Daily Derivatives Report 21 May 2025 by Axis Securities Ltd

The Day That Was:

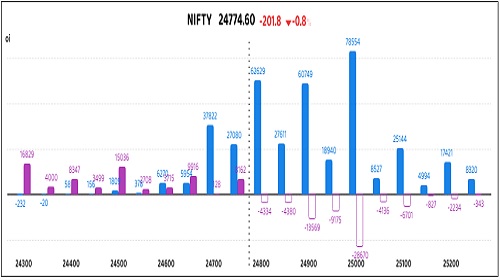

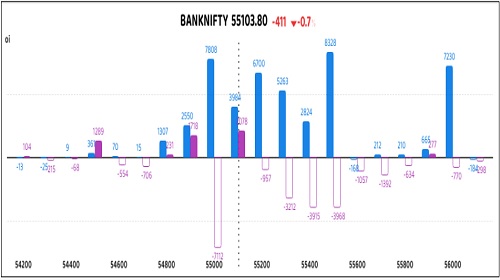

Nifty Futures: 24,774.6 (-0.8%), Bank Nifty Futures: 55,103.8 (-0.7%).

Nifty Futures and Bank Nifty Futures fell 202 and 411 points, respectively, indicating broad profit-booking despite supportive global cues. Market participants remained cautious, focusing on the nascent Q4 earnings season, which is expected to guide future sentiment. Benchmark indices recorded their third consecutive loss after a brief rebound due to the India-Pakistan ceasefire agreement post-Operation “Sindoor”. All sectoral indices closed negatively, led by the auto, media, and FMCG sectors. The grim market sentiment worsened after Moody's downgraded the US credit rating and US Treasury Secretary Scott Bessent warned about potential tariffs. Indian benchmark indices dropped due to selling pressure from Foreign Institutional Investors (FIIs) on major financial and IT stocks. Diminished foreign inflows and rising Covid-19 cases in Asia and, to some extent, in India are contributing to cautious market sentiment, but the impact of this is most likely to be minimal. India VIX, a measure of near-term market volatility, rose 0.17% to 17.39. Meanwhile, the Indian Rupee (INR) opened at 85.47 against the US Dollar (USD), fluctuating between a high of 85.39 and a low of 85.65, finally settling at 85.63. This 21-paise depreciation mirrored the weakness in domestic equity markets and a notable rise in US Treasury yields. A surge in futures premiums was noted, with Nifty Futures premium increasing from 31 to 91 points and Bank Nifty Futures premium rising from 94 to 226 points.

Global Movers:

US stocks paused for breath yesterday as investors took profits after a six-day advance. The S&P 500 and the Nasdaq fell 0.4% each. The former has jumped nearly 20% from its early April lows, adding $8.6T during this time and turning the most overbought in six months. Big tech stocks led the decline, but overall sentiment so far in May has been surprisingly positive, as tariff-related fears have all but disappeared. Talking markets, the VIX and the dollar fell 0.3%, the 10-year yield traded near 4.5%, Gold jumped nearly 2%, and Nymex crude briefly broke above $64 as CNN reported that Israel may be planning a strike on Iranian nuclear facilities.

Stock Futures:

In yesterday's trading session, DLF, Zydus Lifesciences, Tata Steel, and PI Industries experienced a significant increase in activity, marked by higher trading volumes and notable price movements, which indicated a rise in investor interest.

DLF recorded its fifth consecutive session of gains, closing up 2.6% and achieving its highest closing price in three months, while also establishing a new monthly high. This uptrend was fueled by a remarkable 59% YoY surge in consolidated net profit and a 44.5% YoY increase in consolidated revenue. Moreover, DLF surpassed its annual sales target of Rs 17,000 crore, with new sales bookings of Rs 21,223 crore, marking a 44% YoY growth. The stock's price rise coincided with a 5% increase in open interest in futures, currently at 50,516 contracts, adding 2,401 new contracts, equal to 1.9 million shares. In the options market, the put-call ratio (PCR) remained steady at 0.67, with call options totalling 30,350 contracts and put options at a yearly high of 20,226 contracts, which included increases of 10,738 call options and 6,754 put options. The rise in futures open interest, coupled with a stable PCR and significant accumulation in put options at a yearly high, indicates potential consolidation or further upside, as participants hedge against downside risk while holding a positive outlook.

Zydus Lifesciences saw its largest single-day decline this month, dropping 3.1% with the highest trading volume since the current expiry began. This suggests strong participation from institutional and retail investors in yesterday's session. The drop occurred despite the company reporting an 18% year-over-year (YoY) revenue increase in Q4 and a robust 24% YoY and 30% sequential growth in its US formulation business. A one-time loss of ?220 crore primarily caused the 1% Yoy net profit decline. The price drop was worsened by a "short addition" in futures contracts, with a 15.4% rise in open interest. The current open interest stands at 13,494 contracts, boosted by 1,804 new contracts, which added 1.62 million shares. The rise in open interest alongside a price drop in futures indicates a bearish trend, pointing to aggressive short-selling in the derivatives market.

