Daily Derivative Report - 03rd February, 2026 by Religare Broking Ltd

Market Outlook

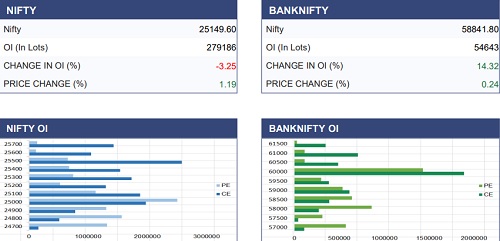

The Nifty index witnessed a relief rally, gaining 1.06% after the budget-driven decline in the previous session. However, the index continues to trade below its key long-term moving average, the 200-DEMA, indicating sustained weakness in market sentiment. On the derivatives front, next week’s expiry data shows significant call writing at the 25,200 and 25,500 strikes, highlighting immediate and strong upside hurdles, respectively. On the downside, the 24,600 level has emerged as a crucial support zone. On the daily chart, failure to sustain above the 25,150 zone may intensify selling pressure and could lead to a resumption of the downward trend.

Please refer disclaimer at https://www.religareonline.com/disclaimer

SEBI Registration number is INZ00017433

.jpg)