Daily Derivatives Report 08th December 2025 by Axis Securities Ltd

The Day That Was:

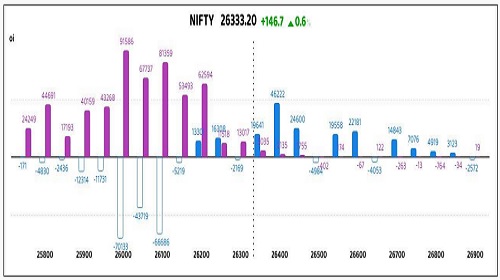

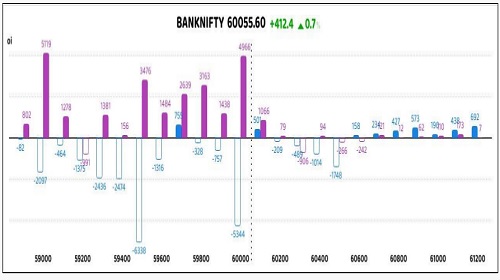

Nifty Futures: 26,333.2 (0.6%), Bank Nifty Futures: 60,055.6 (0.7%).

Nifty Futures and Bank Nifty Futures, after an initial dip, ended with significant gains reflecting persistent buying interest that drove a decisive rally toward the session's high. This upward momentum was initially triggered by a major domestic catalyst: the RBI's decision to cut the repo rate by 25 basis points to 5.25% and announce measures to enhance liquidity, immediately boosting rate-sensitive sectors like banking and finance. Further strengthening the market rally, the RBI raised its real GDP growth forecast for FY26 to 7.3% from 6.8% earlier, while concurrently lowering the CPI inflation forecast for FY26 to 2% from 2.6%. Market sentiment gathered additional positive momentum from the India-Russia Annual Summit, which reaffirmed the "Special and Privileged Strategic Partnership" and included an agreement to accelerate negotiations for an FTA between India and the EAEU. Reflecting this positive action, Nifty Futures rose 146.7 points with a decrease in open interest, which dropped by 3.13 lakh shares (or -1.9%) to 161.36 lakh; this indicated Short Covering. Similarly, Bank Nifty Futures rose 412.4 points with an open interest decrease of 1.41 lakh shares (or -7.7%) to 16.80 lakh, also indicating Short Covering. The Nifty futures premium consequently decreased to 147 points from 153, and the Bank Nifty premium dropped from 355 to 278 points. Sector-wise, PSU Bank, IT, and private bank shares advanced, while media, consumer durables, and pharma shares declined. India VIX, the gauge of expected volatility, fell sharply by 4.64% to 10.32, signalling a receding fear factor and strengthening the overall bullish sentiment. While, the rupee (INR) showed depreciation against the US Dollar (USD), closing near ?89.96 following the RBI's 25 bps rate cut and the announced liquidity measures worth Rs 1 lakh crore.

Global Movers:

US equity markets finished the week with strong positive momentum on Friday, closing higher and near record levels as investors reacted favourably to tame PCE inflation data, which solidified expectations for an eventual Federal Reserve rate cut. The Dow Jones Industrial Average advanced to close at 47,954.99 (up 104 points), while the S&P 500 Index rose slightly to finish at 6,870.40, and the tech-focused Nasdaq Composite closed up at 23,578.13 a rise of 73 points. Investor confidence remains strongly influenced by high expectations for an imminent Federal Reserve rate cut at the next FOMC meeting, especially after the latest core Personal Consumption Expenditures (PCE) price index showed an annual rise of 2.8%, below forecasts. Reflecting the mixed signals and anticipatory pause before the Fed's decision, the yield on the benchmark 10-year U.S. Treasury note saw a modest increase, last trading near 4.14%. In the commodity space, precious metals were strongly buoyed by future monetary easing prospects, with Gold futures rallying near 4,230 per ounce and Silver surging to close near 58.30 per ounce, while WTI Crude Oil futures climbed to around 60.1 per barrel, maintaining underlying support from geopolitical risks and ongoing supply constraints.

Stock Futures:

Patanjali Foods Ltd. rebounded sharply from its recent 52-week low, recouping losses after a three-day slide as investors accumulated at lower levels, aided by sector tailwinds in FMCG and edible oils and improved liquidity from the 2:1 bonus issue. The stock gained 4.1% with short covering, while futures open interest slipped 0.4% to 35,890 contracts, shedding 153. The put-call ratio (PCR) edged up to 0.58 from 0.57, with call OI rising to 6,218 contracts and put OI to 3,597, additions of 571 and 375 respectively. The derivatives setup signals cautious optimism, with call buyers pressing positions while put writers show resilience, reflecting accumulation bias near support levels.

SBI Cards and Payment Services Ltd. surged to a two-month high, reversing the prior day’s decline as the RBI’s surprise 25 bps repo rate cut ignited bullish sentiment across NBFCs and rate-sensitive financials. The stock advanced 3.3% with long additions, futures OI climbing 0.9% to 19,580 contracts on 167 new positions. PCR improved to 0.70 from 0.67, with call OI at 7,335 and put OI at 5,110, additions of 155 and 265 respectively. The build-up reflects balanced optimism, with call buyers extending exposure and put writers absorbing risk, underscoring confidence in sustained momentum.