Tata Steel's equity rose 0.9%, reaching its highest monthly close, driven by strong trading volume. This momentum was bolstered by improved sentiment in the broader metals sector following the People's Bank of China's (PBoC) recent interest rate cut, aimed at stimulating domestic demand and industrial recovery in China, which is crucial for global metal consumption. In the derivatives market, Tata Steel saw a "long addition" in futures contracts, with a 1% increase in open interest, now at 39,339 contracts after a fresh addition of 394 contracts (2.17 million shares). This marks a reversal from the recent unwinding trend, even as the stock price remained stable. The mix of price gains, high trading volume, and renewed open interest in futures indicates growing bullish sentiment, suggesting a potential for an upward trend.

PI Industries saw a 0.6% price cut and the highest single-day trading volume this month after announcing a 10.6% year-over-year decline in consolidated net profit. Despite this dip, the agri-science major reported a 2.6% revenue increase. The company maintained a stable EBITDA margin at 25.5%, slightly up from 25.4% in the previous quarter (Q4FY24). The price drop was largely due to a "long unwinding" in futures contracts, evidenced by a 13.5% decrease in open interest. Current futures open interest is at 13,885 contracts, reflecting a reduction of 2,078 contracts, or 2.6 lakh shares. This is the largest single-day unwinding in three months, indicating significant profit booking or a change in sentiment among long position holders. In options, total open interest in call options was 7,784 contracts, with put options at 4,849 contracts. Call options added 923 contracts, while put options increased by 35 contracts. The long unwinding in futures, a classic bearish signal, along with reduced outstanding long positions, suggests a cautious outlook among market participants, despite the stable EBITDA margin.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) fell to 0.69 from 0.82 points, while the Bank Nifty PCR fell from 0.86 to 0.77 points.

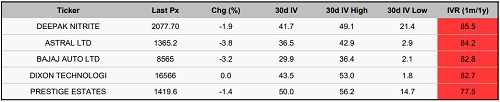

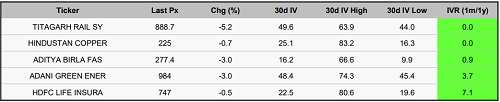

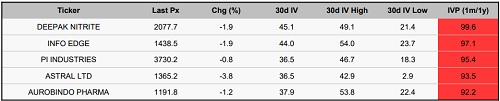

Implied Volatility:

Deepak Nitrite and Astral Ltd have experienced notable changes in their stock prices, sharing similar implied volatility rankings of 86 and 84, respectively. Currently, Deepak Nitrite's implied volatility is at 42%, while Astral Ltd's is at 37%. This uptick in implied volatility implies that options are becoming more expensive, prompting traders to adopt risk management strategies reflective of market conditions. In contrast, Titagarh Rail and Hindustan Copper exhibit the lowest implied volatility ranking, with IV readings of 50% and 25%, respectively. These values suggest that their options may be appealing to investors seeking long positions.

Options volume and Open Interest highlights:

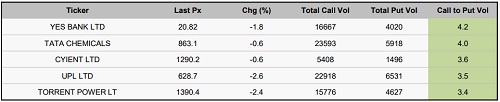

Tata Chemicals and UPL Ltd might present an optimistic outlook, as indicated by their strong call-to-put volume ratios, each at 4:1. This reflects high demand for call options, suggesting that market participants foresee price rises. However, the significant call skew may imply possible overvaluation within the options market. In contrast, Birlasoft Ltd and Aarti Industries display a notable put-to-call volume ratio, with increasing put volumes showing a cautious stance driven by concerns over price drops. High put volumes could also indicate an oversold condition, potentially leading to opportunities for contrarian trading strategies. Regarding market positioning, Indian Hotels and Muthoot Finance demonstrate considerable open interest in call options, whereas BEL and DLF show significant open interest in put options. This trading activity suggests the likelihood of price volatility, which may act as a resistance level or promote price increases. (This data considers only those stock options that saw a minimum of 500 contracts traded on the day for both calls and puts.)

Participant-wise Open Interest Net Activity:

In the index futures segment, a significant shift of 29,773 contracts was observed. Retail clients demonstrably increased their long positions by adding a substantial 26,167 contracts, signaling a pronounced bullish sentiment from this participant group. Conversely, Foreign Institutional Investors (FIIs) exhibited a distinctly bearish stance, aggressively reducing their exposure by 15,250 contracts. Proprietary traders, often considered a bellwether for short-term market direction, modestly increased their long positions by 3,606 contracts, indicating a cautious yet positive outlook. The stock futures market witnessed a more substantial churn, with a total of 144,958 contracts changing hands. Retail clients, mirroring their conviction in index futures, augmented their long positions by 37,330 contracts, reinforcing their optimistic bias. In stark contrast, FIIs significantly reduced their holdings by a substantial 62,422 contracts, indicating a widespread bearish outlook on individual equities. Proprietary traders, however, displayed a notably aggressive bullish posture, adding a remarkable 107,628 contracts. This suggests a strong conviction among proprietary desks for a potential upward movement in stock-specific opportunities, potentially driven by fundamental or technical factors.

Securities in Ban for Trade Date 21-May-2025:

1) MANAPPURAM

2) RBLBANK

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

Stocks With High Call Volume To Put Volume :

Stocks With High Put Volume To Call Volume :

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Nifty has an immediate Support at 24540 and on a decisive close below expect a fall to 24470...