* Credit growth stood at 11.3% YoY as of 31 October, down from 11.8% in the corresponding period last year, while deposit growth moderated to 9.7% YoY (Vs 11.8%)

Above views are of the author and not of the website kindly read disclaimer