Daily Derivatives Report 25 June 2025 by Axis Securities Ltd

The Day That Was:

Nifty Futures: 25,071.7 (0.3%), Bank Nifty Futures: 56,500.8 (0.7%).

Nifty futures and Bank Nifty futures opened with a significant gap-up, with Nifty futures reaching their highest levels since early October, fuelled by positive global cues. This initial market optimism stemmed from US President Donald Trump's announcement of a tentative ceasefire between Israel and Iran, a development that subsequently triggered a global relief rally, including within Indian markets. The perceived de-escalation of geopolitical tensions in the Middle East encouraged investors to embrace greater risk exposure, thereby driving buying activity in equities. However, both benchmark indices pared all early gains after Israel reportedly ordered military action against Tehran, citing Iran's violation of the ceasefire following 12 days of conflict. Despite surrendering initial advances, the Nifty ultimately concluded the session in positive territory, gaining 78 points, while Bank Nifty futures advanced 403 points. The India VIX, a key measure of market volatility, concluded the session at 13.64, representing a 2.9% decrease from its prior close of 14.05. Concurrently, the rupee experienced a substantial recovery from its record low, appreciating by 75 paise to close at 86.03 against the U.S. dollar, primarily bolstered by the dip in global crude oil prices amid hopes of de-escalation in West Asian tensions. Further reflecting market dynamics, the Nifty futures premium expanded to 27 points from 21 points, and the Bank Nifty premium increased to 39 points from 38 points.

Global Movers:

US stocks rose, with the Nasdaq surging to a record high as Middle East tensions de-escalated and the Fed Chair opened the door for more cuts if inflation eased further. The Nasdaq 100 gained 1.5%, closing at its first all-time high since Feb. 19, while the S&P 500 climbed 1.1%, ending at less than a percent away from its own record. According to flows data, investors added to longs and covered their shorts last week as risk-on became the dominant theme after it became clear that Iran would not shut the Strait of Hormuz. Coming to related markets, the VIX fell nearly 12%, both the dollar index and the 10-year yield fell for the third day, gold slipped 1.3% and fell below $3300 briefly before recovering at the close somewhat while brent crude fell another 6% and finished the session at $64.37 as President Trump reiterated that the ceasefire will be honored by both Iran and Israel.

Stock Futures:

Yesterday’s trading saw significant price swings and high volumes in Titagarh Rail Systems, Delhivery, KPIT Technologies, and Oil India, signalling rising investor optimism and potential sector momentum shifts.

Titagarh Rail Systems (TRSL) has demonstrated sustained upward momentum, registering its third consecutive session of gains on the back of substantial trading volumes. This positive sentiment largely stems from the company's strategic diversification into passenger transport and driverless train technologies, coupled with robust analyst endorsements, with a prevailing "Buy" consensus. Despite recent underperformance in quarterly earnings attributed to wheelset supply constraints, TRSL's market positioning within the expanding railway sector remains a key driver of investor confidence. Derivative market activity reinforces this bullish outlook. The stock witnessed significant long accumulation, evidenced by a 5.5% price appreciation alongside a substantial 25.6% increase in open interest (OI). Current futures OI stands at 10,968 contracts, reflecting a fresh inflow of 2,236 contracts, equivalent to 14 Lc shares added to open interest. In the options segment, call option OI totals 8,915 contracts, significantly outpacing put option OI at 4,835 contracts, yielding a put-call ratio (PCR) of 0.54. This skew towards calls is further highlighted by the addition of 2,284 call option contracts versus 1,012 put option contracts. The low PCR, coupled with the notable increase in call options and futures open interest, underscores prevailing bullish sentiment and anticipates further price appreciation for Titagarh Rail Systems.

Delhivery has demonstrated robust performance, extending its gains for the third consecutive session to achieve a current month's highest close. This upsurge is primarily fueled by the unveiling of its new on-demand shipping service, "Delhivery Direct," coupled with proactive expansion initiatives and overwhelmingly positive analyst sentiment, largely endorsing "Buy" ratings. The market's increasing confidence in Delhivery's capacity to capitalize on the logistics sector's ongoing consolidation has overridden earlier concerns regarding Meesho's internalising its logistics operations. From a derivatives perspective, Delhivery exhibits clear signs of long buildup. The stock's 4.6% price appreciation is corroborated by a 6.5% increase in futures open interest (OI). The current futures OI stands at 9,715 contracts, reflecting a fresh injection of 589 new contracts, equivalent to 9 Lc shares in open interest. In the options market, call option OI amounts to 4,920 contracts, exceeding put option OI of 3,496 contracts. While there was an addition of 652 call option contracts, the put option contracts also saw an increase of 712. This particular options activity, despite the higher call OI, indicates a nuanced sentiment where put writers may be adding positions at lower strikes or short-term puts are being bought for hedging, even as overall market participants maintain a bullish bias on the stock's future trajectory given the concurrent futures accumulation.

