Nifty immediate support is at 22400 then 22250 zones while resistance at 22700 then 22900 zones - Motilal Oswal Wealth Management

Morning Market Outlook

* The market is expected to open on a positive note due to a smart recovery in the US market after it bounced back from its intra-day low, following dovish comments by the US Federal Reserve, which fuelled hopes of an interest rate cut.

* The Dow Jones Index gained over half a percent, recovering nearly 2% from its intra-day low. Weaker US payroll and employment data improved sentiment around a potential rate cut by the US Fed.

* Asian markets are showing a mixed performance. Market participants are also awaiting inflation data from the US, Europe, and India this week, which will be key factors in determining interest rate decisions by the US Fed and RBI.

* The Gift Nifty is down by 0.2%. Focus is expected to remain on PSU banks, Rice exporters, Auto, Rail, and Energy stocks.

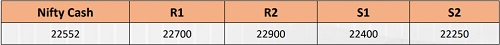

NIFTY (CMP : 22552) :

Nifty immediate support is at 22400 then 22250 zones while resistance at 22700 then 22900 zones. Now it has to hold above 22450 zones for an up move towards 22700 then 22900 zones while supports have shifted higher to 22400 then 22250 zones.

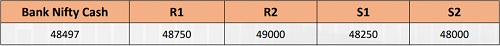

BANK NIFTY (CMP : 48497) :

Bank Nifty support is at 48250 then 48000 zones while resistance at 48750 then 49000 zones. Now it has to hold above 48500 zones for a bounce towards 48750 then 49000 levels while on the downside support is seen at 48250 then 48000 zones.

Derivative Outlook

* Nifty March future closed at 22,649.95 with a premium of 97.45 point v/s 76.25 point premium in the last session.

* Nifty Put/Call Ratio (OI) decreased from 1.14 to 1.08 level.

* India VIX decreased by 1.86% to 13.47 level.

* On option front, Maximum Call OI is at 23000 then 22800 strike while Maximum Put OI is at 21500 then 22000 strike. Call writing is seen at 22800 then 23100 strike while Put writing is seen at 22600 then 22500 strike. Option data suggests a broader trading range in between 22000 to 23000 zones while an immediate range between 22300 to 22700 levels.

* Option Buying : Buy weekly Nifty 22650 Call if it holds above 22450 zones. Buy Bank Nifty 49500 Call if it holds above 48500 zones.

* Option Strategy : Nifty weekly Bull Call Spread (Buy 22650 CE and Sell 22850 CE) at net premium cost of 60-65 points. Bank Nifty Bull Call Spread (Buy 49000 CE and Sell 49500 CE) at net premium cost of 170-180 points.

* Option Writing : Sell weekly Nifty 21900 PE and 23050 CE with strict double SL. Sell Bank Nifty 46000 PE and 51000 CE with strict double SL.

Fundamental Outlook

Global Market Summary:

* US Markets gained 0.5-1%, after Federal Reserve Chair Jerome Powell said the economy was "in a good place," but uncertainty about U.S. trade policy lingers.

* Dow Futures is currently down -0.3%, after the US President Trump is 'strongly considering' large-scale sanctions and tariffs on Russia until a ceasefire and peace agreement with Ukraine is achieved.

* Asian markets are mostly trading ~0.5% lower.

* Global Cues: Negative

Indian Market Summary:

* There was some relief on the US tariff front as President Donald Trump postponed the 25% tariffs on most goods from Canada and Mexico. The temporary suspension is till April 2nd, when the US has threatened to impose a global regime of reciprocal tariffs on all trading partners.

* Broader market traded mixed with Nifty Midcap100 down 0.3%, while Smallcap100 was up by 0.7%.

* FIIs: -Rs2,035 crore DIIs: +Rs2,320 crore. GIFT Nifty is trading lower by 47 points (-0.2%).

* Domestic Cues: Weak

News and Impact :

* IndusInd Bank: The RBI has approved the reappointment of Mr. Sumant Kathpalia as MD & CEO of the bank for a one-year term, effective 24th Mar’25, following the conclusion of his current term. This marks the second instance when the MD’s term extension has been shorter than the board’s proposal. Impact: Negative

* JSW Steel: The company reported consolidated crude steel production for February 2025 at 24.07 lakh tonnes, growing 12% over 21.50 lakh tonnes in the same month last year. Capacity utilization at Indian operations stood at 93.5% for February. Impact: Positive

Bharti Hexacom : CMP INR1328, TP INR1625, 22% Upside, Buy

* Bharti Hexacom, the licensed operator of wireless and fixed-line services under the Airtel brand in Rajasthan and North East circles, provides pure-play exposure to the two high-growth businesses of Airtel – India wireless and Home broadband.

* Given lower teledensity and lower internet penetration in Hexacom circles (vs. pan-India), we believe Hexacom can potentially grow a few percentage points faster than Airtel on both subscribers and ARPU.

* Further, with significantly lower penetration of fixed broadband in Hexacom’s circles and the recent ramp-up of Fixed Wireless Access (FWA) offerings, we believe Hexacom’s wired broadband business could also grow at a faster clip.

* We initiate coverage on Hexacom with a BUY rating and a TP of INR1,625, premised on 13x FY27E EV/EBITDA (on par with our Airtel’s India wireless multiple). Our preference for Hexacom over Airtel is largely driven by lower capital misallocation concerns.

View: Buy

Lupin : CMP Rs2029

* Lupin has launched Rivaroxaban tablets in the United States after final approval of its ANDA from the US FDA. The drug is bioequivalent to Xarelto tablets by Janssen Pharmaceuticals.

* It is used to reduce the risk of major cardiovascular events in patients with coronary artery disease and thrombotic vascular events in patients with peripheral artery disease.

* We like Lupin given: 1) the benefits from the PLI scheme, 2) a robust ANDA pipeline for the US market, and 3) an enhanced reach for prescription, trade generics as well as diagnostic businesses in the India market.

View: Positive

What is this?

Based on technical indicators this strategy gives 2 stocks that have a high likelihood to fall during the day (from open to close). This is an intraday Sell strategy which can provide a good cushioning during a black swan event.

What are the rules?

* Stock names will be given at market open (9:15 am)

* Recommended time to entry: between 9:15 to 9:30 am.

* Entry: We short 2 stocks daily (intraday)

* Exit: we will exit at 3:15 as this is an intraday call

* SL: is placed at 1% of the open.

* Book profit: At 1% fall since open.

* In special situations the book profit might be delayed if the stock is in free fall.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Quote on Market Wrap 18th September 2025 by Shrikant Chouhan, Head Equity Research, Kotak Se...