Kaynes Technology India Ltd. tumbled 12.5% in a steep sell-off, extending a 25% slide this series and nearing its 52-week low after a domestic institution flagged inconsistencies in FY2025 disclosures, sparking panic despite management clarifications. Futures OI surged 42.1% to 43,956 contracts with 13,022 new positions, indicating aggressive short additions. PCR fell to 0.41 from 0.49, with call OI swelling to 67,322 and put OI to 27,298, additions of 21,335 and 4,674 respectively. The derivatives structure highlights bearish conviction, with call writers dominating and put buyers hedging, reinforcing pressure on the downside.

PG Electroplast Ltd. extended its correction, sliding 4.6% and deepening a 50% drop from its 52-week high after analysts flagged leverage and cash flow concerns. Futures OI eased 0.5% to 15,712 contracts with unwinding of 73 positions, while PCR slipped to 0.62 from 0.65. Call OI rose to 11,212 and put OI to 6,924, additions of 2,663 and 1,378 respectively. Futures closed at a 4.55-point premium to spot, down from 6.75, reflecting weakening sentiment. The positioning suggests call buyers remain active while put writers retreat, pointing to fragile sentiment and limited conviction in recovery.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) rose to 1.22 from 0.93 points, while the Bank Nifty PCR rose from 0.94 to 1.08 points.

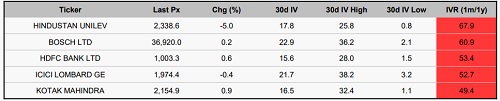

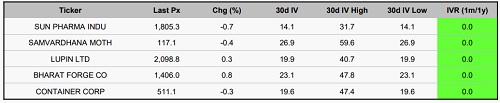

Implied Volatility:

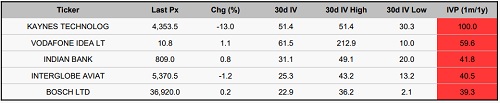

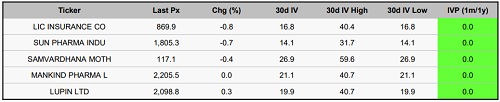

Hindustan Unilever (HINDUNILVR) and BOSCH Ltd, are commanding a substantial premium in their options pricing, which is reflected in their high Implied Volatility Rankings (IVR) of 68% and 61%, respectively. These elevated implied volatility for these two companies significantly exceeds their recent actual price fluctuations (realized volatility). HindUnilvr has recently experienced a realized volatility of 18%, and BOSCH Ltd's stands at 23% which suggests that traders in the options market are pricing in a significant future increase in price swings that will be much larger than what the stocks have demonstrated in the recent past. The market sentiment is anticipating heightened instability for these stocks. Conversely, at the lower end of the volatility scale within the Futures and Options (F&O) segment are Sun Pharma and Samvardhana Motherson, which have the lowest IVR. Given their current realized implied volatilities are 14% and 27%, respectively, the options contracts for these two stocks are perceived as being undervalued or trading at a discount relative to their typical, long-term historical volatility levels.

Options volume and Open Interest highlights:

RVNL and Prestige are exhibiting a strong short-term bullish surge, highlighted by an extremely high 5:1 Call-to-Put Volume Ratio in both; however, this intense concentration of Call buying suggests the rally may be nearing its immediate peak as buying interest could soon be exhausted or profit-taking will commence. Conversely, Interglobe Aviation Ltd and Kaynes Technology face bearish pressure, evidenced by increasing Put option volumes and a large Open Interest (OI) build up at lower strike prices acting as a price cap, though their overall volume ratios remain neutral, allowing for a small potential counter-trend reversal. Crucially, both Interglobe Aviation Ltd and Kaynes Technology, along with JSW Steel (Call side) and TMPV (Put side), are positioned in a major volatile phase, characterized by a significant, dual-sided accumulation of Call and Put OI near their 52-week highs, strongly indicating that a sharp, sudden directional price movement is being "coiled up," with the ultimate trigger being the subsequent liquidation of these massed options contracts. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

Index Futures saw a net change of 10,200 contracts, exposing divergent risk appetites. Retail clients dramatically curtailed their exposure, shedding a significant 5,176 contracts, suggesting a risk-off or bearish posture. Conversely, Foreign Institutional Investors (FIIs) took a mildly constructive position, augmenting contracts by 1,228. Proprietary desks, often swift short-term movers, heavily liquidated 5,024 contracts, aligning with the large client reduction, which contributed to a broadly cautious or neutral-to-bearish market tone in the index segment. Stock Futures, conversely, revealed a more decisive direction, with 20,080 contracts changing hands. Here, clients were marginally constructive, adding 1,379 contracts. However, the overwhelming directional conviction was supplied by FIIs, who aggressively added 18,701 contracts, indicating a strong bullish belief in underlying stocks. Proprietary traders decreased 2,273 contracts, likely taking profits or hedging. This contrasting activity underscores that FIIs are aggressively pursuing stock-specific opportunity despite a more reserved approach in the broader index.

Nifty

BankNifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633