KPIT Technologies concluded trading at a month's low, experiencing its largest single-day percentage price decline in the past two months. This downturn is primarily attributed to a mid-quarter business update revealing an uncertain operating environment, exacerbated by escalating geopolitical tensions and ambiguities surrounding global tariff structures. While the company maintains a robust deal pipeline, the conversion rate of these deals has decelerated, and the pace of new project wins has slowed, with some new engagements even cannibalising existing revenues due to constrained client budgets. Derivative market dynamics reflect this bearish sentiment. KPIT Technologies witnessed significant short accumulation, characterised by a 6.8% price erosion and a substantial 38.6% surge in open interest (OI). The current futures OI has escalated to 12,396 contracts, marking the highest level across the last three series, with a notable addition of 3,454 new contracts, translating to 13.8 Lc shares in open interest – the largest single-day addition in the current series. In the options segment, the put-call ratio (PCR) stands at 0.44, indicating a preponderance of put options. Call option OI is at 11,511 contracts, and put option OI is at 5,040 contracts, both reaching their highest levels in the series. The concurrent addition of 5,849 call options and 2,230 put options, alongside a low PCR and significant futures OI build-up, signals a strong bearish bias and anticipates further price downside, as traders are aggressively building short positions.

Oil India (OIL) experienced a significant downturn, closing below its previous week's low and recording its steepest single-day decline this month, accompanied by elevated trading volumes. This precipitous drop is a direct consequence of the global plunge in crude oil prices, following US President Donald Trump's announcement of a ceasefire between Israel and Iran, effectively concluding the "12-day war" in the early hours of Tuesday, June 24. Brent crude prices, which had tested $81 per barrel on Monday, tanked over 15%, settling below $70 per barrel. In the derivatives market, OIL registered considerable short accumulation, evidenced by a 5.6% price depreciation and a massive 34% expansion in open interest (OI). The current futures OI stands at 19,489 contracts, marking the highest level in the past year, with a record single-day addition of 4,948 contracts, equivalent to 53 Lc shares in open interest for the year. Concurrently, call option OI reached a yearly high of 12,353 contracts, significantly exceeding put option OI at 5,942 contracts. While there was an increase of 1,554 contracts in call options, put options also saw an addition of 357 contracts. The substantial increase in futures open interest alongside a price decline clearly signals aggressive short positioning, reflecting market participants' bearish conviction on OIL's price trajectory, driven by the adverse impact of falling global crude oil prices.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) fell to 0.85 from 1.04 points, while the Bank Nifty PCR rose from 0.91 to 0.92 points.

Implied Volatility:

Astral Ltd and Power Grid experience significant stock price swings, as shown by their high implied volatility (IV) scores of 79 and 66. Currently, Astral's IV is at 31%, and Power Grid's is at 23%. This increase in IV has raised option premiums, encouraging traders to adjust their risk management strategies to handle market shifts more effectively. In contrast, PFC and Hind Zinc are more stable, holding the lowest IV rankings in their group. PFC IV is relatively low at 31%, and Hind Zinc's is at 28%. Their consistent volatility makes them appealing to investors looking to take long positions amid rising uncertainty and fluctuating market prices.

Options volume and Open Interest highlights:

RVNL and Kaynes Technology are showing strong bullish signals, with high call-to-put volume ratios of 6:1 and 5:1 respectively. This suggests traders are optimistic about short-term price increases. However, such skewed ratios could also indicate overvaluation in the options market, so caution is advised for those considering new long positions. On the other hand, MCX and IndusInd Bank display a more cautious approach, with higher put-to-call ratios and increased put activity, signalling investor concerns about potential downside risk. While this may reflect genuine bearish sentiment, the rise in put volumes could also point to oversold conditions, offering contrarian trading opportunities for those expecting a reversal. Regarding positioning, Oil Ltd shows significant open interest on the call side, followed by Glenmark Pharmaceuticals, indicating expectations of price movement. Similarly, Bharat Dynamics has concentrated open interest on the put side, along with L&T Finance, which could serve as key resistance or support levels. These patterns suggest potential for sharp market moves, supporting volatility-focused strategies. (This data considers only those stock options that saw a minimum of 500 contracts traded on the day for both calls and puts.)

Participant-wise Open Interest Net Activity:

In the Index futures segment, Client activity indicated a moderately bullish stance, increasing their long positions by a net 3,798 contracts. Conversely, Foreign Institutional Investors (FIIs) significantly reduced their exposure, decreasing a substantial 6,764 contracts, suggesting a cautious to bearish outlook from this key participant group. Proprietary traders, often reflective of short-term directional plays, added 884 contracts, aligning with a marginally positive bias. The aggregate picture in index futures, particularly the substantial FII reduction, suggests a prevailing cautious sentiment despite client accumulation. In Stock futures, Retail clients demonstrably trimmed their bullish bets, decreasing their positions by a significant 7,415 contracts, potentially indicating profit-taking or a shift towards caution in individual equities. In stark contrast, FIIs demonstrated a strong conviction towards specific stocks, substantially increasing their long positions by 18,948 contracts. This aggressive accumulation by FIIs in stock futures points to targeted bullishness despite overall market reservations. Proprietary traders, meanwhile, significantly reduced their stock futures exposure by a substantial 30,268 contracts, which could reflect profit-taking, a move to a more neutral stance, or a bearish outlook on individual stock volatility.

Nifty

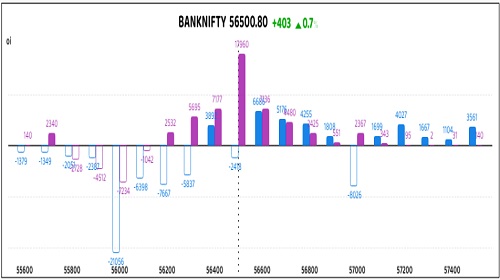

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Nifty Open Interest Put Call ratio rose to 0.95 levels from 0.75 levels - HDFC Securities Ltd